International Trade Flows of Fashion Products have Halved

The lockdown of production activities and the collapse in consumption have drastically reduced the global demand for fashion

Published by Luigi Bidoia. .

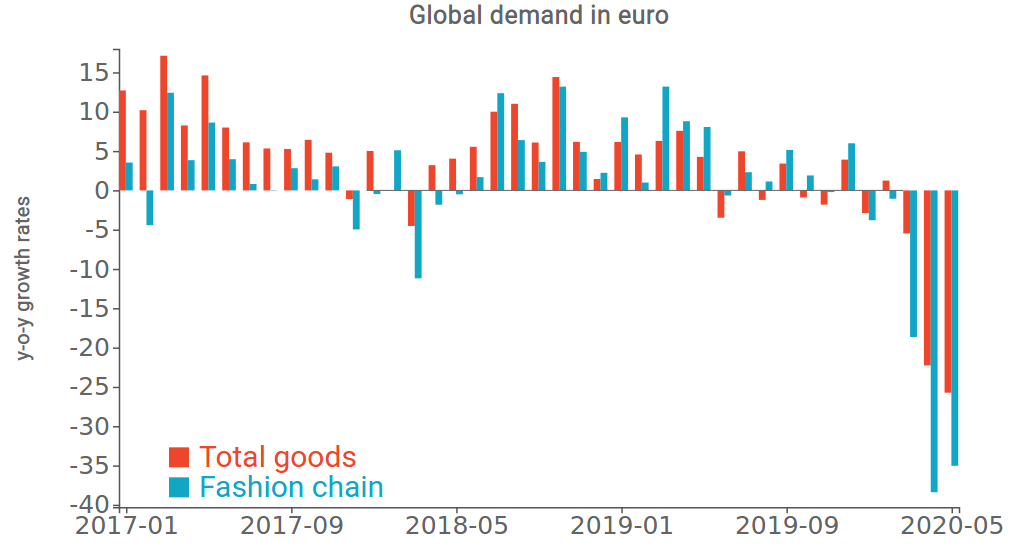

Fashion Conjuncture Great Lockdown Global economic trendsGlobal demand in the fashion and personal goods supply chain falls by 35% in euro in the two-month period April-May 2020

The recent update of the ExportPlanning Information System (up to May 2020) allows to make an initial quantitative assessment of the impact of the current health and economic crisis on the fashion and personal goods supply chain. As is clear from the graph below, in the two-month period April-May 2020, the Fashion System has suffered a drop in trade flows in euro of 35% year over year, 10 points worse compared to the performance shown by total goods. Together with the automotive sector, fashion and personal goods are by far the most affected by this crisis.

Constraints on people's mobility, shops' closures, income reductions and uncertainty about the future have led families in all countries of the world to drastically reduce their purchases of fashion and personal goods.

