Early 2024: the health of the world economy in times of conflict

A glimpse of Russia, nearly two years later

Published by Alba Di Rosa. .

Exchange rate Macroeconomic analysis Europe Importexport Emerging markets Trade balance Russian rouble Uncertainty IMF Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The possibility of a soft landing for the global economy is approaching, at least according to the latest International Monetary Fund (IMF) forecast released in late January. For 2024, the World Economic Outlook Update forecasts world GDP growth of 3.1 percent, up 0.2 p.p. from October's estimates, thanks to greater than expected resilience from the U.S. economy in the second half of 2023, but also from several emerging and developing countries. Growth in the world economy is still confirmed to be below the historical average (which had been 3.8 percent over the 2000-2019 period), but the disinflation process is ongoing and risks to global growth appear to be rather balanced, and more moderate than in the past.

As can be seen from the graph, the upward revision for GDP growth estimates in 2024, compared to the previous edition of the WEO, is moderate but widespread to both emerging and advanced economies. Unexpectedly, among the countries included in the scenario, it is Russia that has the highest revision: in fact, the country's GDP is projected to grow by 2.6 percent this year, up 1.5 p.p. from last October's IMF estimates.

According to the Fund, these particularly dynamic growth rates for the current wartime environment come on the heels of higher-than-expected growth as early as 2023 (amounting to +3 percent), due to high military spending and private consumption, supported by wage growth in a tight labor market. Thus, the so-called "war economy" contributes to economic growth; on the other hand, from the perspective of foreign trade, a reallocation - at least partial - on the export front has also contributed positively to the resilience of the Russian economy.

Focus on foreign trade through the mirror flow technique

Let us then delve into the latest international trade data regarding Russian trade. In the absence of any declarations by Russia on its trade flows since the aftermath of the start of the conflict with Ukraine, we can use the mirror flow technique: we then consider the respective figures provided by countries that have declared trade with Russia, either inbound or outbound.

