Packaged Food and Beverages: in the third quarter of 2018 strengthening of US imports' growth

US imports thus confirmed their maximum levels

Published by Marcello Antonioni. .

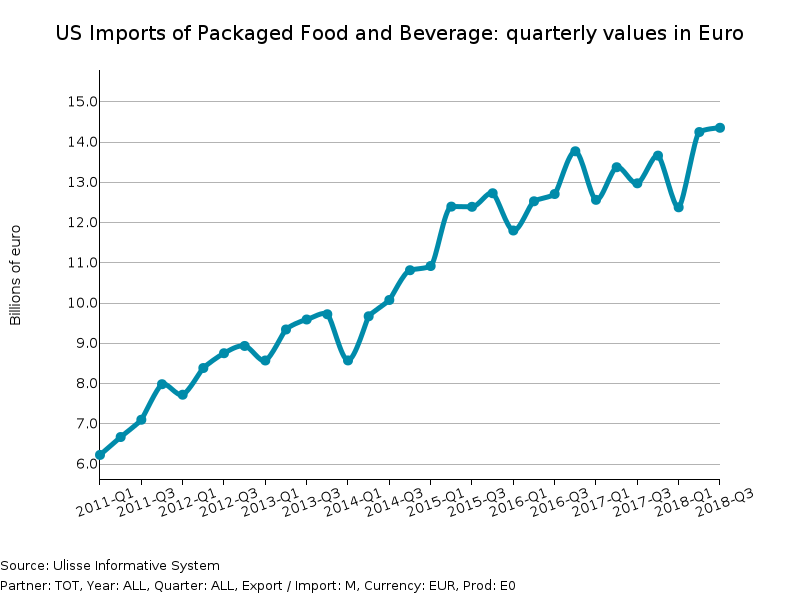

United States of America Food&Beverage Competitor analysis Conjuncture AgribusinessUS imports thus confirmed their maximum levels in quarterly figures (14.4 billion euros in the period between July and September), equivalent to 54.7 billion euros on an annual basis.

US market of Packaged Food and Beverages recorded - on the basis of the statements of US companies' customs - a new high in the third quarter of 2018, with a Year-Ove-Year growth rate of 10.6% in euro; the cumulative annual (January-September) was + 5.3%. Values in 2018 are about double those of the beginning of the decade.

|

| Source: ExportPlanning.com > Market Research > Analytics |

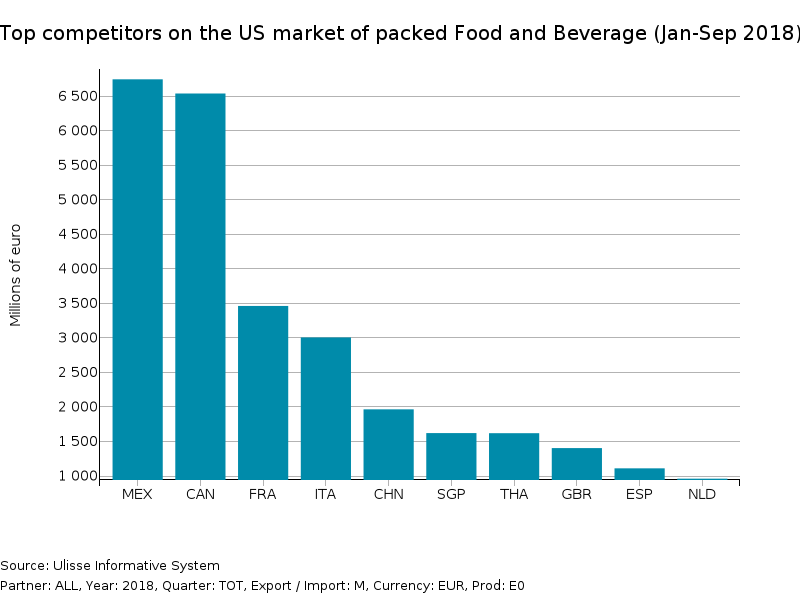

In the third quarter of the year sales from Italy were confirmed at maximum values, exceeding one billion euro on a quarterly basis, bringing the cumulative first nine months to exceed 3 billion euro, and started to repeat at the end of the year the record of over 4 billion euro of sales registered last year.

Therefore, Italy confirms the progress shown on the US market of packaged food products and beverages, in 4th place in the ranking of competitor countries, just behind France.

|

| Si veda: ExportPlanning.com > Market Research > Analytics |

It should be noted, however, that the growth performance of Italian sales (+3.1% Y-O-Y in euros in the period January-September 2018)

is lower than the average of competitors on the US market. In particular, we note:

Conversely, we see the decrease in US imports from Canada

(-2.5% cumulative trend in euro values) and the lack of dynamism of those from China (+ 0.8%), both certainly penalized by the proclamations of commercial wars in the course of year.

1 See hereafter the description of the sector analyzed in this article: Packaged Food and Beverage.