A Measure of the Changes in Demand by Type of Goods

How to gauge changes in consumer preferences, investment strategies and value chains?

Published by Luigi Bidoia. .

Great Lockdown International marketing Internationalisation tools

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

One of the topics of greatest interest in recent months in marketing studies is the possible changes in lifestyle and consumer preferences caused by the ongoing pandemic.

Will we return to travel to explore the world? Will we leave our current loungewear in the wardrobes? How will global value chains change? Will large companies give priority to local suppliers? Will the rate of product innovation and the demand for machinery incorporating new technologies increase?

Questions are numerous very different. Each company is confronted with both general and specific questions, that directly concern the enterprise, together with a few competing companies.

In this context there is a tendency to distinguish between changes that characterize the health emergency phase (e.g. the strong demand for loungewear) and changes that will be permanent in the post-Covid19 phase. Information on short-term changes is essential to implement tactical actions that can alleviate the corporate effects of the current crisis. Information on "permanent" changes will be increasingly crucial in defining optimal strategies in the post-Covid19 world.

The traditional tool to collect this information is market surveys, whose demand could increase significantly in the near future. However, market surveys are relatively expensive, especially if carried out on several markets.

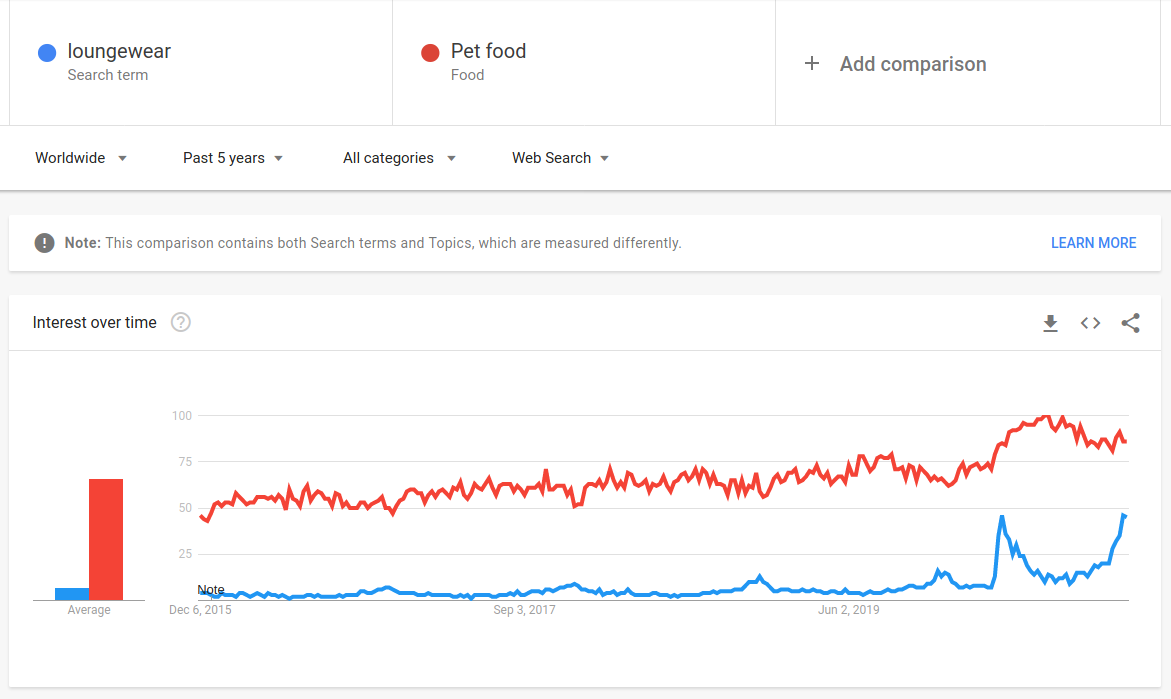

A less expensive alternative is the interest index derived from Google Trends. The following graph shows this index for the search term "loungewear" and the topic "pet food".

Interest Index for Loungewear and Pet Food

The interest index captures an explosion in interest in loungewear during both the first and the second lockdown. Conversely, the interest in pet food shows a growing dynamics in the first lockdown, with a maximum value reached in the summer 2020, which seems to be followed by a return to normal in the autumn months.

