The growth of the packaging user sectors: focus on the Perfumes and Cosmetics industry

Particularly favourable dynamics of world trade, especially in the Premium-Price segments.

Published by Marcello Antonioni. .

Premium price Fashion Europe Asia Global demand Forecast Consumption pattern Export Foreign markets International marketing Made in Italy International marketing

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

As highlighted in a recent article ("Packaging Industry: the long-term Growth of end-user Sectors"), the main sectors in which packaging is used are highly dynamic. Among these, the growth performance of the Perfumes and Cosmetics sector1, analyzed in this article2, should be highlighted.

The high dynamism of world trade

in Perfumes and Cosmetics...

In the last decade, world trade in Perfumes and Cosmetics showed a Compound Annual Growth Rate (CAGR) of +8.1% in US Dollars, for an overall increase of 52 billion $, reaching in 2019 - according to the estimates formulated by StudiaBo3 - a new record value (96.4 billion $) more than one and a half times higher than the beginning of the decade4.

... especially on Premium segments.

In recent years, world trade flows of High Price range in the Perfumes and Cosmetics sector have been well above the threshold of 20 billion $, compared to the minimum values (on average less than one billion $) of the last decade. In particular, an absolute maximum point in values was reached in 2016 (27.8 billion $), equal to almost 40 percent of the total flows), before settling at values that are still above 20 billion $ in the most recent period.

At the same time, world trade flows in the Medium-High Price range of the sector have largely exceeded the threshold of 20 billion $, with a pre-estimate of 2019 value close to 30 billion $ (equal to 31 per cent of the total flows).

High-Price segment: Competitors and Markets

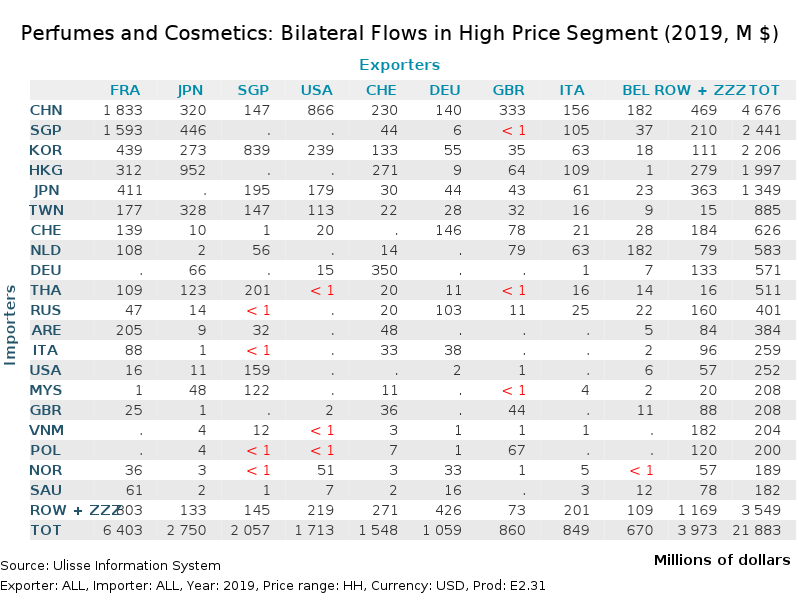

The following table shows the international flows of Perfumes and Cosmetics for the High Price Range, broken down by main exporting countries (competitors) and importing countries (markets).

ROW+ZZZ: Rest of the World + Statistical Discrepances

France is in the first place in the 2019 ranking of High Price Perfumes and Cosmetics, with a 29.2% share of the segment, ahead of Japan (12.6%).

Other important competitor countries in the High Price segment are the United States (with an estimated high-end export value of 1.7 billion $ in 2019, about half of which is on the Chinese market), Switzerland (1.5 billion $), Germany (1.1 billion $), United Kingdom (860 million $) and Italy (849 million $).

The Chinese market is indeed the main destination for high-end sector not only for US exports, but also for French (with a value of 1.8 billion $ in 2019), British and Italian exports.

It should be noted the case of Singapore, which acts as a "hub" for the distribution of sectoral products of high price range mainly to the South Korean market (839 million $ exported in 2019). Such flows originate however from other countries in quality of producers, mainly France (that exports to Singapore products of the sector of High Price range for approximately 1.6 billion $), Japan (446 million $ of exports towards Singapore of products of High Price range) and - even though in smaller measure - Italy.

Sector Forecasts 2020-2023

In the 2020-2023 scenario, the forecasts formulated by StudiaBo on the basis of the International Monetary Fund's World Economic Outlook5 (and already documented in the article "Packaging Industry: the long-term Growth of end-user Sectors") indicate the continuation of an accelerated growth rate for world trade in the Perfumes and Cosmetics sector.

In particular, the value of world trade in the sector is expected to exceed the threshold of 120 billion $.

1) See the products' list analyzed in the following sector's description.

2) For further information on the dynamics of world trade in the sector, reference should also be made to the following report: "Perfumes and Cosmetics: World Trade, Markets and Competitors".

3) For more information, please refer to the Ulisse Datamart in the Analytics section of ExportPlanning.

4) Within the sector, the particularly dynamic growth of world trade in make-up products business areas is noted; see on this subject the following reports:

5) For more information, please refer to the Forecast Datamart in the Analytics section of ExportPlanning.