Exchange rate movements: factors at play for the greenback

Published by Alba Di Rosa. .

United States of America Exchange rate Dollar Trade balance Exchange ratesAfter the case of Indian Rupee and Chinese Yuan, in this article we analyze how variables such as trade flows, direct investments, portfolio investments and foreign exchange reserves affect the movements of the greenback.

2011-2019: the dynamics of the dollar

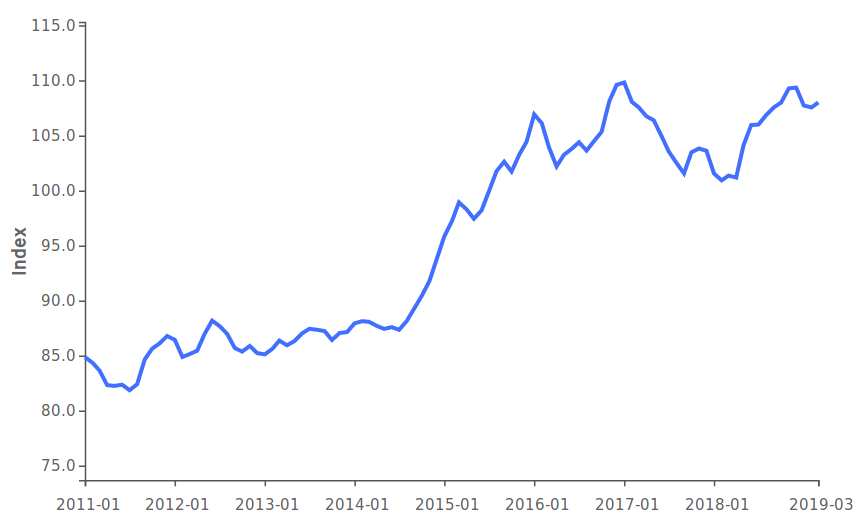

As you can see in the graph below, from mid-2011 to the first half of 2014 the dollar showed a mild strengthening. Then, between the second half of 2014 and the end of 2016, it entered a phase of significant appreciation; in this period the US economy grew on average faster than the other developed economies, e.g. the Eurozone and Japan.

US Dollar – Effective exchange rate

(2011-2019)

Source: exportplanning.com

The weakening of the dollar started with Donald Trump, at the beginning of 2017, and went on until the first months of 2018, when US rates hikes welcomed a new phase of strengthening for the greenback.

2019 seems to have started with a slight weakening of the dollar compared to the end of 2018: -1.3% in terms of effective exchange rate in the first 3 months of the new year, according to the latest data released on Exportplanning. Among the many factors, the dollar could have been affected by the Fed's slowdown in the normalization of monetary policy, which has taken place in recent months.

Exchange rate movements: factors at play

The dynamic graph shown above examines the trends of the greenback in terms of effective exchange rate, from 2011-Q1 to 2018-Q3. For each period, the graph highlights which factors have been driving the weakening or strengthening of the currency: we analyze the role of trade flows, direct investments, portfolio investments and foreign exchange reserves.

To sum up, the factors that show a key role in the period examined in the graph are basically two: when the dollar appreciates, a fundamental role is played by portfolio investments inflows, given the strong ability of the US economy to attract capital, while in the phases of depreciation current account deficit plays a major role.

Anyways, these elements alone are not sufficient to explain the dynamics of the dollar, which is obviously influenced by monetary policy and market expectations, as well as by the fundamental role of the dollar as a reserve currency. As a matter of fact, it is the "privilege" role of the dollar in the international monetary system that makes such a large current account deficit sustainable, since a deficit in terms of trade is compensated by a huge influx of capital, not only linked to the attractiveness of the US economy, but also to the role of the dollar as reserve currency.