Effects of the Great Lockdown on the Export Performance of the EU Fashion Industry

Preliminary figures indicate a reduction in EU exports of around 13% in EUR

Published by Marcello Antonioni. .

Fashion Great Lockdown Conjuncture Export Made in Italy Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

According to ExportPlanning pre-estimates from the latest Eurostat data, last year's European export of Finished goods for the Person1 left over €48 billion on the ground, corresponding to a 13% decline compared to 2019.

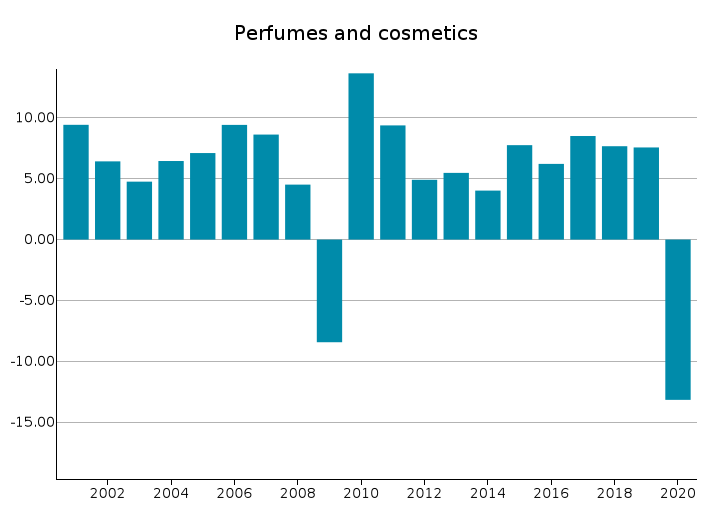

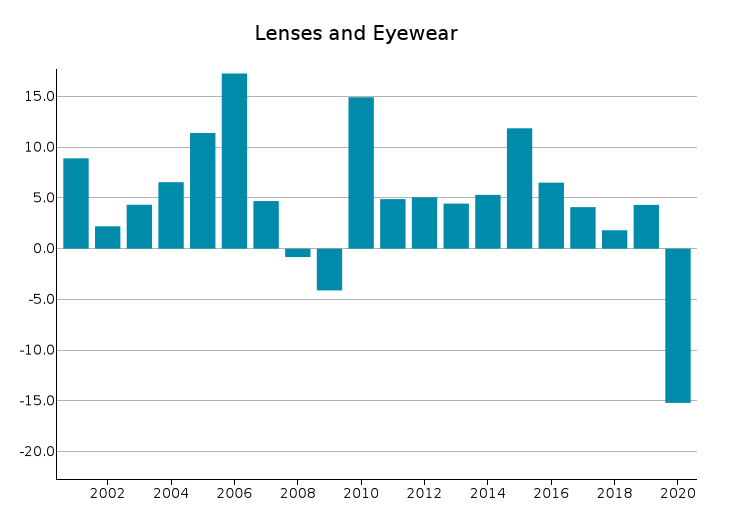

The reduction experienced by the sector's exports, and caused by the strong impact of the lockdowns on the consumption of fashion products at an international level2, appears higher - in terms of intensity - than the one recorded at the time of the Great Recession: in 2009, in fact, the drop in EU exports of the Fashion industry was just under 10% in EUR3.

