Forecast scenarios for Italian exports

A comparison between Sace scenario and StudiaBo scenario

Published by Luigi Bidoia. .

Conjuncture Forecast Export Export markets Internationalisation tools

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The Italian joint stock company SACE, specialized in supporting Italian companies on the global market, has published the outlook for Italian exports a few days ago: Export Karma. It is therefore possibile to compare Sace and StudiaBo forecast scenarios; you can find the latter in the Analytics section of ExportPlanning.

The two scenarios express their forecasts using the same unit of measurement, the value of exports in euro, which makes them easily comparable1. Furthermore, these scenarios use different methodologies and exogenous hypotheses (world economic cycle, dynamics of raw materials prices, exchange rates, etc.), formulated independently by the two institutions.

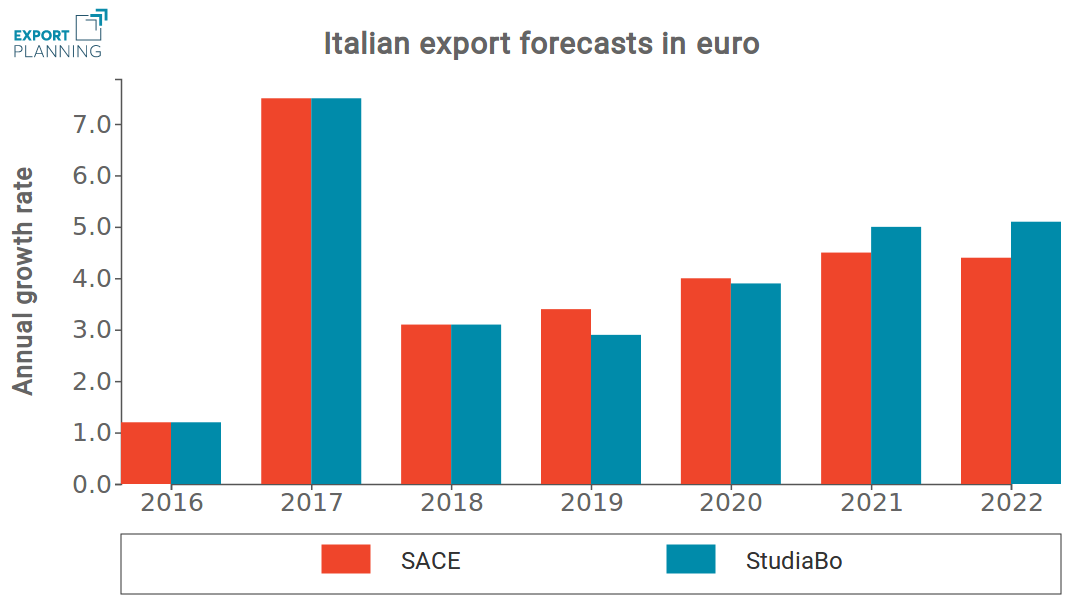

The two scenarios present very similar results for total Italian exports, as illustrated in the graph below.

The Sace scenario is slightly more optimistic in 2019; the two scenarios are equivalent in 2020. In the two-year period 2021-2022, the StudiaBo scenario is more optimistic by about half a percentage point, with an average annual growth forecast of Italian exports amounting to 5%, compared to a 4.5% SACE forecast.

Another issue to take into account is the comparision of the two scenarios from a country-specific point of view. In the graph below, markets are positioned on the basis of the expected average change in Italian exports in the period 2019-2022 according to the StudiaBo scenario (x-axis) and the Sace scenario (y-axis). The size of the circle is proportional to the level of Italian exports in 2018. The colour of the different countries indicate their stage of development, distinguishing between:

- Developed countries, with high income levels;

- Emerging countries, with low income levels and economic conditions that support a significant phase of development;

- Others, characterized by limited economic resources.

The two scenarios yield very similar results, even at the country level.

1) The measure normally used in forecasting scenarios are exports at constant prices, i.e. net of changes in prices and exchange rates. The reason is that economists are used to distinguishing the dynamics of quantities from those of prices and exchange rates. Companies, on the other hand, use almost exclusively the current values, which is the extent to which they express their revenues and costs.