The Global Crisis of Investment Goods

Worldwide exports of electrical engineering products, machinery, tools and equipment, industrial plants have been falling for 4-5 quarters in a row

Published by Marcello Antonioni. .

Slowdown Metal industry Conjuncture Global demand Check performance Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The negative phase of the investment cycle intensified in early 2020, but was already underway in 2019

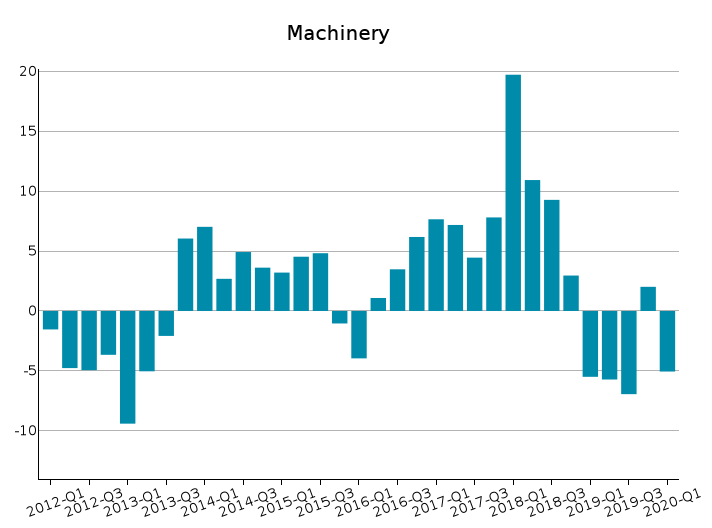

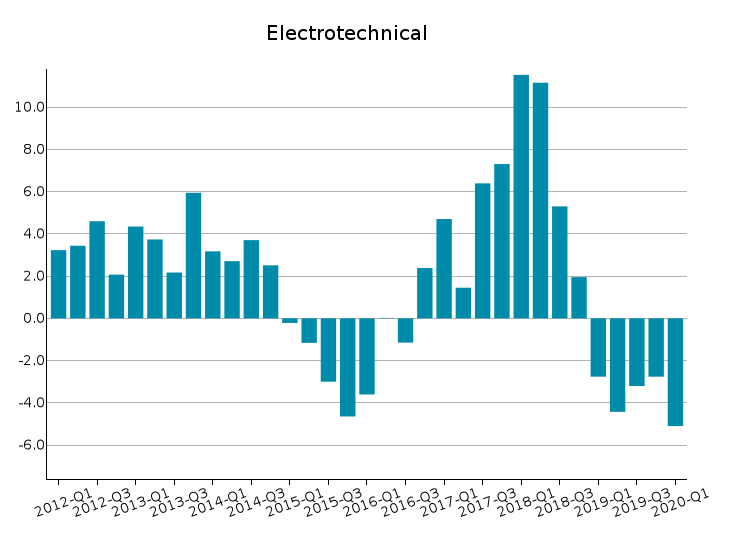

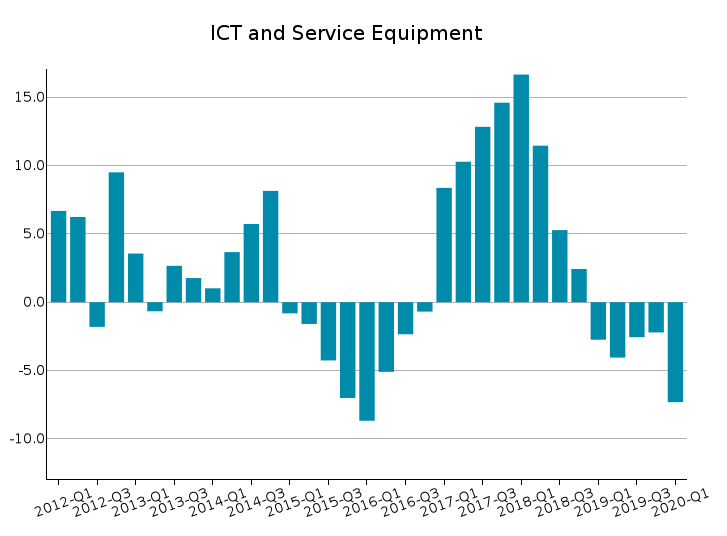

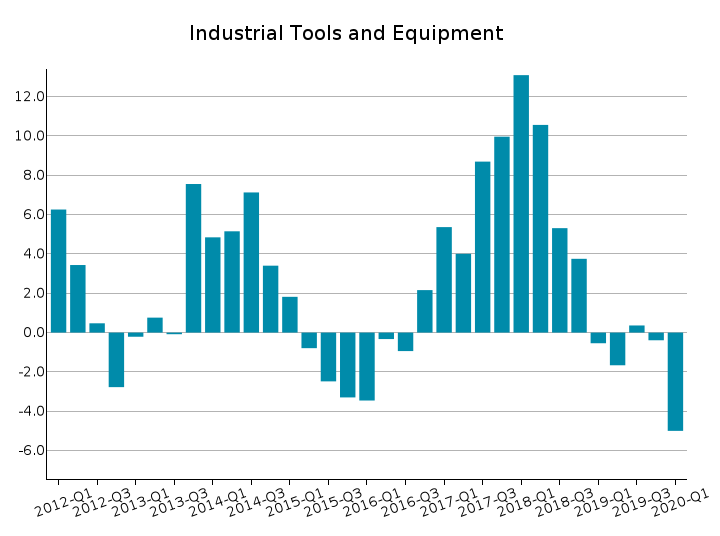

The analysis of world trade, updated to the first quarter of 2020 (see ExportPlanning World Trade Datamart), reports in the last 4-5 quarters a generalized drop in world exports for electrical engineering products, industrial machinery and plants, industrial tools and equipment, tools and equipment for ICT and services, industrial plants.

