World trade conjuncture: a geographical analysis

Against a deteriorating macroeconomic backdrop, some areas of the world still show attractive import growth rates

Published by Marzia Moccia. .

IMF Macroeconomic analysis Uncertainty Conjuncture Covid-19 Great Lockdown Global economic trends

The latest update of the World Economic Outlook, published by the International Monetary Fund (IMF) last July, returns a picture of the global economy still marked by the lingering effects of the pandemic and the Russian-Ukrainian conflict, with a downward revision of the growth estimated over the next two years. In the baseline scenario, growth is estimated to slow from last year's 6.1% to 3.2% in 2022 (0.4 percentage points lower than in the April 2022 World Economic Outlook), to 2.9% in 2023, with the outlook predominantly downward.

In fact, according to IMF analysts, many of the risks included in the April scenario have materialized, in particular:

- higher-than-expected inflation on the world stage, especially in the United States and major European economies, which has caused financial conditions to tighten;

- a marked and pronounced slowdown in China, due to the outbreaks and closures imposed by the resurgence of the virus, which will not allow the country of the Dragon to reach its growth target for 2022;

- the lingering negative effects related to the war in Ukraine

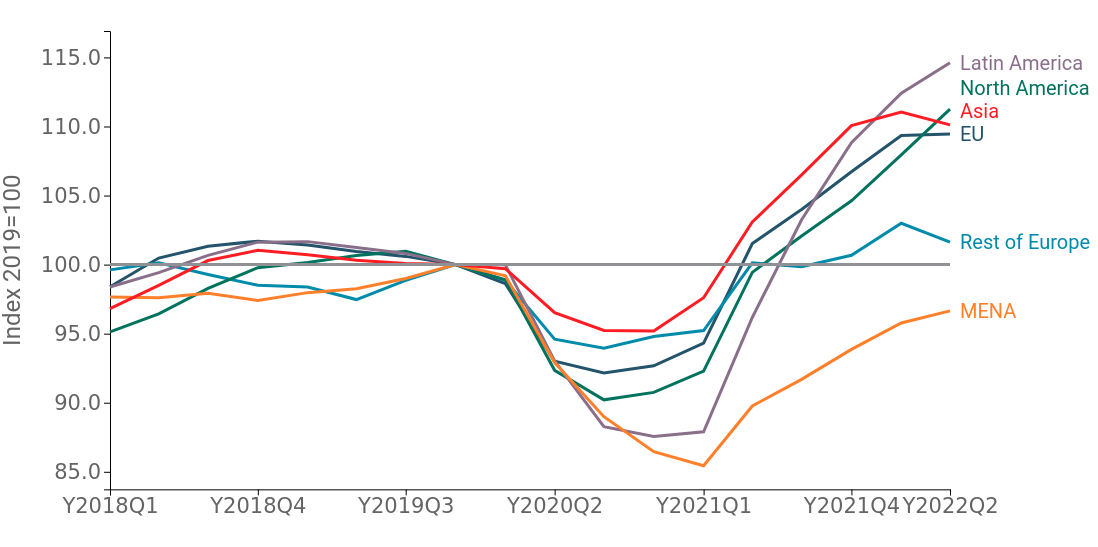

Against such a deteriorating macroeconomic backdrop, world trade data also signal a marked slowdown in its pace of expansion (see the article First Half 2022: World Trade Scenario between War and Inflation). The slowdown in world trade in goods affected mainly certain areas of the world, as shown in Fig.1.

Fig.1 – World trade conjuncture by geographic area

(cumulative 4 quarters, index 2019=100)

Source: ExportPlanning.

Although all the main areas of the world are placing themselves well above pre-crisis levels (the only exception being the MENA area), it is particularly evident how the slowdown, which occurred especially in the second quarter of the year, affected Asian and non-EU European imports in particular, due to, on one hand, the lockdowns that affected the main Chinese ports and, on the other hand, the negative effects of the conflict. EU imports also show signs of deceleration, while imports from the entire American continent are still in the midst of an expansionary phase.

Within the geographic framework just described, it is particularly relevant for exporters to identify those markets that, over the past few quarters, have been in a counter-trend dynamics to other areas of the world and the expansion trend marked in the medium term, between 2011 and 2019.

In order to highlight which markets are in an acceleration/deceleration phase with respect to the trend of recent years, the following graph positions on the x-axis the average annual change recorded by country between 2011 and 2019, and on the y-axis the change reported between the first half of 2022 and the corresponding period of 2019. Through this representation, it is possible to distinguish, in the upper-left section of the graph, economies that have accelerated from the long-term trend, and in the lower-right section, those that have instead entered a deceleration phase.

Fig.2 – International conjuncture: the driving and restraining markets

Source: ExportPlanning - Datamart World Conjuncture

As anticipated, among the main importing countries, showing a marked deceleration from the long-term trend we find China. The result reflects the negative effects related to the closures of major Chinese ports, with the resulting logistics inefficiencies. Also marking a timid slowdown compared to the 2011-2019 average annual change are the economies of the United Kingdom and Canada.

On the diametrically opposite front, we find the United States, which, together with Poland and Switzerland, are located in the upper right area of the chart, showing a definite acceleration from an already particularly dynamic long-term trend. Excellent signs also for Turkey, and for the Asian economies of South Korea and Indonesia.

Decidedly more differentiated is the picture for the major European economies: almost all of them, with the sole exception of France, show a pace of import expansion that dominates the long-term trend, which, however, especially for Italy, Germany, Spain and Belgium, had been distinguished by little dynamism in the 2011-2019 horizon.

In summary, in an international scenario increasingly marked by risks of downside, and a relatively differentiated breakdown by areas, the activity of "real time" monitoring of economic foreign trade information becomes increasingly relevant for exporters to optimize internationalization strategies and investments.