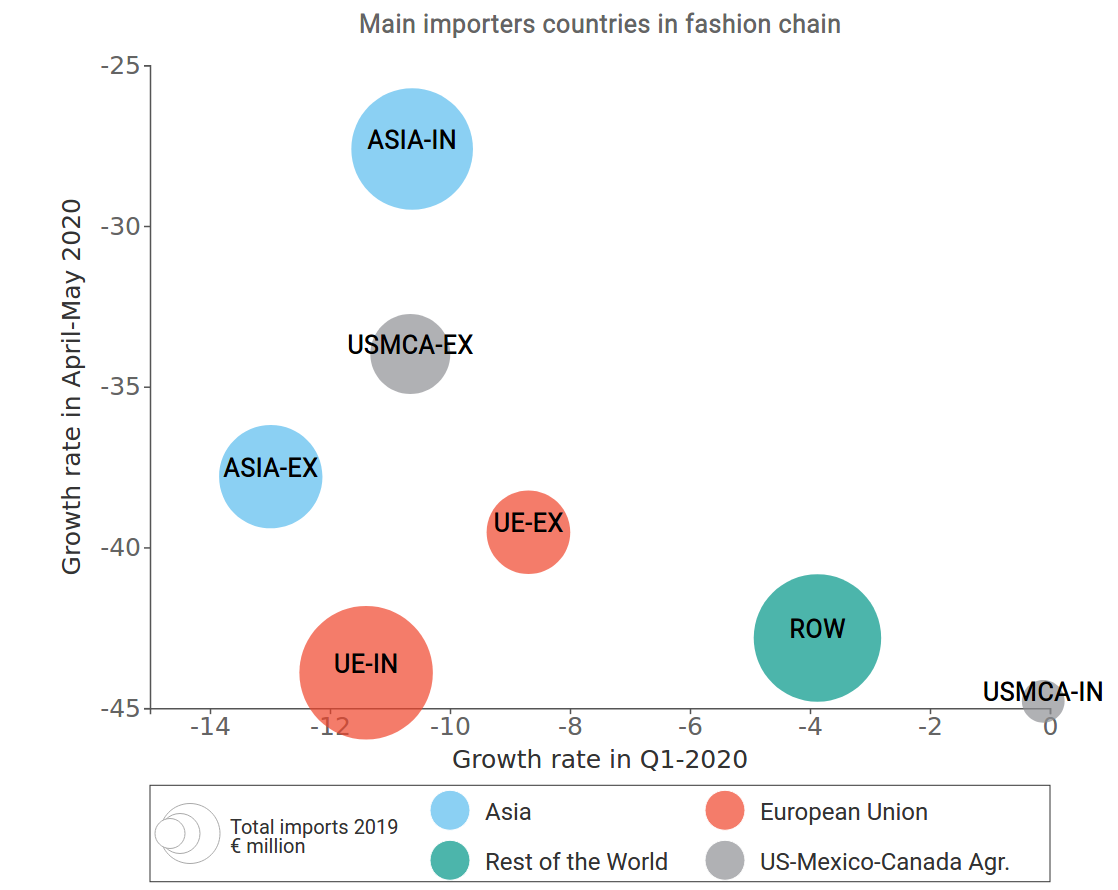

The collapse of trade has been very different between areas of the world...

As the graph below illustrates, trade between European Union countries in fashion and personal goods fell by almost 45% in the two-month period April-May. Equally intense was the collapse of internal trade in the North American area that recently signed the USMCA (ex-Nafta) free trade agreement (United States, Canada and Mexico). Conversely, the decline in trade between Asian countries was relatively less pronounced, confirming that Asia was, overall, less affected by the first wave of SARS-CoV-2.

