American Market: Falling Demand for Machinery

In Q1-2020, a drop in imports spread to all sectors of machinery - with the relevant exception of Food Machines.

Published by Marcello Antonioni. .

Industrial equipment Check performance United States of America Uncertainty Import Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

US trade data for Q1-2020 released on ExportPlanning show a deep fall in the American demand for Machinery1. In the first quarter of the year US imports of Machinery recorded a double-digit drop in USD values (-13.4% year-over-year), going down for the second consecutive quarter2.

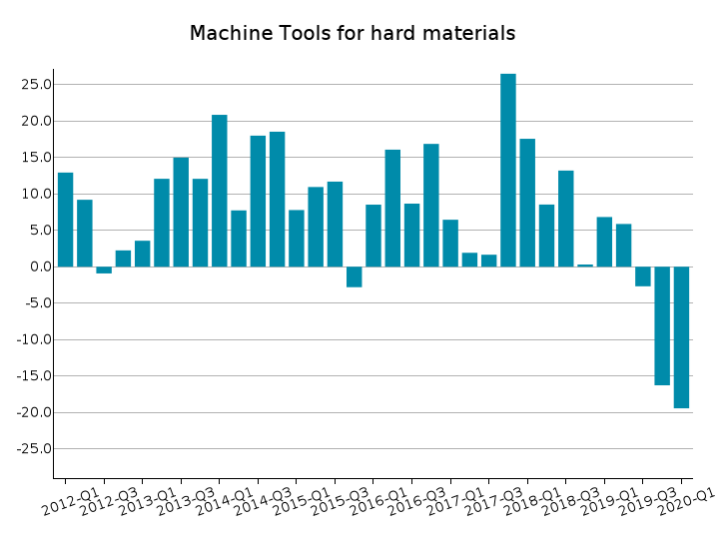

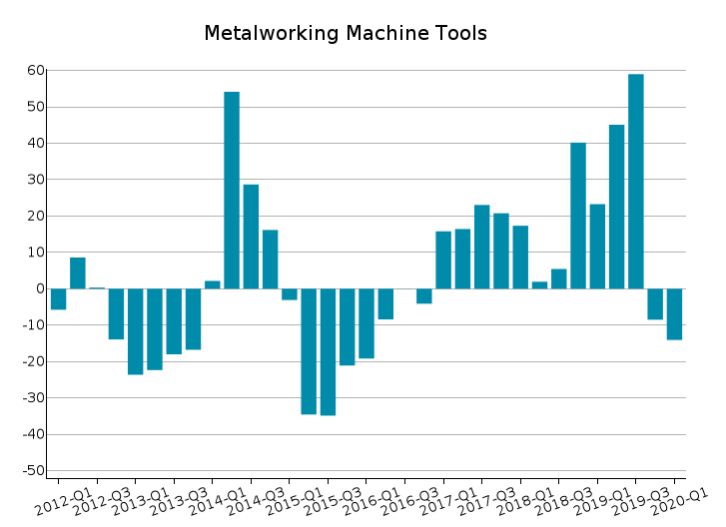

Deep falls in US imports, especially for Machine Tools (metalworking and for hard materials)

As mentioned in our recent article, the US demand for Machinery has been showing a sharp deterioration, after a phase of lively growth until the first part of last year.

Within the Machinery industry, Machine Tools, both metalworking3 (-14.1% year-over-year in USD) and those for hard materials [ie: wood, glass, etc.]4 (-19.4%), are the most affected sectors by the drop in US imports.

