U.S. Machinery Market: very encouraging signs from Q2-2021 data

In the first half of the year, U.S. imports returned to pre-crisis levels in several sectors of the industry

Published by Marcello Antonioni. .

Great Lockdown Industrial equipment Conjuncture United States of America Foreign market analysis

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

In the second quarter of the year, U.S. imports of Machinery1 showed a significant positive rebound (+21.2% in euro values), bringing the cumulative annual figure into positive territory (+8.4%).

The values of the first half of the year are, however, still about 10 percentage points below the values of the corresponding half of 2019, the period before the recessionary effects of the Great Lockdown.

In addition to the overall result, several sectors have returned to levels similar to or even (much) higher than pre-crisis levels

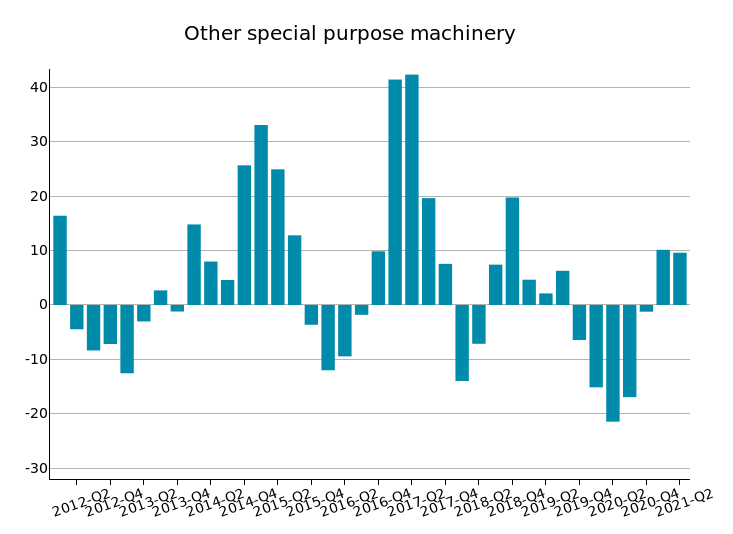

Beyond the overall result, rather differentiated trends are reported within the sector.

|

|

|

|

|

|

|

|

|

|

Source: ExportPlanning - Market Research - Analytics, US Trade Datamart

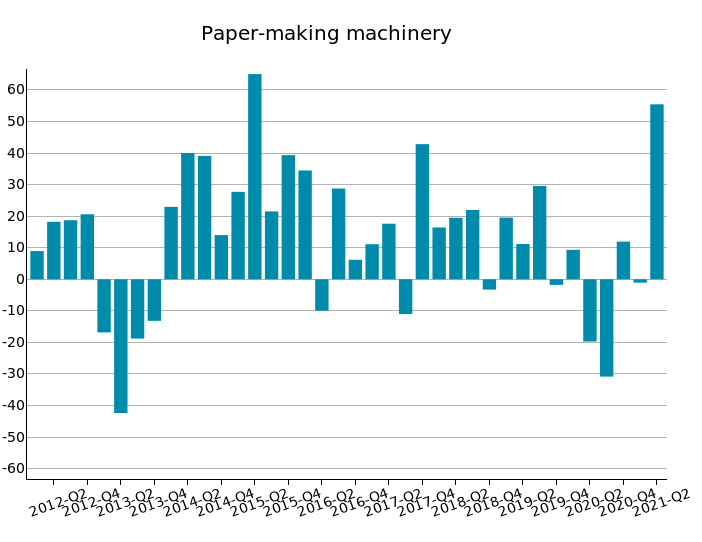

Among the most dynamic sectors of the Machinery industry in the second quarter of the year, Papermaking Machinery should be highlighted (+55.4%, with a cumulative annual growth of almost +24% and - above all - a return to values almost 17% higher than in the corresponding period of 2019, testifying to a very robust growth profile.

