Sub-Saharan Africa: market potential for Textile Machinery

South Africa, Mauritius, Madagascar, Ethiopia, Uganda, Kenya, Tanzania and Nigeria are the top potential markets.

Published by Marcello Antonioni. .

Africa Fashion Planning Marketselection Industrial equipment Emerging markets Export markets International marketing Foreign market analysis

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

Although still not very relevant as a whole, Sub-Saharan Africa shows potential in some countries to be carefully monitored in the coming years.

Textile&Clothing supply chain: positioning of the SSA area

The Sub-Saharan African (SSA) area as a whole still appears to have a limited role in the global Textile-Clothing supply chain: as shown in the table below, the incidence of SSA's production of Textile-Clothing on the world total does not show any sign of improvement. In fact, it has registered a slight decrease in recent years, accounting for less than 1% of the global turnover.

Similarly, the weight of SSA's imports of Textile Machinery1 does not show any sign of improvement, remaining around 2 per cent of the world demand of the sector.

Sub-Saharian Africa: evolution of the relevance of Textile&Clothing supply-chain

% Shares of world totals (current price)

| 2000 | 2008 | 2013 | 2018 | |

|---|---|---|---|---|

| Textile&Clothing Production | 0.77% | 0.80% | 0.69% | 0.60% |

| Textile Machinery Imports | 1.58% | 1.99% | 2.14% | 1.96% |

Source: ExportPlanning-Market Research (CountryData Datamart)

South Africa, Ethiopia, Mauritius, Madagascar and Uganda, but also Kenya, Tanzania and Nigeria are to be considered the top potential markets.

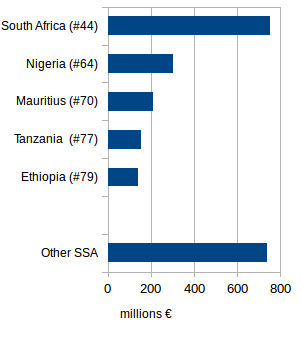

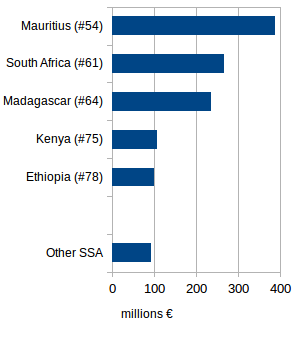

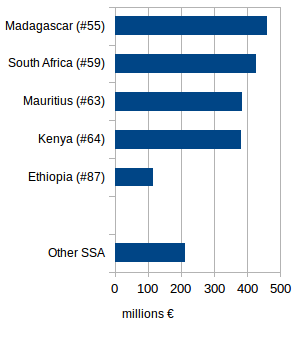

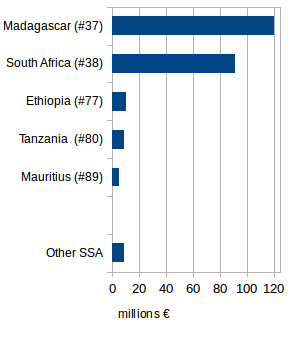

Top SSA producing countries of Textile&Clothing

The geographical composition of the production of Textile-Clothing products in the Sub-Saharan Africa area presents a rather concentrated offer:

- the predominance of South Africa's production of Textile Intermediates2 products, with an estimated production value in 2018 of 751 million euros (corresponding to about one third of the production of the entire area), ahead of Nigeria (301 million EUR);

- the productive leadership of Mauritius in Underwear and Hosiery3 products, with a production value estimated in 2018 equal to 387 million euros, ahead of South Africa and Madagascar;

- the driving role of Madagascar in the production of Outerwear4 (461 million euros in 2018, preceding South Africa and Mauritius) and Clothing Accessories5 (120 million euros, ahead of South Africa and Ethiopia).

Textile&Clothing - Top SSA Producing Countries in 2018

| ||

|---|---|---|

| Fabrics | Underwear and Hosiery | |

|

|

|

| Outerwear | Clothing Accessories | |

|

|

|

Source: ExportPlanning-MarketResearch (CountryData Datamart)

Other important producers are Kenya, ranking 4th among the producing countries in the area in the Underwear and Hosiery (107 million euros in 2018) and Outwear (€ 380 million) sectors, and Tanzania, in ranking fourth for value of Clothing Accessories production in 2018.