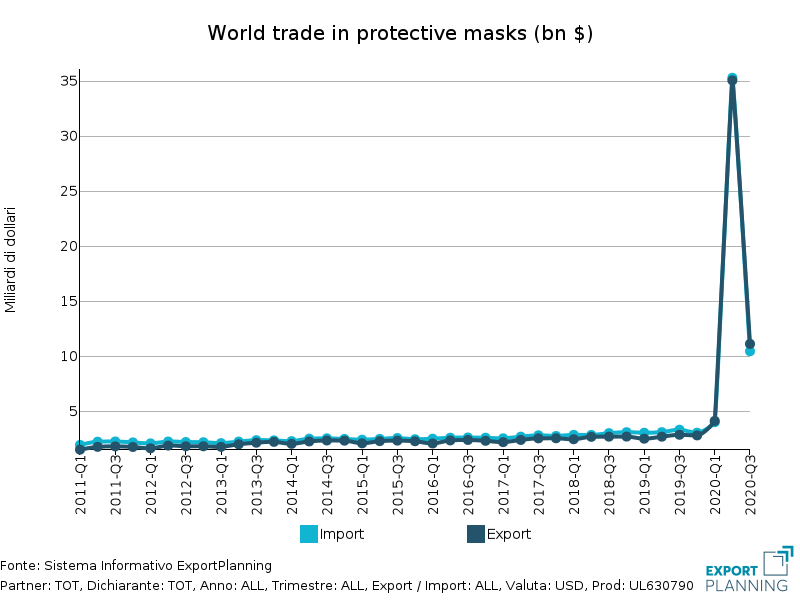

Another alternative to gauge changes in terms of consumer preferences is the use of data on world trade flows and, above all, import flows, that can photograph any acceleration in demand recorded on a given market. The most striking example are, of course, protective masks, whose imports from all world countries jumped over $35 billion in the second quarter of 2020. The only country able to satisfy this explosion in demand was of course China.

Data on world imports also allow a first general view of the changes in the structure of demand by type of goods.

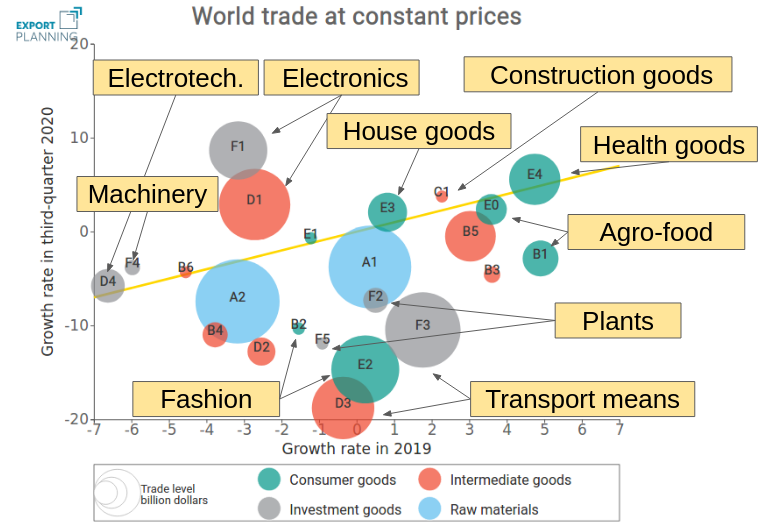

The map that follows positions the 21 "industries" of the ExportPlanning classification on the basis of the rate of change recorded by world imports in 2019 and in the third quarter of 2020.

World trade in Q3-2020: Situation by Industry

The chart also includes a bisector, that highlights products that in the third quarter have more or less recovered the development path of 2019. From the analysis of the map it is possible to extract the following information:

- Among consumer goods, the industry most affected by the current crisis is the fashion industry. After the dramatic second quarter, world imports in Q3 were down 15% compared to the corresponding quarter of 2019.

- Conversely, home goods in the third quarter recovered the dynamics of 2019.

- The food sector suffered from lower demand from the Horeca channel, only partially offset by higher purchases in shops. A particularly penalized consumption is that of fish.

- Among capital goods, Electronics more than recovered its 2019 trend.

- On the opposite side, means of transport are experiencing sharp falls in imports also in the third quarter of 2020.

- Machinery and electrical engineering goods showed a significant drop in the third quarter, but in line with what already suffered in 2019, indicating that there were factors at play containing demand even before this crisis.

- Goods and components for industrial plants seem to be much affected by this crisis. This crisis seems, in fact, to mainly affect investments to increase production capacity, while it seems to exert a minor impact on purchases aimed at introducing process and product innovations.

Conclusions

The dynamics of world's imports by type of product can allow a precise monitoring of changes in consumer preferences, in the investment choices of companies and in global value chains. Data that will be made available in the coming quarters will therefore be crucial to keep monitoring this trends.