|

|

Source: ExportPlanning.com - MarketResearch - Analytics tool, US Trade datamart

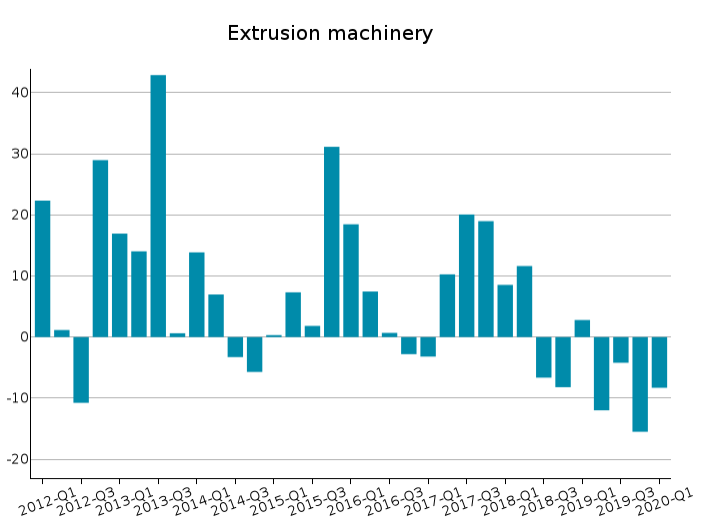

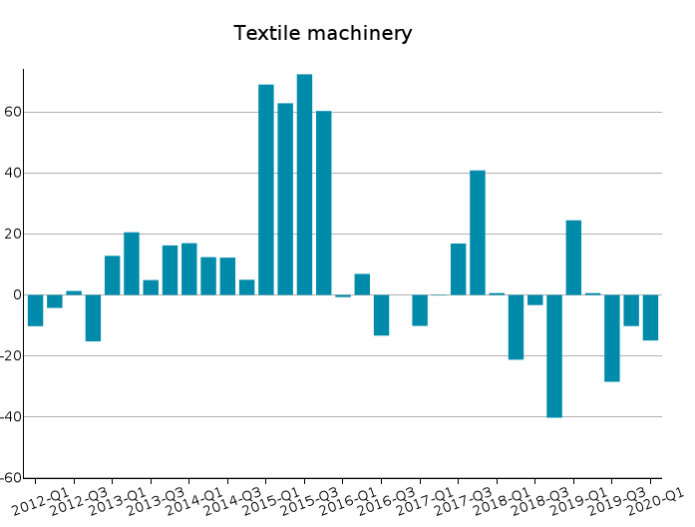

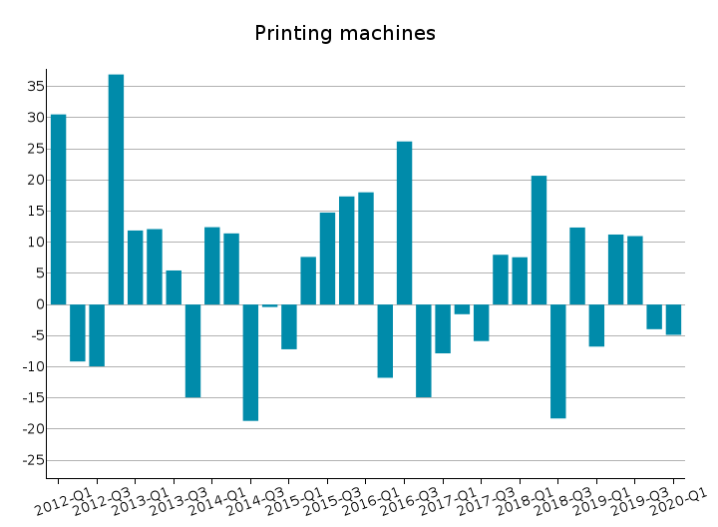

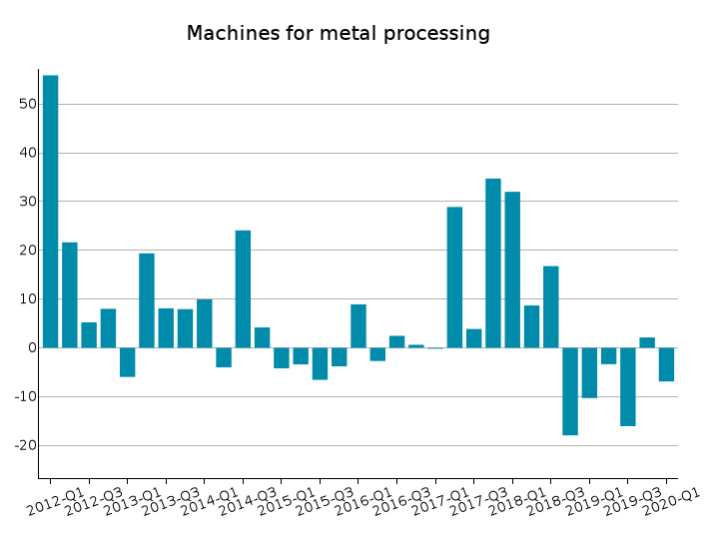

Persistent falls for Extrusion Machinery, Textile Machinery and Printing Machines

In Q1-2020 US imports continued to decline for Extrusion Machinery5 (-8.3% year-over-year in USD, after -15.5% of Q4-2019), Textile Machinery6 (-12.3%) and, to a lesser extent, Printing Machines (-4.9%)7.

