Market analysis: the case of tiles in South Korea

ExportPlanning offers tools to support comprehensive and effective target market analysis

Published by Simone Zambelli. .

Foreign markets Internationalisation Foreign market analysis

For companies wishing to enter the global market, foreign trade data are an extremely important mine of information and are fundamental in the development of an effective business strategy, especially in today's increasingly uncertain and changing international environment.

In fact, one of the crucial phases within an internationalisation process is that of analysing and deepening the main information and characteristics of a certain target market, taking into consideration the short and long term dynamics that have characterised the imports of the market for the product of interest, as well as the positioning of the main active exporting countries.

ExportPlanning's Reporting tool aims to respond to these information needs by providing an expert system that allows in-depth reports, such as the Market Report, to be produced in real time. In particular, in this article we will analyse the case of the South Korean market for a sector of excellence of the Italian industry in the world, which boasts a long tradition of success: tiles.

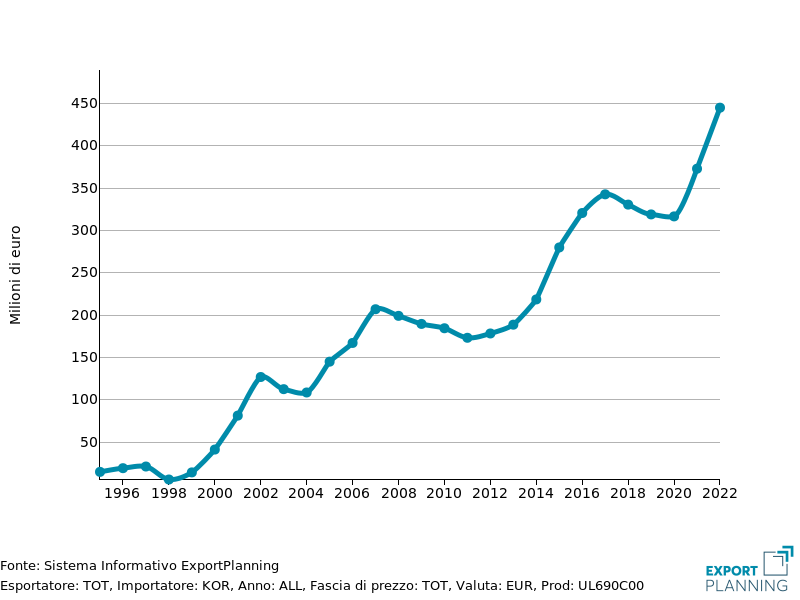

South Korea is a fast-growing market for the ceramic tile and wall tile segment: in the last 10 years the value of the country's imports has more than doubled, rising from 180 million euros in 2012 to 445 million in 2022. Moreover, after a brief period of slowdown, the post-pandemic has seen an even more pronounced growth in demand for the product from abroad, supported by new consumer preferences and a growing focus on enhancing the domestic environment.

Fig. 1 - South Korean Tile Imports

The biggest player in the Korean market is China, which in 2022 exported tiles worth close to 270 million euros, equivalent to a market share of 60% of the total. Italy is in second position with almost 100 million and a 20% share, followed at a distance by Spain and Vietnam, as shown in the table below, which gives an overview of the main tile exporting countries in the Korean market, ordered by relevance.

Fig. 2 – Main tile exporters to South Korea (values)