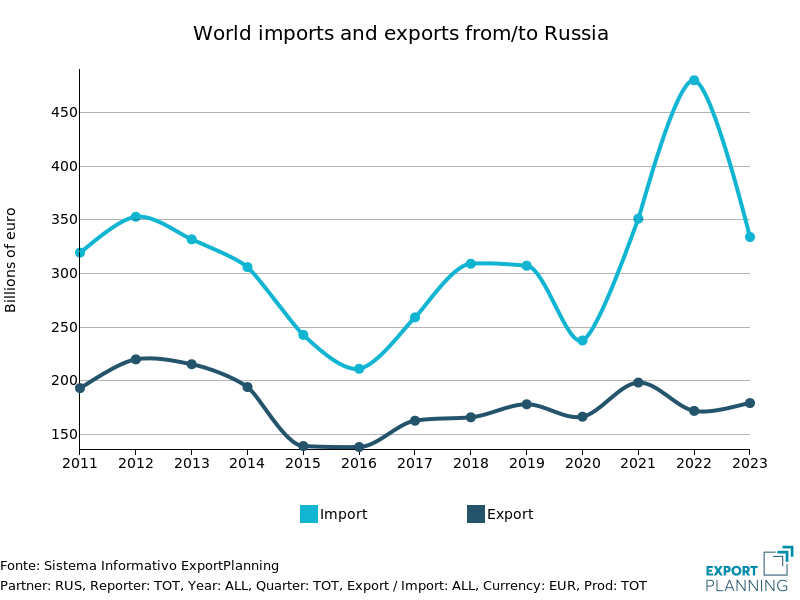

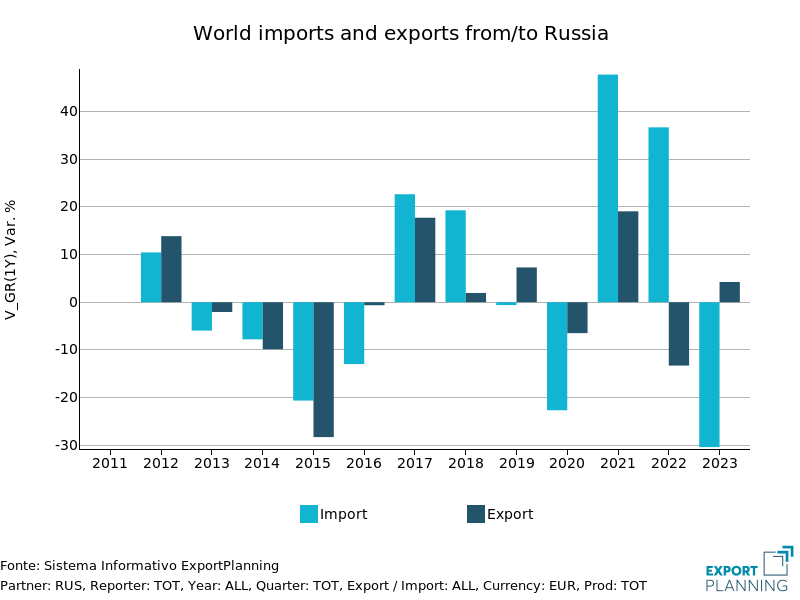

In the graphs below, we report the import and export declarations of the world's countries from/to Russia, in current and constant prices, and their growth rates.

|

|

|

|

As the graphs show, world imports from Russia, measured in constant prices, are clearly declining, especially over the last year. According to ExportPlanning data, a -19% contraction of is estimated for 2023, after -12% fall in 2022 (which had brought flows at constant prices back to 2020 levels).

On the other hand, considering values at current prices (which are thus not adjusted for the effects of the generalized price increase), global imports from Russia show a marked increase in 2022, followed by a 30% decline in 2023. In 2023, world's imports from Russia are estimated above €300 million at current prices, thus being slightly below 2021 levels, aided by the price effect and an at least partial reallocation of outflows from Russia to eastern markets.