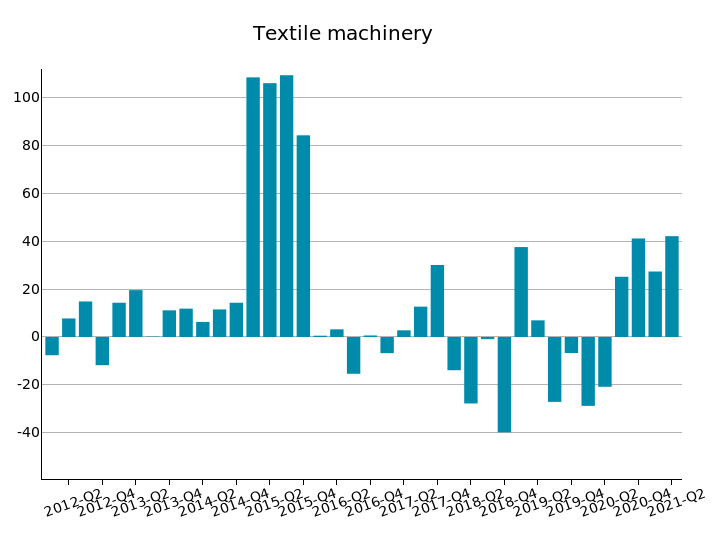

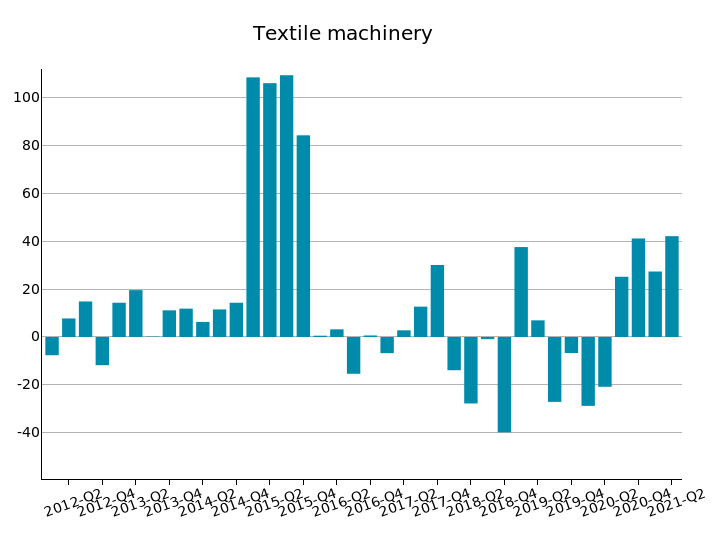

Strong upswing also for US imports of Textile Machinery, which in the second quarter of the year posted excellent growth (+42.1%), bringing the balance of the first half of the year to +35% trend over 2020 and, even more significantly, exceeding - if only slightly - the values of the first half of 2019.

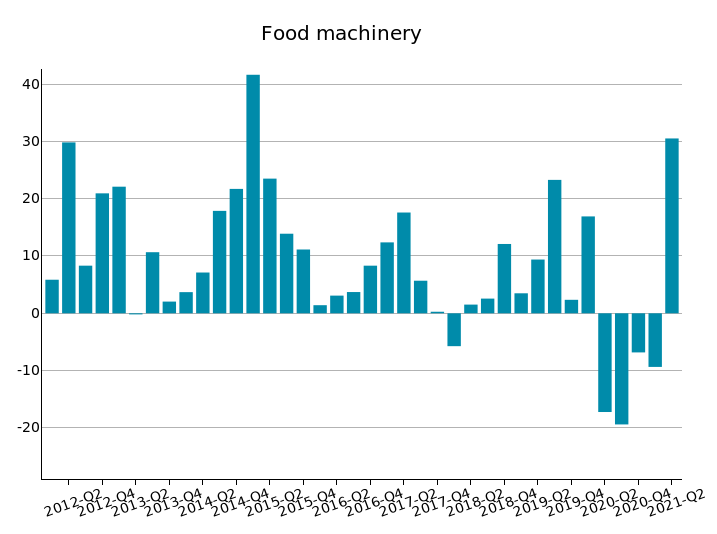

Sustained recovery also for Food machinery (+30.5% in the most recent quarter), which close the first half of the year at values about 9 percent higher than the same period in 2020 and - most significantly - are +7.1 higher than pre-crisis values.