Top SSA specialized countries in Textile&Clothing

The analysis of foreign trade flows of Textile-Clothing products also indicates a trade deficit of Sub-Saharan African countries, but with some exceptions:

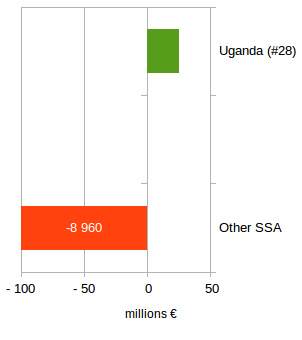

- Uganda shows a commercial surplus in Intermediates Textile products, with net exports growing in recent years and expected to remain positive in the 2022 scenario6;

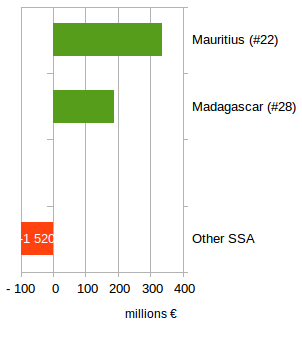

- Mauritius (+335 million euros of trade surplus in the 2022 scenario) and Madagascar (+189 million euros) are the two most specialized countries in Underwear and Hosiery;

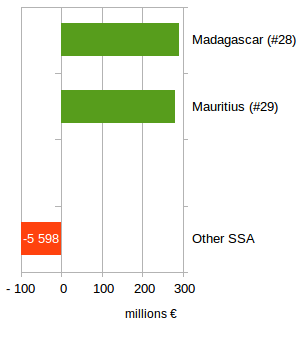

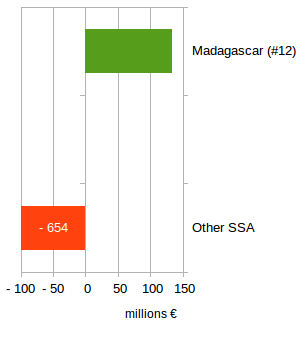

- Madagascar does record dynamics of increasing specialization and vertical integration in the supply chain, with a significant increase in the trade balance in the Outerwear sector (exceeding - in the scenario 2022 - the one of Mauritius) and - above all - as the only country in the area with significant trade surplus in Clothing Accessories.

Textile&Clothing - Top SSA Specialized Countries expected in 2022

| ||

|---|---|---|

| Fabrics | Underwear and Hosiery | |

|

|

|

| Outerwear | Clothing Accessories | |

|

|

|

Source: ExportPlanning-MarketResearch (Forecast Datamart)

Top SSA importing countries of Textile Machines

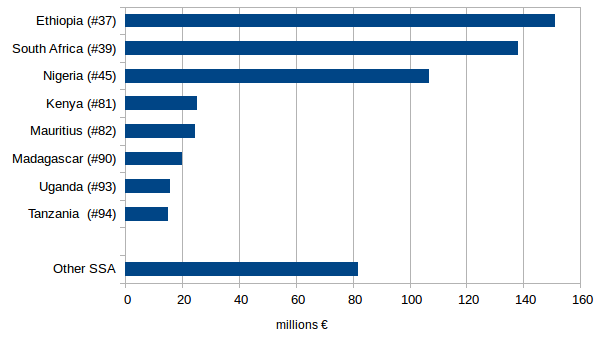

The 2022 forecast scenario, recently formulated by StudiaBo on the basis of the data of the latest World Economic Outlook7 published by the International Monetary Fund, shows the following ranking of Sub-Saharan African countries by value of imports from the world of textile machinery products:

- Ethiopia, due to the significant incoming Foreign Direct Investments8 which have characterized this economy, is expected to highlight the higher values of imports of Textile Machinery (exceeding 150 million euros in 2022), in 37th place in the world ranking;

- South African imports, albeit at a less dynamic pace, will be confirmed at the top of the area's chart, with 138 million euros;

- Nigeria (3rd place in 2022 for value of imports of Textile Machinery of the area), as well as Uganda, Kenya and Tanzania, will be able to express improvements, thanks to the dynamic macroeconomic context forecasted by the International Monetary Fund (and documented in the recent article A map of global economic growth);

- positive trends are also expected by Madagascar and Mauritius, on the basis of the distinctive specializations in the clothing supply chain which characterize, as previously documented, these two economies.

Textile Machines - Top SSA Importing Countries expected in 2022

Import Values, Mln € (in brackets the position in world-wide ranking)

Source: ExportPlanning-MarketResearch (Forecast Datamart)

1) For a list of the considered product categories, see the following Product description table.

2) For a list of the considered product categories, see the following Product description table.

3) For a list of the considered product categories, see the following Product description table.

4) For a list of the considered product categories, see the following Product description table.

5) For a list of the considered product categories, see the following Product description table.

6) For a description of the methodology used in formulating the forecasts considered in this article, please refer to the Forecast of international trade: Methodological Note by StudiaBo.

7) See the related WEO Datamart.

7) See the related FDI Datamart, which documents Foreign Direct Investments flows in Ethiopia of over 3 billion euros per year in 2016 and 2017.