October 2020 IMF Scenario: the Long Road to Recovery

The latest World Economic Outlook sheds a ray of hope on 2020, compared to previous estimates; however, all major economies remain in negative territory, with China as a relevant exception

Published by Alba Di Rosa. .

Covid-19 Great Recession Europe Great Lockdown Emerging markets United States of America Uncertainty Italy Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

On October 13, the International Monetary Fund released its latest forecast scenario, the October 2020 World Economic Outlook (WEO), a flagship publication to assess the evolution of the world economy. As in the previous April scenario, the extraordinary effects of the pandemic shock on the economy dominated the discussion; estimates are therefore characterized by a high margin of uncertainty.

The baseline scenario assumes that social distancing measures will continue in 2021, to be then gradually loosened with the potential spread of a vaccine and improved treatment. It is assumed that the local spread of the virus could be brought to contained levels by the end of 2022.

The October publication confirmed the extent of the crisis, already identified in the April scenario: the current economic crisis triggered by the pandemic is confirmed as the greatest since the Great Depression of '29, in the words of Kristalina Georgieva, IMF Managing Director. Excluding the collapse caused by World War II, it is therefore the deepest economic contraction that has occurred in recent history in peacetime.

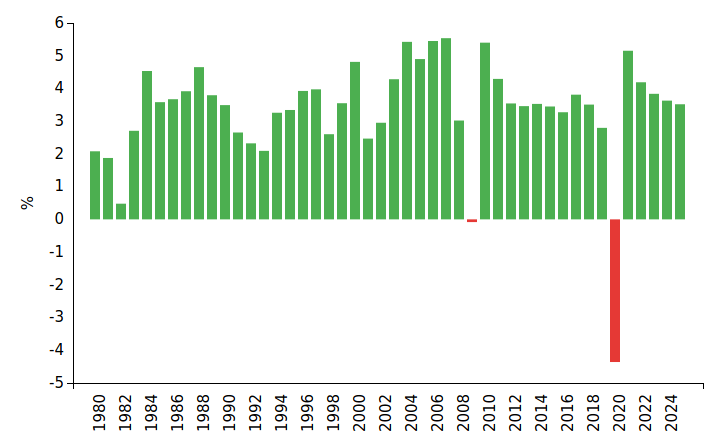

As can be seen from the graph below, the contraction of world GDP by 0.08% in 2009 is almost negligible, compared to the collapse expected for the current year.

Global GDP growth rate (1980-2025)

Source: ExportPlanning elaborations on International Monetary Fund data.

In spite of the overall gloomy scenario, the latest IMF publication shows a glimmer of optimism, compared to the data released in June (WEO Update): estimates for global GDP growth in 2020 were revised upwards (-4.4%, compared to the previous -5.2%), due to shallower-than-expected contractions in Q2 and signals of a stronger-than-expected recovery in Q3. For 2021, growth is expected to be 5.2%, to then settle at 3.5% in the medium term.

It is therefore confirmed that the world economy has started its recovery, after the collapse due to the Great Lockdown. This recovery, however, remains "long, uneven and uncertain" according to Gita Gopinath, Economic Advisor and Research Director of the Fund.

The main sources of uncertainty affecting the scenario are as follows:

- The evolution of the pandemic and the consequent effects in terms of damage to economic activities

- Spillovers from a weaker world demand, a reduction in tourism and remittances

- Financial markets' sentiment and its implications for capital flows

Analysis by country

For all advanced, emerging and developing economies, GDP is expected to remain below 2019 levels in 2020; the only major exception is China, where the recovery has been faster than expected, and for which a positive change in GDP is expected already in the current year (+1.9%, revised upward compared to June).

For developed economies as a whole, the growth forecast for 2020 has been revised upwards (-5.8%, compared to the previous -8.1%), while emerging and developing economies (excluding China) have been subjected to a downward revision: from the previous -5% to the current -5.7%.

GDP forecasts for Italy have been revised upwards (-10.6%, compared to -12.8% in June), as well as the United States (-4.3%, compared to the previous -8%), Germany, France and the United Kingdom. On the contrary, the -12.8% forecast for Spain is unchanged, thus marking the largest contraction at EU level, followed by Italy, Portugal and the United Kingdom.

Towards 2021

Broadening our view to 2021, world GDP should score a modest increase of 0.6% compared to 2019 levels. However, this recovery will be concentrated in a few countries: for most of the world's economies, in fact, 2021 will not be enough to fully recover the fall generated by the Covid crisis.

The following two graphs, referring respectively to developed and emerging countries, show:

- On the X-axis, the rate of change in GDP forecasts for 2020

- On the Y-axis, the expected percentage change in GDP in levels between 2019 and 2021

The size of the ball is proportional to the value of the country's imports in 2019.

Developed countries

By positioning the mouse on each circle, a table summarizing data related to the selected country will be displayed.

While all developed countries are expected to show a negative change in GDP in 2020, only a small portion of them are expected to exceed 2019 GDP levels by next year: these include Ireland, South Korea and Norway. For the other developed countries, the level of GDP in 2021 is expected to remain even lower than in 2019. Among the hardest hit nations we can find Spain, Italy, Great Britain, France, Portugal and Hong Kong.

Emerging countries

By positioning the mouse on each circle, a table summarizing data related to the selected country will be displayed.

For emerging countries, the scenario depicted by the IMF looks slightly more encouraging. While China and Vietnam are expected to show a positive economic growth rate as early as 2020, countries such as Taiwan, Indonesia and Malaysia are expected to exceed 2019 levels in 2021; in the European area, a full recovery from the Covid fall is only expected for Lithuania and Poland next year. However, for the rest of the EM cluster 2021 will not be sufficient to ensure a complete recovery of pre-crisis levels.