Premium Opportunities for the European Fashion industry: after record numbers in 2019, the Chinese Market Unknown

In Q1-2020, EU Exports of Fashion products - especially Clothing - to China are expected to experience a sharp drop.

Published by Marcello Antonioni. .

Premium price Slowdown Fashion Internationalisation Conjuncture Export markets International marketing Made in Italy Foreign market analysis

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The driving role of the Chinese market for the European high-end Fashion industry

The recovery of the Chinese economy from the effects of the Covid-19 emergency1 constitute a strong element of uncertainty for Italian and European companies in the high-end fashion industry. In the space of a few years, the Chinese market has in fact become - after Switzerland, often used as a logistics hub for fashion brands - the main destination for premium-price sales by EU exporters of Fashion products2.

In 2019 EU exports of Fashion products to the Chinese market set a new record, exceeding for the first time €9 billion, of which almost €7 billion are attributable to the High Price Range (source: StudiaBo elaborations3).

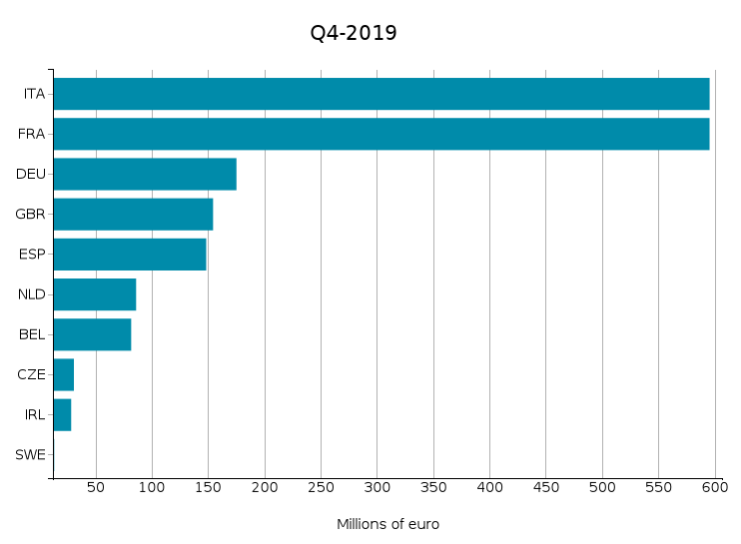

Italy4 represents China's main trade partner on the Chinese market for high price range Fashion products: at the end of 2019, Italian high-end sales on the Chinese market preceded - in order - those of Japan, South Korea and France (all with values exceeding €2 billion).

Results for Q1-2020 strongly penalize EU Exports of Fashion products to China

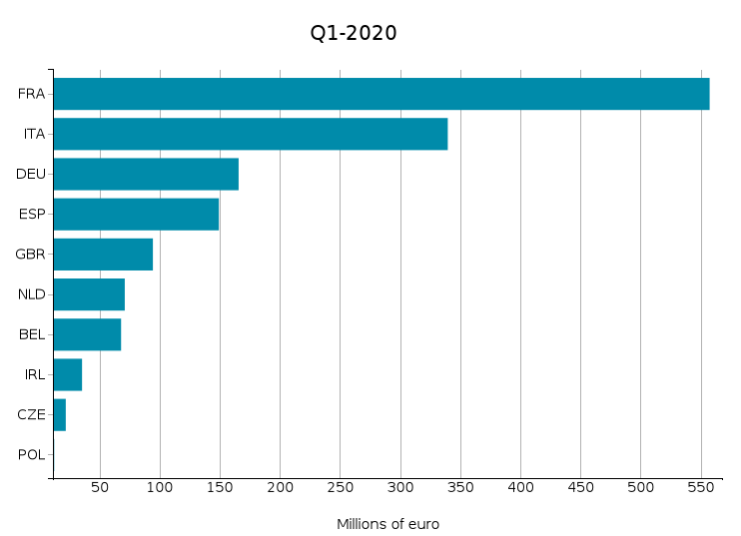

In the first quarter of 2020, pre-estimates made by StudiaBo on the basis of EU companies' foreign trade data show a decline in EU exports of Fashion products to the Chinese market amounting to -15% year-over-year in euro.

