Greenback: All Hail the King

In a context of lingering and widespread uncertainty and weakness, the dollar confirms its role as safe-haven currency.

Published by Alba Di Rosa. .

Slowdown Exchange rate Dollar Uncertainty Trade war Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The past week has been characterized by relative calm on forex markets, given the absence of significant developments. Major trends observed in recent months have been confirmed: first and foremost, the strength of the dollar.

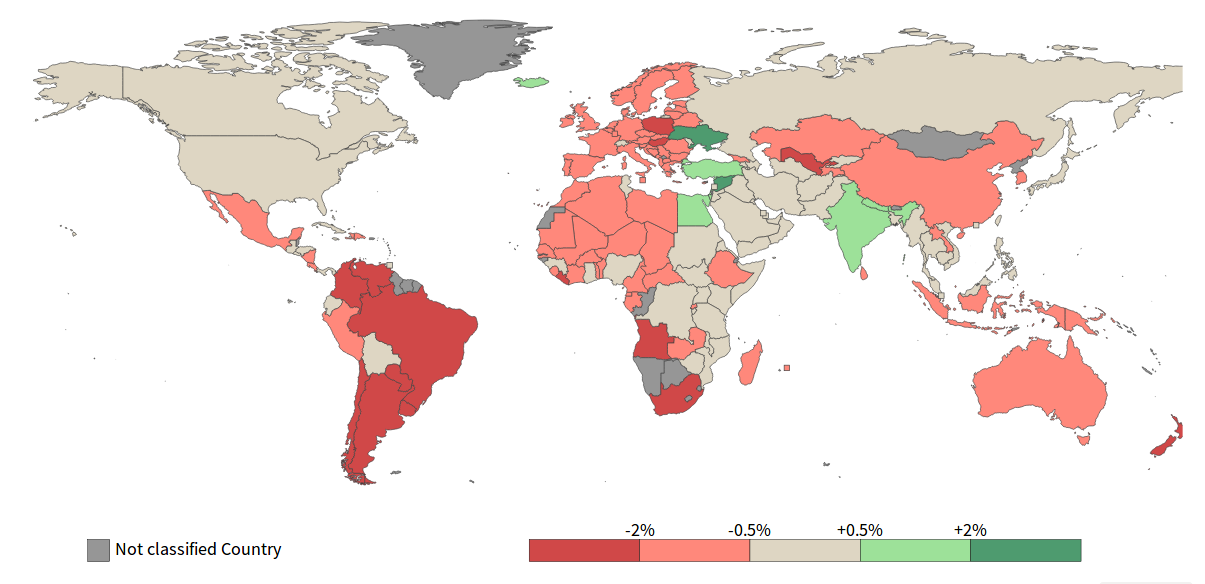

The map below shows world currencies’ exchange rates against the dollar on September 27, 2019; the red colour indicates indicates the presence of a depreciation against the greenback, while shades of green indicate an appreciation. As is evident, only a few countries are spared from the weakening against king dollar.

World Map: Exchange Rate against the Dollar

September 27, 2019

In addition to the strenght of the dollar, some additional trends that we analyzed in recent months have been confirmed in the past week:

- Lingering yuan weakness

The Chinese currency, which plays a key role in the US-China trade conflit, broke the threshold of 7 yuan per dollar at the beginning of August. Notwithstanding some fluctuations, it remained above the critical threshold in the following months. - Single currency weakness, which reflects the broad current weakness of the Eurozone economy.

