Weak economic conditions and trade war impact on the Aussie

Published by Alba Di Rosa. .

Exchange rate Central banks Trade war Uncertainty Conjuncture Exchange rate risk Exchange ratesA few weeks ago, we addressed the issue of central banks recently turning towards an accommodative monetary policy approach. Among these central banks, we can find the Reserve Bank of Australia (RBA), which cut its reference rates from 1.5 to 1.25% in early June, and in doing so established a record low. In this article, we will look the reasons for this decision by analysing the Australian currency and economic situations.

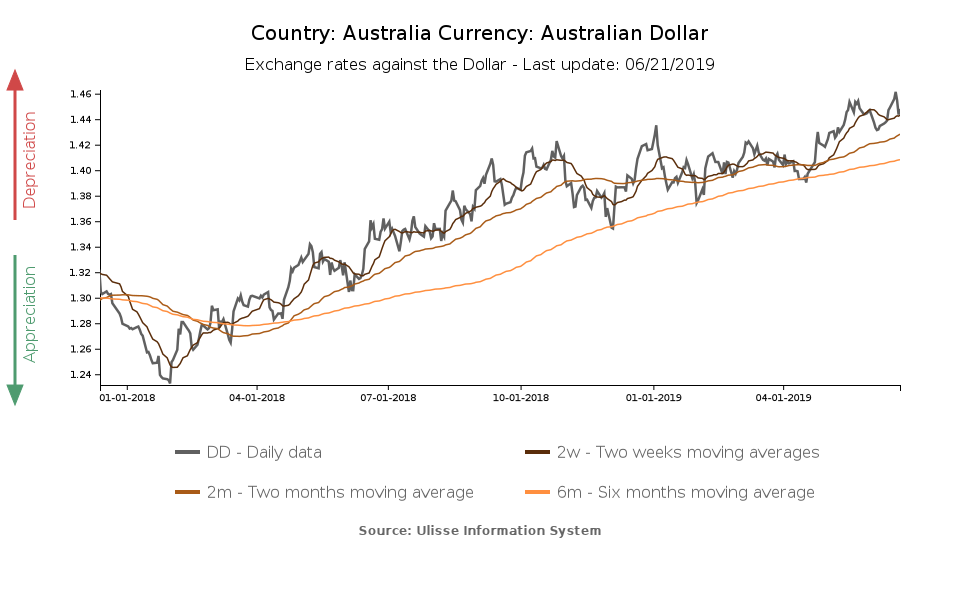

AUD: falling since the start of 2018

The graph below shows that the Australian dollar has been weakening since the beginning of 2018: in the period under consideration, the currency lost about 16% of its value against the USD.

Today, the USD-AUD closed at 1.45 AUD per US dollar, after reaching a peak of 1.46 yesterday. In recent times, such levels of exchange rate weakness were reached only in January 2016 and in 2009.

Looking at the main variables that influence exchange rate dynamics, such as current account balance and foreign currency reserves, no warning signs emerge. On the other hand, conditions of the national economy play a more significant role in explaining the dynamics of the Aussie, together with the ongoing US-China trade war tensions.

National economic situation

Quarterly data released by the Australian Bureau of Statistics suggests that from the beginning of 2018, a progressive slowdown in GDP growth rates has been taking place.

In Q1-2019, and the last quarter of 2018, the Australian economy grew by 0.3% compared to the preceeding quarter (chain volumes). The last time Australia showed such low growth rates was in 2008, during the world financial crisis. Turning to GDP per capita, the data is even less reassuring: in both Q4-2018 and Q1-2019, the indicator showed a slight contraction (0.1%), compared to the previous quarter. Local newspapers speak about "per capita recession".

Nonetheless, the RBA growth forecast for 2019 and 2020 is still quite good (about 2.75%), but below the bank’s long-term objective (3.5%).

Another economic indicator that is providing a negative signal is Australian household consumption, whose growth rate has slowed down since mid-2018, penalized by a long period of low income growth.

Last but not least, inflationary performance has not been satisfactory either: in Q1-2019, prices increased by 1.3% y-o-y, below the 2-3% target.

The global context

Apart from the domestic context described, marked by signs of slowdown, another factor to take into account is the well-known US-China trade war, which weighs heavily on the currency, increasing uncertainty and risks. The clash between the two economic powers, now underway for a year, intensified in May, with the increase in US tariffs on Chinese goods from 10% to 25% and the subsequent Chinese counteroffensive.

Trade war impacts Australia mainly for its strong commercial ties with China. According to ExportPlanning data, in 2018 Australian exports to China accounted for 32.5% of total exports, while 21.2% of its imports came from China. Ties with the US are comparatively small: Australia exported only 3.2% of its goods to the US last year and 10.5% of its total imports came from there.

In this context of internal slowdown and external tensions, we can infer that the currency might have been penalized. The very same factors led the central bank to opt for an accommodative approach. This is in line with the current global climate: this week, at the Sintra central bank forum, ECB President Mario Draghi opened the door to new stimulus, while the FED committee - which met a few days ago and left its rates unchanged - has renewed its willingness to intervene to support US economic growth.