Brexit chaos and weakness in the Eurozone

The pound hasn't been penalized by the latest developments in the Brexit maze.

Published by Alba Di Rosa. .

Exchange rate Dollar Euro United States of America Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The main economic theme this week has undoubtedly been Brexit. Last Tuesday, the agreement negotiated with Brussels has been rejected by British Parliament. This hasn’t led to the fall of the government led by Theresa May, which has survived a no-confidence vote the following day.

So, the government remains in office with the hard task to deliver, on Monday, a new Brexit plan that could get parliamentary approval.

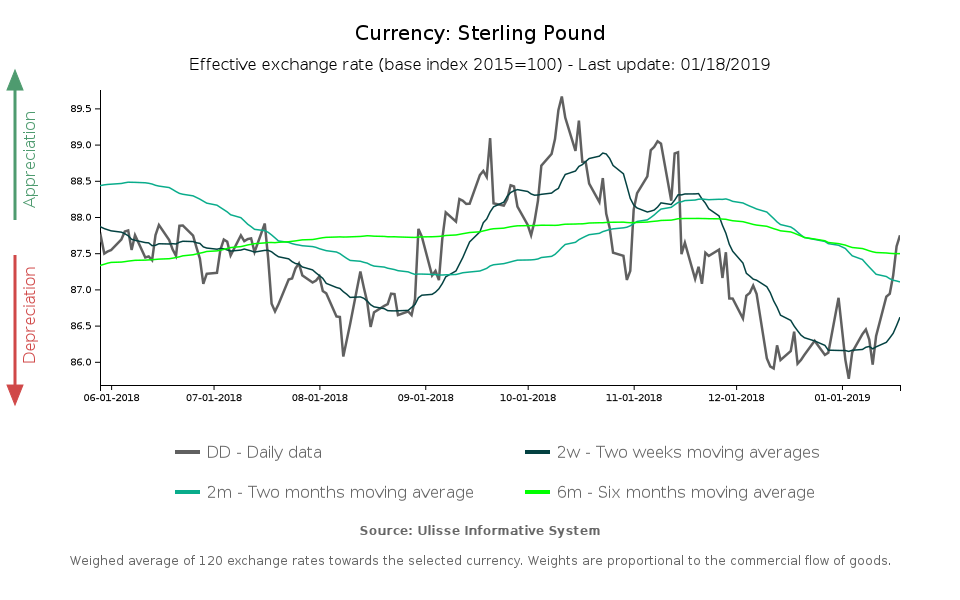

In the face of political chaos, the pound hasn’t showed a depreciation dynamics; on the contrary, it has appreciated by 1.6% in the last week, in terms of effective exchange rate (EER), after reaching a 13-month low in the first days of January.

The following graph shows the dynamics of the pound (EER) in the last 6 months; in the final part of the series you can notice the ongoing recovery.

What could explain pound’s appreciation, in an unfavourable context of political chaos and uncertainty about Brexit? There might be many factors at play:

- Firts of all, markets expected the deal to be rejected by British parliament, so it is likely that they had already taken this political defeat into account.

- One further point to bear in mind is that, according to analysts, the chance of a no-deal Brexit has declined. For this reason, the currency doesn’t show signs of concern.

At the end of November, a publication from the Bank of England (BoE) warned against the dangers of a hard Brexit. According to the BoE, leaving the EU without a deal could lead to a 8% fall in the GDP in the first quarter of 2019 (worst-case scenario). This negative view isn’t shared by all international commentators: Paul Krugman, for example, considers these predictions too pessimistic.

Overall, markets might consider a no-deal Brexit quite unlikely, since the dangers that it entails have been extensively discussed. - Another factor that could support the strengthening of the pound is its current undervaluation: according to The Economist’s Big Mac Index, the British currency is 27% undervalued compared to US dollar.

- Last but not least, the appreciation of the pound in terms of EER has been supported, in the last week, by the weakening of the single currency. As a matter of fact, the EU represents the first commercial partner for the UK, both in terms of imports and exports (source: Ulisse Information System1).

Eurozone economy keeps slowing

Focusing on the last point, i.e. the weakening of the euro, this seems to reflect the general weakness that affects the Eurozone economy.

On January 11 Eurostat released updated estimates

about GDP growth in the EU and in the Eurozone in Q3-2018. The data have been disappointing and confirm that the Eurozone economy is slowing down: even if the growth rates are positive

(+1.6% year-on-year, +0.2% quarter-on-quarter), they confirm the slowdown trend started in Q4-2017.

Looking closer, Germany grew 1.2% year-on-year, the lowest rate since Q1-2015, and Italy stopped at 0.7%, the lowest since Q3-2015.

US-China: coming to a close?

On the other side of the ocean economic data look more promising: the US grew 3% year-on-year in Q3-2018.

On the currency front, after a

phase of weakening for the dollar started at the end of december, the currency

is now recovering, thanks to the signs of a thaw from the US-China front. According to the Wall Street Journal, US Treasury Secretary Mnuchin is carrying out the proposal to partially

lift tariffs from China, in order to reach an agreement faster. Anyways, he might face opposition from US Trade Representative Lighthizer.

1. You can access Ulisse Information System data through exportplanning.com, section Market Research>Analytics.