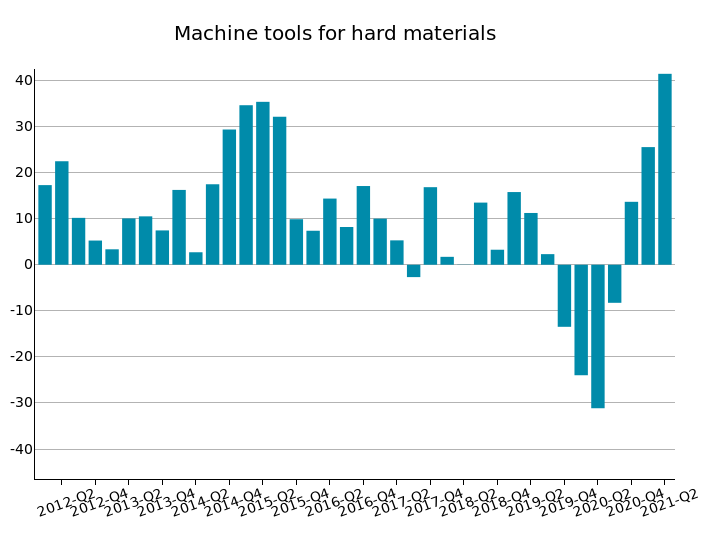

Another sector that rose sharply was Machine tools for hard materials (+41.4% quarter-on-quarter in euro values), which recorded a +33.3% increase over 2020 at the end of the half-year, very close to closing the gap with 2019 (-3.6%).

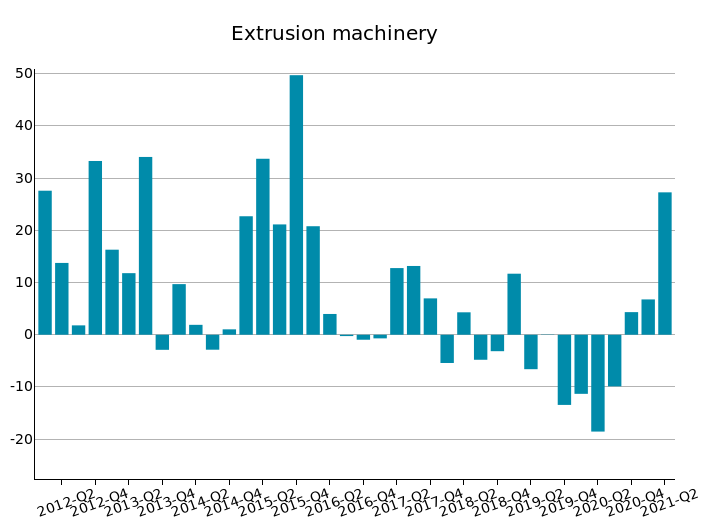

Similarly, the Extrusion Machinery sector (+27.3% in the quarter in trend terms) shows a positive change of +16.2% compared to 2020, just below (-1%) the values of the corresponding half-year of 2019.

The growth trend of Packaging Machinery also continues, closing the first half of the year with a trend increase of 11.5 percentage points in euro values and, even, at levels almost 19 percent higher than the corresponding period of 2019.