The contraction is particularly relevant for machinery, far less pronounced for industrial plants.

In particular, the negative phase of the investment cycle (measured in terms of distance between the maximum and minimum point of world exports at constant prices) can be described as follows, at the industry level:

- Machines and industrial plants1

- Over -16%

- 5 of the last 6 quarters on a downward trend (in particular, Q1-2020 was down by 5.1%)

- Electrical engineering2

- Over -13%

- Last 5 quarters on a downward trend (the last quarter was the worst, with a drop of over 5%)

- Tools and equipment for ICT and services3

- Above -11%

- Last 5 quarters down by 7. 3%

- Industrial tools and equipment4

- Close to -11%

- Last 5 quarters down (particularly significant is the reduction in Q1-2020, by 5%)

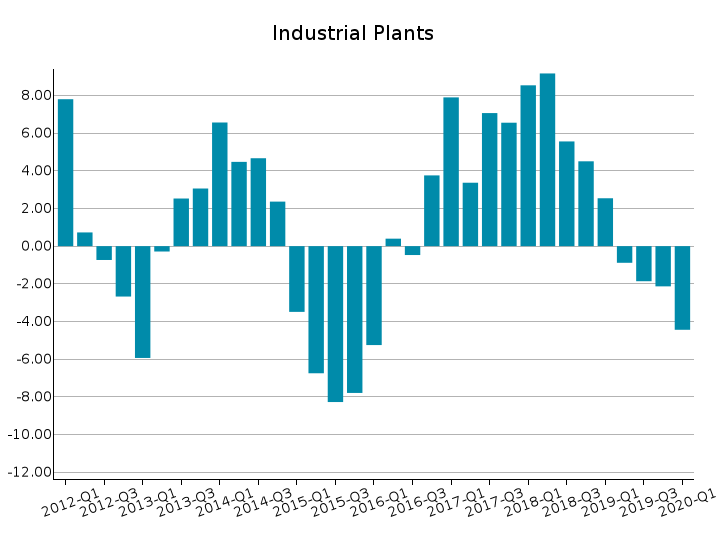

- Industrial plants5

- -6.8%

- Last 4 quarters on a downward trend (in particular, the last three months were down by 4.4%)

|

|

|

|

|

|

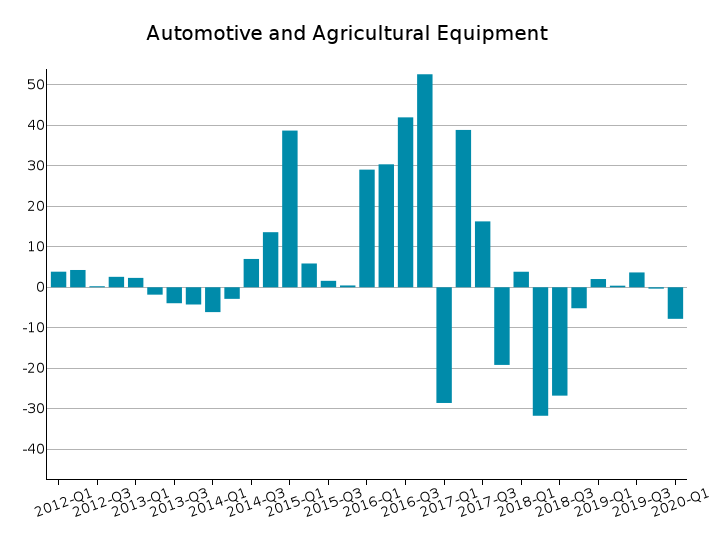

Source: ExportPlanning - Market Research - Analytics, World Trade Datamart

The case of the Cars, transport and agriculture equipment6 should be noted for its dynamics of prolonged weakness in world exports. In this case, the effects of uncertainty linked to the technological transformations taking place in the automotive supply chain are added to economic factors. Overall, the intensity of the reduction is in any case similar to the other industries considered above, equal to approximately 12 percentage points, but with a less sharp fall: the last quarter considered (January-March 2020) marks, moreover, a YoY decrease of almost 8%.

Inevitable new (deep) fall in Q2-2020:

which prospects for the second part of the year?

The second quarter of 2020 will most likely show a further sharp decline in global exports of capital goods, in line with the lockdown phase of the major Western economies.

The trend of the second half of the year and, more generally, the ways of reversing the investment goods cycle will crucially depend on the shape of the global demand crisis: hopefully a "V", thanks to the possibility of a "rebound" effect on global demand from the normalization of the health emergency, a "U" or, in the worst case scenario (as happened in the Great Recession started in 2008), a "L": see the article "The form of the global demand crisis will be in V, U or L ?".

1) See the list of the sectors inclueded in this industry in the related

industry description.

2) See the list of the sectors inclueded in this industry in the related

industry description.

3) See the list of the sectors inclueded in this industry in the related

industry description.

4) See the list of the sectors inclueded in this industry in the related

industry description.

5) See the list of the sectors inclueded in this industry in the related

industry description.

6) See the list of the sectors inclueded in this industry in the related

industry description.