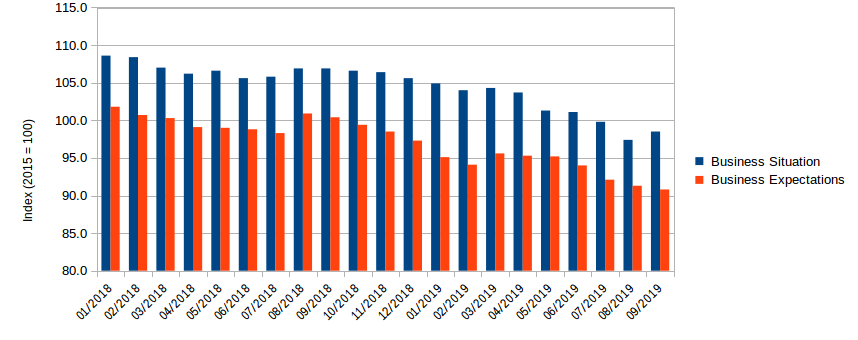

Indeed, economic growth in the area has been flagging for several months; in particular, the “German locomotive” is in the eye of the storm. The latest update of the ifo Index, one of the most popular indicators that gauge the health of German economy, suggests the presence of a slight improvement in September for the business situation component, compared to the previous month; on the other hand, the index shows a worsening in terms of business expectations. The overall index dynamics clearly points towards a deterioration since early 2019.

Germany: ifo Index (2018-2019)

Source: StudiaBo elaborations on ifo Institute data.

Dollar, still a major safe-haven currency

In a context of widespread weakness and uncertainty, it is therefore apparent that the safe-haven currency par excellence is once again proving to be a trusted place for international investors. On top of this there are the good yields offered by US bonds, and their low risk compared to emerging markets.

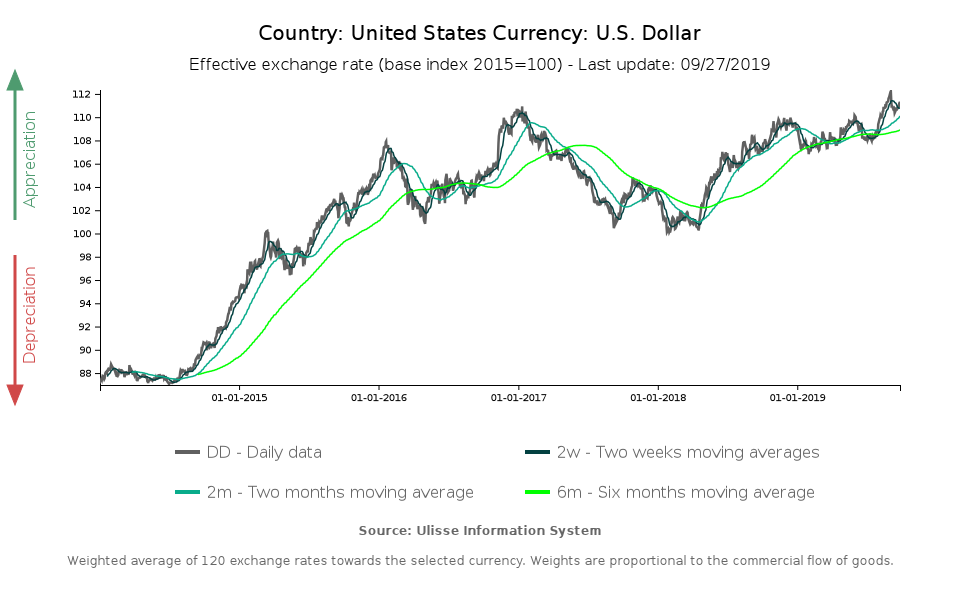

In the last year the dollar confirmed its supremacy, strengthening by almost 7% against the euro. As regards the greenbacks’ most recent movements, in the last few days different news pushed the currency in opposite directions; nonetheless, the resilience of the exchange rate has not been affected.

During a recent interview, President Trump stated that an agreement with China could take place "sooner than you think"; this certainly helped the dollar, renewing markets’ hopes for a trade deal.

On the other hand, downward pressures came from an impeachment threat: last Wednesday, Democrats launched an impeachment inquiry over President Trump’s alleged search for personal advantage in US 2020 elections, through contacts with the Ukranian president Zelenskiy.

Both situations are in the making, so investors are in wait-and-see mode. Nevertheless, the dollar seems to hold up well: its effective exchange rate (available in our Exchange Rates tool), which measures the dollar's overall strength against the basket of currencies of its trading partners, is at an all-time high.