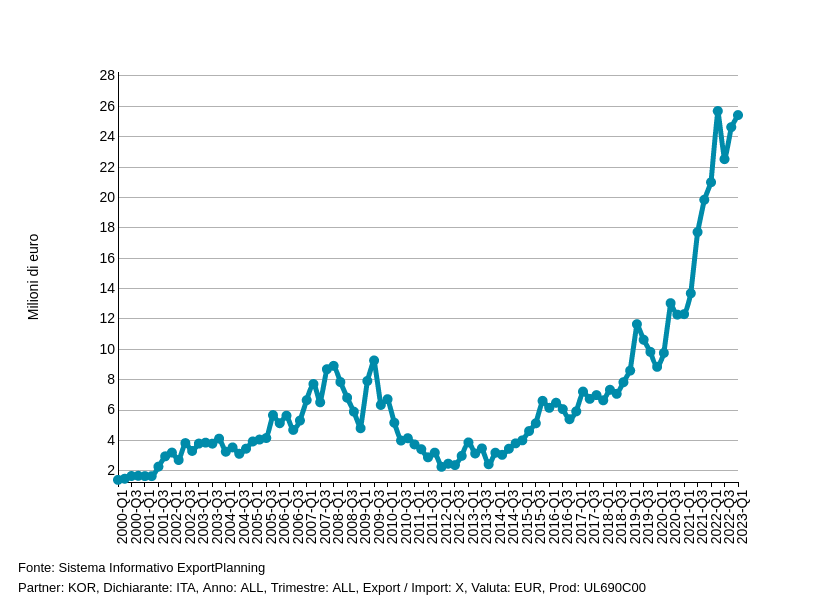

Through the analysis of trade flows and relative rates of change, we can easily understand the dynamics followed by individual exporters and the South Korean market as a whole over the last 4 years. Of particular interest is the strong recovery of Italian tile exports, which since 2019 have outperformed the overall market trend, closing 2020 in positive territory as well (+6.3%). In the two-year period 2021-2022, the Belpaese country also recorded a vertiginous growth with rates of change close to +50%, among the highest among the main market players.

Fig. 3 – Italian tile exports to South Korea

A further step in the analysis is to investigate the dynamics of imports in quantity (Fig.4).

Fig. 4 – Main tile exporters to South Korea (square metres)

First of all, the strong discrepancy between the exported square metres between the two market leaders is evident, with China having more than 58 million square metres in 2022, and Italy being a niche player, with 4 million square metres.

The different dynamics that characterised the two countries' exports are also of particular importance: against a growth in value of 14.8% in the last year, China recorded a drop in quantity of -13.6%, demonstrating the strong inflation that has characterised the past few quarters and the consequent increase in prices; the growth of the country of the Dragon is therefore mainly attributable to nominal growth. A similar dynamic is shared by other exporters, including Spain and Vietnam. On the contrary, Italy remained in positive territory: against a more contained increase in price levels, growth in value of 54% was accompanied by growth in quantity of 34%, confirming the dynamism of Italian exports in the sector.

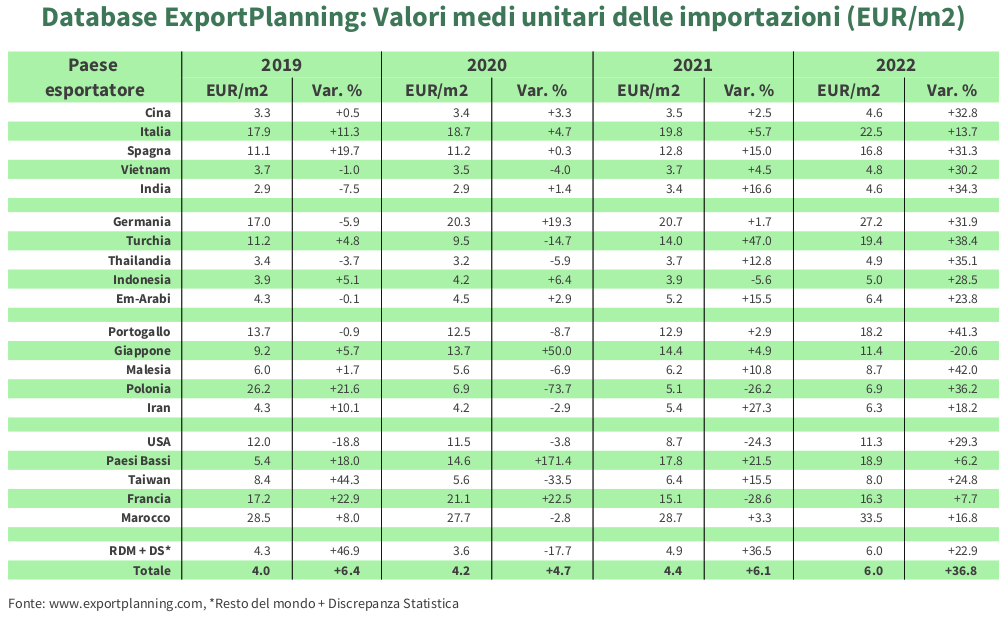

Finally, to get a complete picture, it is possible to analyse the positioning of the different exporting countries in terms of prices (average unit value).

Fig. 5 – Main tile exporters to South Korea

(price per square metre)

As we can see from the table, Italy is mainly positioned in the high quality segment with a price per square metre exceeding 22 euros in 2022, followed by Spain which occupies the medium-high bracket. The substantial difference with the Chinese figure of 4.6 euro per square metre stands out, as the country of the dragon dominates the lower price bracket, as do Vietnam and India.

Conclusions

The analysis carried out offers information of fundamental importance for an exporting company in order to draw as many useful indications from the available customs statistics as possible with a view to constructing an appropriate marketing strategy. With the new ExportPlanning update, the Reporting tool will be enriched with these new types of tables, for a complete picture of the market of interest.