Countries declaring to import from Russia

|

|

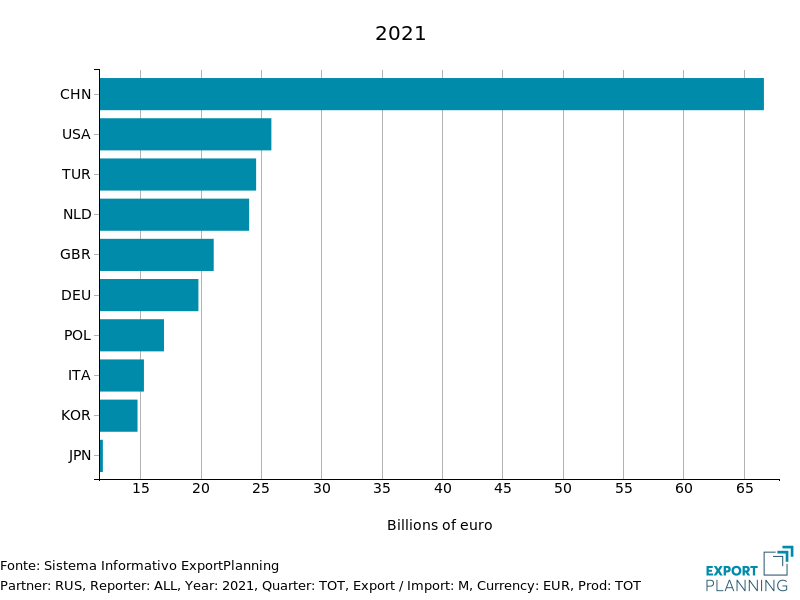

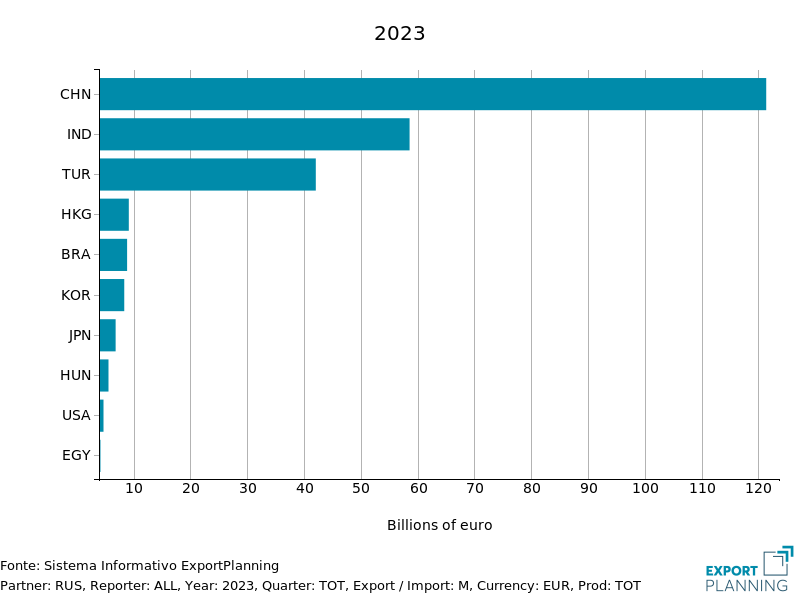

In fact, looking at the data regarding the countries that reported to import from Russia, we can see that in 2023 36% of total imports came from China, 18% from India, and 13% from the EU. Consider that in 2021 the Chinese share was close to 20%, the Indian share around 2%, and the European share was over 40%.

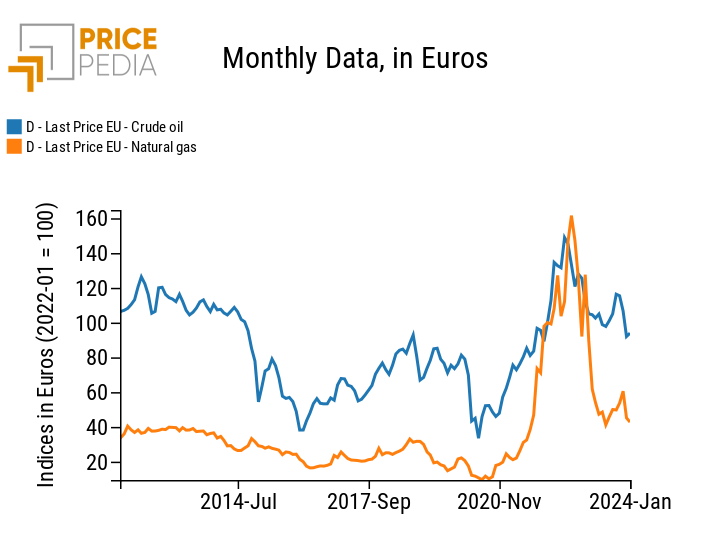

Given the significant concentration of Russian exports on the commodities front (accounting for 68% of the country's total exports in 2021), the significant increase in prices that occurred especially in 2022 also affected export-related revenues, as well as the country's balance of payments. Indeed, IMF data on the current account balance (goods) show a high point in Q2 2022, which then gradually went down amid the general decline in commodity prices and the gradual effect of Western sanctions.

|

|

Sources: International Monetary Fund (left) and PricePedia (right).

Hand in hand, the effects of sanctions on export earnings also reflected on the currency, the Russian ruble, which lost more than 20 percent of its value against the dollar during 2023.

What prospects for the future? While in the short term Russia seems to show a fair degree of resilience to the effects of the war, thanks to the support of government spending and the very nature of the country's economy, which is heavily focused on commodities largely under state control, experts say the long-term outlook is not as optimistic. We find, in fact, on the one hand the risk of a gradual loss of revenue on the commodities front, and on the other an aging production apparatus, in the face of reduced technology supply; last but not least, the human capital factor stands out, an asset subject to inevitable weakening in times of conflict and migration.