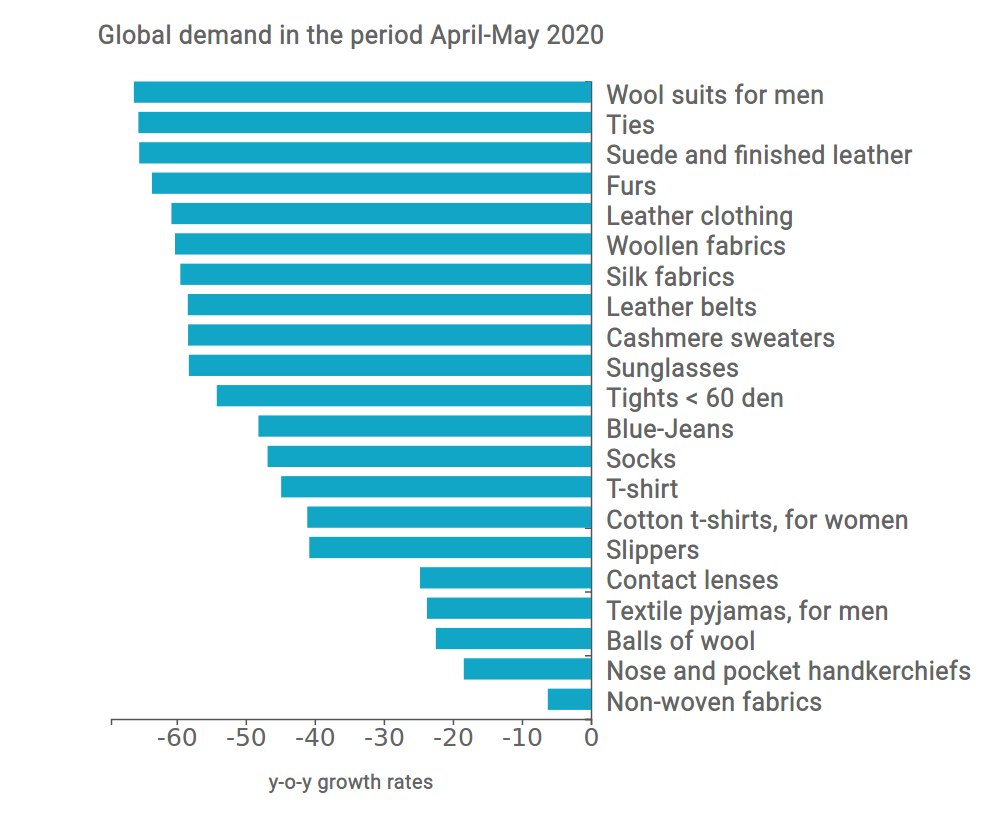

... and between different areas of business

Differences in trade dynamics not only concern the different regions, but also the single kind of personal products. The following graph shows the reductions in trade flows in the two-month period April-May for some representative fashion products and personal goods.

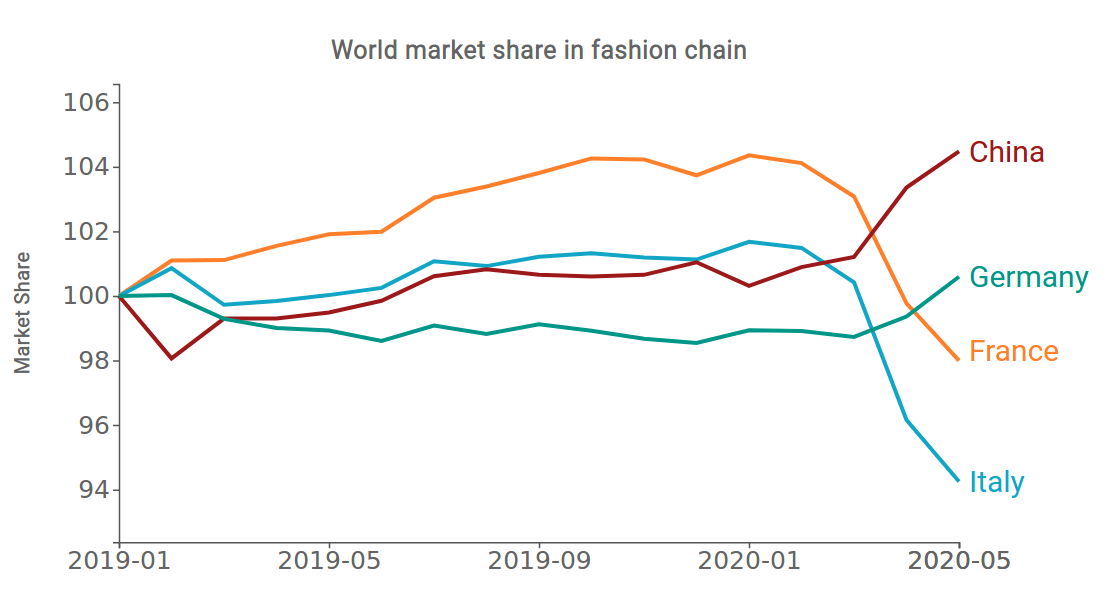

For Italian companies, the crisis was further aggravated by the necessary lockdown of non-core production activities

The seriousness of the Covid19 health crisis in Italy made it necessary to close all non-essential production activities from March 25 to May 3, including most of the companies operating in the fashion and personal goods supply chain. The effect on the international competitive positioning of Italian companies in the sector was very strong, as can be seen from the graph below.

In April and May, the global market share held by Italian exports fell sharply. The deterioration in the share of French exports was equally sharp, confirming the presence of significant effects on competitive positioning in the countries where lockdown also affected non-core production activities. On the other hand, Germany and, above all, China, which already returned to activity levels close to pre-Covid19 levels in April, gained world trade shares.