China risk and Asia opportunities of US tariffs

American tariffs are heavily penalizing US imports of Chinese products, while benefitting other Asian competitors.

Published by Marzia Moccia. .

Asia Conjuncture United States of America Uncertainty South-east Asia Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The worsening of US-China trade war has significantly reduced American imports from the Land of the Red Dragon. However, one of the possible effects of the Washington-Beijing rivalry is to make suppliers of goods from third countries more competitive than Chinese companies.

For this reason, other American trade partners may have gained market share, as anticipated in the

previous article "Who is Gaining from US-China Trade War?".

Looking closer, two questions emerge: which Chinese products have suffered the most significant slowdowns? If a substitution effect is visible, which countries have benefited from it?

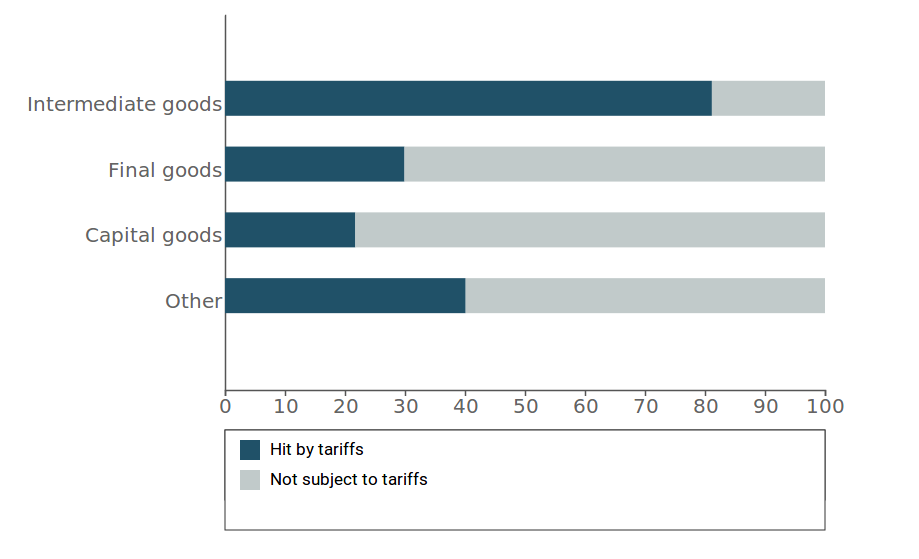

US tariffs affect different categories of products with different intensity: the share of US imports from China covered by tariff actions is 80% in the case of intermediate goods; the share drops to 30% in the case of final goods and to 22% in the case of capital goods (Fig. 1).

Fig.1: US import from China

Source: ExportPlanning.

The Figure below shows the main Chinese products hit by US tariffs, positioned according to the growth rate of US imports in 2018 (x axis) and in the first half of 2019 (y axis). The size of the "ball" is proportional to the value of Chinese exports to the US in 2018.

Source: ExportPlanning.

Chinese exports of the main products subject to tariffs showed a significant contraction in the first half of 2019 compared to the 2018 performance.

The significant deterioration in the performance of Chinese exports on the US market indicates that the duties imposed have significantly undermined the competitiveness of Chinese companies on the American market. Focusing on the sectors that showed the most negative performance in H1-2019, the following cases are underlined.

Computer components

The main decrease is reported by computer components, which belong to the intermediate goods category: while in 2018 US imports of computer components grew by 4.7%, in H1-2019 they marked a 55% reduction.

This result reflects the contraction of the American demand for electronic assemblies for PC, products included in the American tariff action of last September. In the first half of 2018, the US imported more than $9bn worth of electronic assemblies from China; the value dropped to $3bn in the first half of 2019.

Two countries mainly benefited from this reduction in Chinese exports: Taiwan (+$1.4bn) and South Korea (+$430m), which seem to have partially replaced Chinese exports of the product. Indeed, American imports of the product from the world remain in negative territory.

Communications equipment

In H1-2019, the communications equipment reported the continuation of a phase of reduction already begun in 2018. Particularly evident is the reduction of American imports of Chinese mobile phones. The result reflects the phase of turbulence related to the restrictions against the Chinese telecommunications company Huawei required by the US administration. To date, no tariffs are in force on Chinese mobile phones; nonetheless, the uncertainty linked to the evolution of the Huawei case seems to have penalized Chinese exports of mobile phones. Two countries mainly benefited from this situation: Vietnam and South Korea, which are the main US partners for mobile phones after China.

Bags and leather goods

Lastly, Chinese exports of bags and leather goods marked a contraction of 23% in the first half of the year. The substitution effect in this case has mainly benefited Vietnam and Cambodia.

Conclusions

From the first evidences on the trend of the main products subject to tariffs, two main considerations emerge.

First of all, in the cases examined, the main beneficiaries of American tariffs turn out to be Asian countries, privileged by a supply system very similar to the Chinese one. Secondly, the substitution effect has only partially worked: in the short term, new competitors did not manage to completely replace Chinese exports.