Egyptian pound: a year of recovery

An economy poised between growth and weaknesses

Published by Alba Di Rosa. .

Africa Exchange rate Emerging markets Exchange rate risk Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

Among the currencies that appreciated the most during 2018 and are confirming this trend in the first months of 2019, we can find the Egyptian Pound. After the 2016 agreement with the International Monetary Fund for a 12 billion dollars loan over 3 years, the currency was allowed to float; before this monetary policy decision, the currency was overvalued.

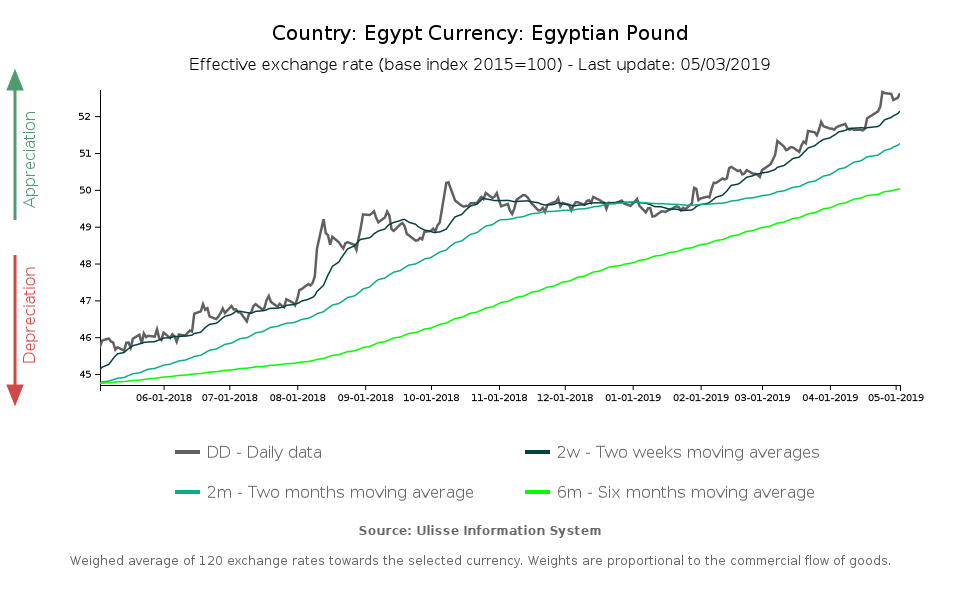

Focusing on the exchange rate dynamics in the last 12 months, shown in the chart below, we can notice a significant appreciation: +15% in terms of effective exchange rate.

The recent appreciation of the Pound can be mainly attributed to portfolio investment inflows: attracted by high interest rates, investors are coming back to Egypt, after the general flight from emerging countries’ assets in 2018. Economic recovery measures suggested by the IMF are unfolding their effects, as well.

The appreciation of the currency therefore seems to reflect the strong growth of the Egyptian economy: according to the latest data released by the Central Bank of Egypt, real GDP grew by 5.5% in Q4-2018, up from +5.3% in the previous quarter. In particular, external demand continues to support the economic activity; the contribution of domestic demand is lower, instead.

Price dynamics

This appreciation is taking place in spite of consistent inflation, and is actually helping counterbalance the loss of purchasing power.

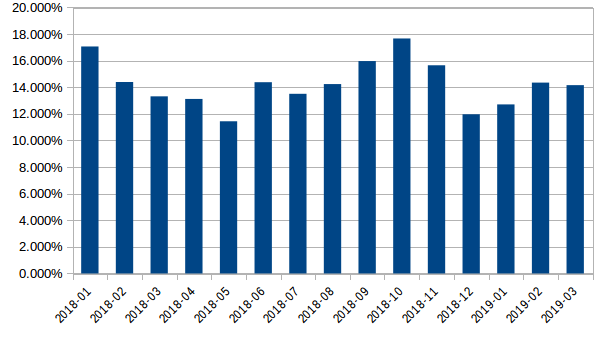

As you can see from the chart below, inflation in Egypt slowed down in December 2018 and January 2019, and then exceeded the 14% threshold again in February.

Egypt: headline inflation (January 2018-March 2019)

Source: StudiaBo elaborations on Central Bank of Egypt data.

Low inflationary pressures gave the central bank the necessary room for manoeuvre to cut reference interest rates in the February meeting: the overnight deposit rate fell to 15.75% and the overnight lending rate to 16.75% (-100 basis points for each rate). In the March meeting, instead, the rates were left unchanged, since inflation restarted growing.

Need for support

In spite of a good growth performance, according to some analysts the Egyptian economy would need further stimulus, both in terms of monetary and fiscal policy.

As a matter of fact, the population is not directly perceiving the benefits of a significant GDP growth, since wage increases are not keeping pace with inflation. In addition, foreign direct investments, unlike portfolio investments, are sluggish: Egyptian central bank data show that net FDI decreased between Q1 and Q3-2018, and then slightly recovered in Q4. However, their value remains lower than the one recorded in Q4-2017. Another issue about FDI is that they are mainly directed towards the energy sector, bringing only moderate benefits in terms of job creation.

The situation in Egypt therefore remains uncertain, poised between possibilities of growth and weaknesses: among the latter, the quality of institutions is at the forefront. The forthcoming end of the IMF program, scheduled for this November, and the consequent direction that fiscal and monetary policies will take after that, remain a question as well.