A negative performance also involved Machines for metal processing8 (-6.9%, thwarting the positive rebound of Q4-2019, thus returning to a negative growth pace) and Other special purpose machinery.

|

|

|

|

Source: ExportPlanning.com - MarketResearch - Analytics tool, US Trade datamart

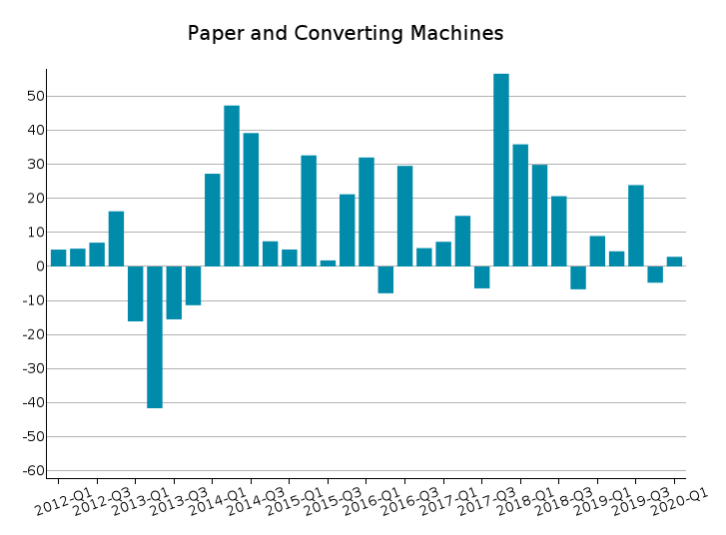

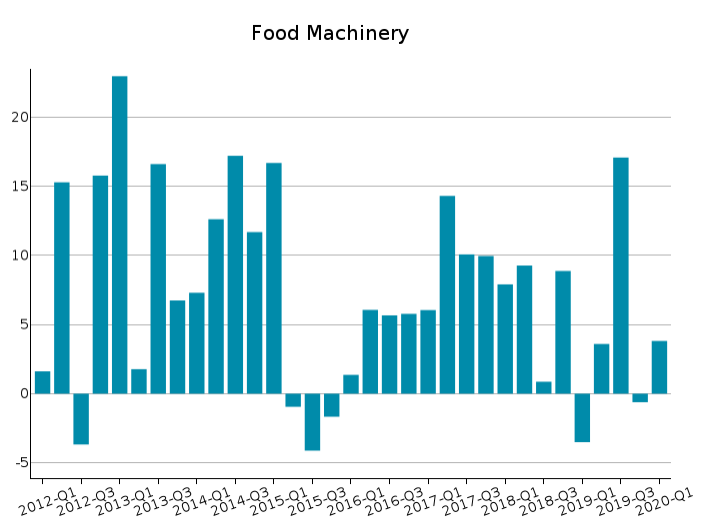

Relatively more favorable dynamics

for Food Machinery and Paper&Converting Machines

The Packaging-Converting supply chain looks less affected by the American recession: in Q1-2020 US imports of Paper and Converting Machines9 nearly recovered from the previous quarter's decline.

Last but not the least, the moderate increase in US imports of Food Machinery10 (+3.8% year-over-year in Q1-2020, measured in US dollars) is also noteworthy, in contrast with the general trend of the Machinery's industry. Furthermore, it follows a positive trend that was also evident in the average for 2019 (+4.3%).

|

|

Source: ExportPlanning.com - MarketResearch - Analytics tool, US Trade datamart

1) See the list of the sectors inclueded in this industry in the related industry description.

2) Please note that little effects of the coronavirus pandemic refer to Q1-2020 for US trade: as documented in the Covid19Lab project, the spread of coronavirus contagion in the USA has accelerated since the last decade of March 2020 and the related lockdown of economic activities officially started last 23rd March only in a few American States.

3) See the list of the products included in this sector in the related sector description.

4) See the list of the products included in this sector in the related sector description.

5) See the list of the products included in this sector in the related sector description.

6) See the list of the products included in this sector in the related sector description.

7) See the list of the products included in this sector in the related sector description.

8) See the list of the products included in this sector in the related sector description.

9) See the list of the products included in this sector in the related sector description.

10) See the list of the products included in this sector in the related sector description.