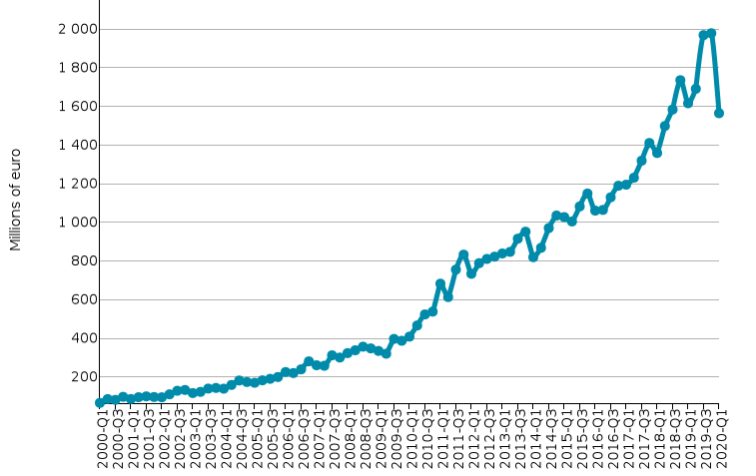

EU Exports to Cina of Fashion products: quarterly values

Italian exports show a particularly sharp fall: -30% year-over-year in euro, due to quite negative performances for both Outwear (-30%) and Underwear and hosiery (-31%).

The performance of Italian exports appears poorer compared to the French competitors, which in Q1-2020 bypassed Italy in the ranking of EU partner countries of Fashion products on the Chinese market, thanks to stable trends for Perfumes and Cosmetics exports5.

China: Top-10 EU Exporters of Fashion products

|

|

Source: ExportPlanning Analytics

1) As is well known, the first outbreak of the Covid-19 global health emergency in early 2020 affected the city of Wuhan, capital of Hubei Province in China, leading in a few weeks to about 80,000 confirmed cases (see Covid19Lab), the "lockdown" of large regions of the country and a blockage of many businesses with the rest of the world. The health normalisation phase has been underway for some time, although it still has significant uncertainties about the country's economy and foreign trade.

Forecasts recently formulated by the International Monetary Fund in its April 2020 World Economic Outlook, show, however, under the assumption of no significant impact of the health emergency, a sharp deceleration of China's GDP in 2020, expected to grow this year "only" by +1.2% at constant prices (compared to a previous forecast for the current year of +5.8%): see the related WEO database in the Analytics section of ExportPlanning.

2) See the list of the sectors inclueded in this industry in the related industry description.

3) In order to extract this information from foreign trade data, StudiaBo has carried out an econometric work

aimed at the preliminary identification of the characteristics of differentiability of the different products at customs code level.

This work has allowed the identification of qualitatively differentiable products. For each differentiable product, 5 price ranges (High, Medium-High, Medium, Medium-Low, Low) were calculated, corresponding to the quintiles of the ordered price distribution (given by the ratio between values and kg) of the specific product worldwide. For a methodological description, please refer to the Methodological Note (see the "Price ranges" chapter).

4) It should be noted, above all, the strong importance of Italian "premium-price" exports of clothing. At the end of 2019, Italian exports to China of Outerwear exceeded, for the first time, €800 million, of which more than 90% were in the high price range; until the beginning of the last decade, these "premium" sales were worth around €100 million. Similarly, in the Underwear and hosiery sector, Italian exports have reached a peak (over €160 million), virtually almost 100% of which can be attributed to the high price range.Furthermore, it should be noted that, until the first part of the last decade, Italian high-end flows were very modest, less than €100 million. See Ulisse Datamart, which collects the historical series from 1995 to 2019 of bilateral flows by price range of over 150 countries, at industry/sector/product level.

5) In the last five years French exports in the Perfumes and Cosmetics sector to the Chinese market have increased fivefold, reaching last year's record figure of over €1.8 billion (+45% YoY); of this value, over 90% is attributable to the high price range.