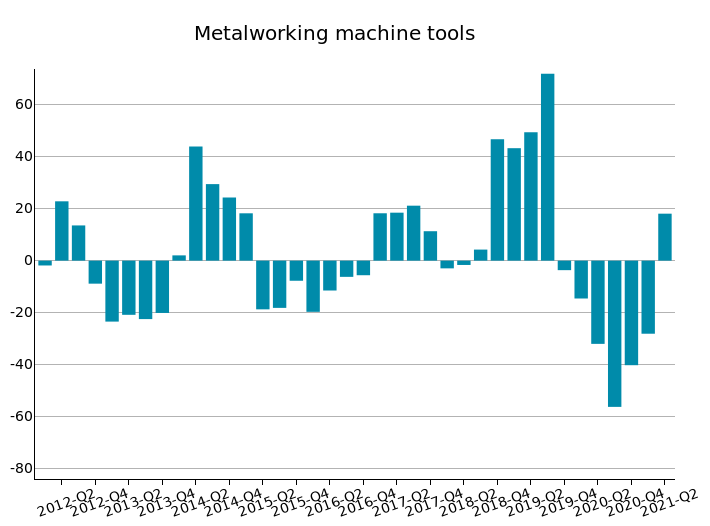

Despite the tendential rise in the second quarter of the year (+9.8%), the cyclical condition of imports of Machinery for Metalworking still appears to be in deficit, with a year-on-year deficit of 4.1% and in the comparison with the corresponding half of 2019 a gap of over 16 percentage points.

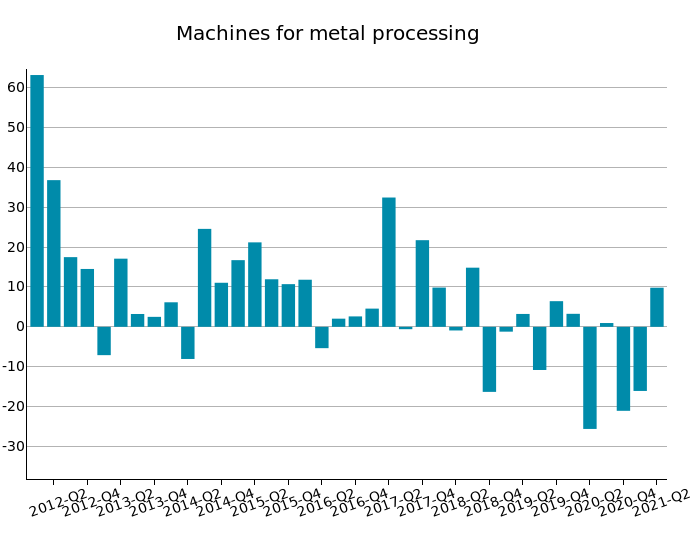

Also in the case of Machine tools for metals, the significant tendential recovery of the second quarter of the year (+18.1%) is not, however, sufficient to counterbalance the negative performance of the previous quarter, bringing the final balance for the year to -6.3%, on half-yearly values almost 29 percentage points lower than those of 2019.

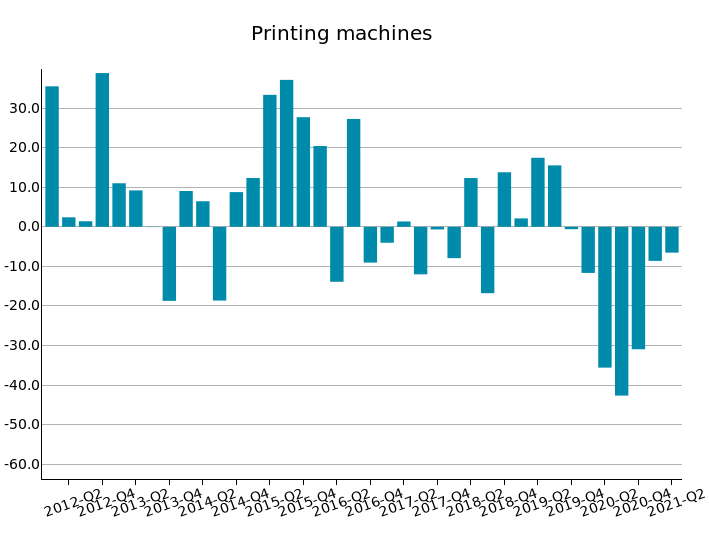

Finally, the case of Printing Machines should be highlighted, which continues to show a negative profile in US imports (-6.5% trend in the most recent quarter), bringing the six-month cumulative to -7.6% and above all more than 30 percentage points away from pre-crisis values.

1) See the list of the sectors included in this industry in the related industry's description.