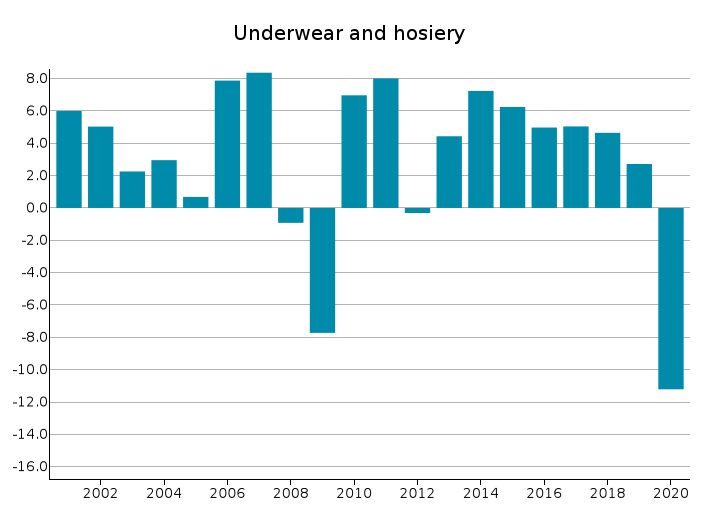

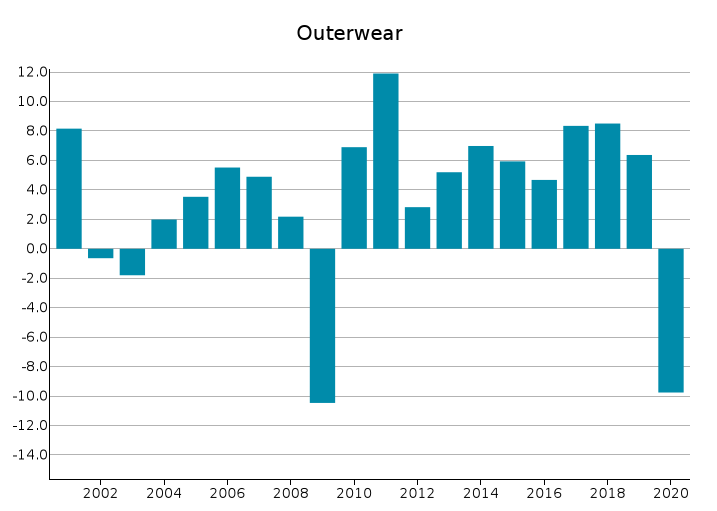

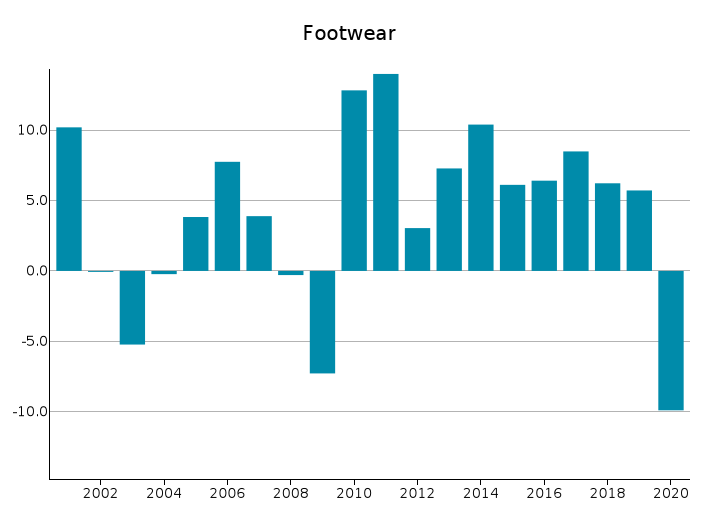

Declines generalized to all major sectors

Unsurprisingly, the impact of the so-called Great Lockdown on consumption in the sector was generalized to all the main areas of the Fashion industry. Declines in the order of 10-12 percentage points in EUR characterized EU exports of Underwear and Hosiery4 (with a reduction of €3.8 billion compared to 2019), Footwear5 (-€4.7 billion), Profumes and Cosmetics6 (-€5.7 billion), Outerwear7 (-€8.4 billion).

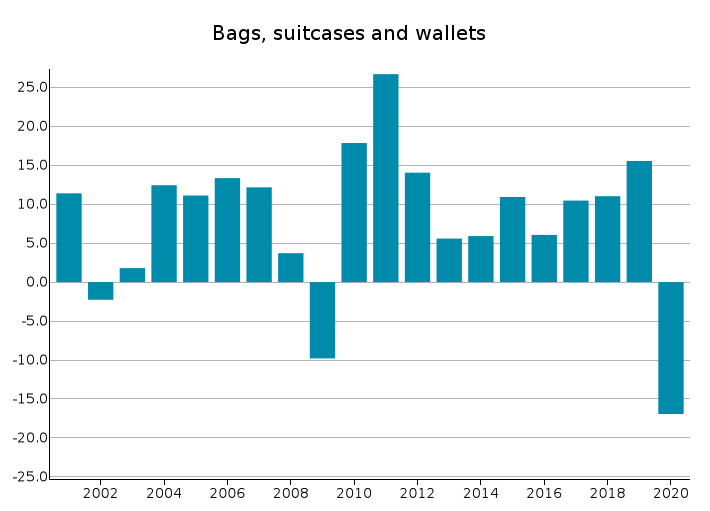

Greater losses were recorded for European exports of Bags, Suitcases and Wallets8 (-17% compared to 2019, equal to -€4.4 billion) and Lenses and Eyewear9 (-15%, for a loss of €1.8 billion).

|

|

|

|

|

|

Source: ExportPlanning - Market Research - Analytics, EU Trade Datamart

Double-digit slumps for all major target markets...

The recessionary effects of the Great Lockdown have not spared any of the main destination markets for European exports of Fashion products.

Last year, the most penalized markets for European sales of the sector were:

- the United States (-€6.8 billion compared to 2019, equal to -26.2%)

- France (-€5.5 billion, corresponding to -16.4%)

- Switzerland (-€5.4 billion, corresponding to -19.5%)

- the United Kingdom (-€3.8 billion, corresponding to -15.3%)

- Italy (-€3.7 billion, corresponding to -17.6%)

Relevant falls were also recorded for Spain, Hong Kong, the Netherlands, United Arab Emirates and Russia.

Poland, China, Kazakhstan and Israel bucking the trend

In contrast, the performance of European exports of Fashion products on some specific markets challenged the dominant downward trend. One of them is Poland which, in absolute terms, offered in 2020 the highest growth contributions to EU exports of the sector, with an increase of €1047 million YoY; China bucked the trend as well, with an increase of 7.6% in its imports of fashion products from the EU in 2020 (+€554 million), as well as Kazakhstan (+€224 million) and Israel.

1) See the list of the sectors included in this industry in the related industry's description.

2) Based on ExportPlanning pre-estimates from the most recent international trade data, last year world exports of Finished goods for the Person showed a slump close to 18 percentage points in euro values (19% at constant prices).

3) However, the different economic profile of the two crises should be noted: while in 2009 there were 4 consecutive quarters of similar decreases in trend, last year EU export performance was compromised in a decisive manner by a second quarter that marked a trend drop of 32% in euro values (with a cumulative annual drop of -20%), and a remaining part that marked a less dramatic -6.7% in euro.

4) See the list of the products included in this sector in the related sector's description.

5) See the list of the products included in this sector in the related sector's description.

6) See the list of the products included in this sector in the related sector's description.

7) See the list of the products included in this sector in the related sector's description.

8) See the list of the products included in this sector in the related sector's description.

9) See the list of the products included in this sector in the related sector's description.