Increase for the nutraceutical sector: Opportunities and Accessibility to the Chinese and Korean markets

Published by Valeria Minasi. .

Marketselection Health products Foreign markets Market Accessibility

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

Nutraceutics includes all these foodstuffs that have nutritional properties and health benefits. Among these products there are food supplements and protein concentrates. Specifically, the word “nutraceutics” refers to the discipline studying the active ingredients and the food components having health properties (i.e. vitamins, omega-3, creatine, proteins). These substances are not always included in a natural way in foodstuff, and are extracted to produce nutraceutical products.

In the last decade the sector experienced a strong growth, due to the increasing attention of consumers towards products designed to protect human health. Among the most exported products are, in fact, the food supplements (represented in the graph by the product "Food preparations not elsewhere specified"), which experienced a real boom since the beginning of the 1910s: in the space of a decade, world trade in these products raised up from 16 to 41 billion euros (with an average annual growth rate of around +10%).

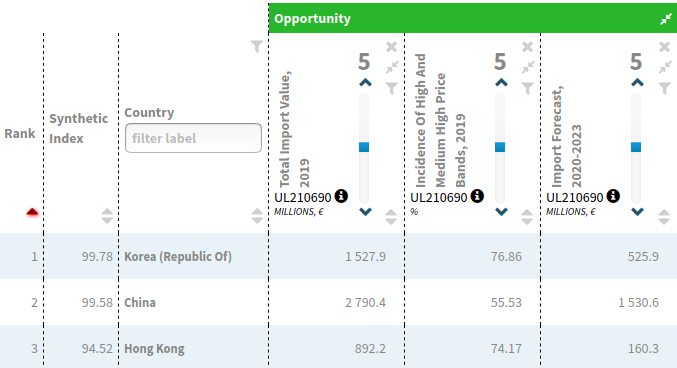

Considering the supplement products as representative of the nutraceutical sector, the Market Selection tool of ExportPlanning was used to select the markets with the greatest potential for the sector.

Specifically, the following potential indicators were considered:

- value of market imports;

- incidence of "premium-price" segments of the market;

- market's growth forecast.

Market Potential Ranking for nutraceutical products

Fonte: Market Selection-ExportPlanning

In the analysis, it results that South Korea and China are among the most interesting markets in value and in quantities for the premium price target; so, we need to go into these two markets in greater depth.

Chinese market of nutraceutical products

As shown in the above chart, China knew a deep growth in the import of the sector in question. One of the reasons could be searched in the rapid population ageing of China (especially in the medium and high level) that could increase an interest on goods having an impact on the human health.

About the accessibility of the Chinese market, the nutraceutical products have a customs duty which goes from 3% to 12%, depending on the specific product, while the VAT is 13%. About the required documents, some of the nutraceutical products requires specific documents and registration (i.e. Registration of Infant Formula Products, Registration of Foreign Exporters of Particular Foodstuffs, Registration of Foreign Exporters of Dairy Products, Registration of Importers of Foodstuffs and Cosmetics, Permit to Import Endangered Species and Products Thereof, Commodity Inspection Certificate, Veterinary Health Certificate for Animal Products).

These requirements depend on the nature and the use of the product and, therefore, should be treated in detail.

Anyway, there aren’t any relevant obstacles to the export of such goods in China.

Korean market of nutraceutical products

Like China, the Korean market, with due differences, is booming in the nutraceutical sector.

Korean imports of products related to the Nutraceutical sector have in fact recorded significant growth, especially with reference to the medium-high price segments. Probably, the reason for this is to be found in the attitude of the Korean population towards the broader Health & Wellness and Beauty & Wellness sector, which always shows very high trends in this population.

About accessibility, the European products exported in South Korea benefit from the Free-Trade Agreement and are not subject to taxation. Some documents are required, particularly for products of plant origins (Phytosanitary certificates, Certificate for the conservation of protected species CITES, Quarantine Permit) and of animal origin (Veterinary Certificate, Number of Identification, Protection of Endangered Species, etc.). These documents may vary depending on the nature of the product and should be better analysed in detail.

In general we can say that, on the basis of the growth in the import in South Korea for the medium-high range of price and of the lack of trade obstacles, due to the Free-Trade Agreement, South Korea can be considered as a market of interest for this sector.