Shifting Consumer Habits: from Fashion to Home&Furniture

The new living context has progressively shifted the search for 'beauty' from goods typically linked to social space to products intended for the domestic sphere

Published by Marzia Moccia. .

Covid-19 Great Lockdown Conjuncture Consumption pattern Foreign markets International marketing

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The spread of the Sars-CoV-2 pandemic has imposed a deep transformation of consumer choices, influencing purchasing behaviour. The epidemic has transformed the usual context of life, leading to a sharp drop in demand for goods linked to social contexts, and an increase in products for domestic consumption.

The Covid-19 pandemic has in fact acted as a catalyst producing a profound change in the luxury industry and for high-priced goods. The new living context has progressively shifted the search for 'beauty' from goods typically linked to 'social space' to products intended for the domestic sphere, thus boosting the Home&Furniture and Home Design sectors.

While awareness of this ongoing transformation is now widespread (witness the increasing importance of the home segment for Fashion Brands 1), it is complex to measure the intensity of this phenomenon, in terms of relevance and speed of change.

In this context, some particularly useful proxies for measuring the phenomenon are:

- The volume of organic search in search engines

- The dynamics of international trade flows, broken down by price/quality bands

Search engines

The first set of information, useful for the analysis of the shift of consumption preferences from personal to household products, is represented by the aggregated indexes of interest over time extracted from Google Trends.This indicator allows to measure the queries of users on particular topics and keywords, taking into account the search volume on a worldwide scale. Two product groups were considered for the analysis: the first one covers a set of personal goods (from blouses to handbags), while the second one includes several household products (from sofas to bookshelves).

Source: Google Trends

The index shows a real explosion of interest in Home goods from the second half of 2020, compared to a persistent weakness in organic searches for personal products. The interest shown by Google users worldwide in Home&Furniture is well above the pre-crisis levels, against a small recovery in searches for Fashion goods in recent months.

International trade data

Another mine of information is world trade flows, thanks to their capacity to take a snapshot of global demand accelerations in the main industries. This information provides an overview of changes in the structure of demand by type of good.

As we have reported on several occasions, in the current economic situation, the Home and the Fashion industries are at opposite ends of the spectrum in terms of recovery from Covid-19 crisis. The graph below shows the dynamics - at constant prices - of the world demand for Home products compared to world demand for Fashion goods.

Source: ExportPlanning

It is clear that while demand for Household goods has recovered markedly, demand for the Fashion goods is still far from recovered pre-crisis levels.

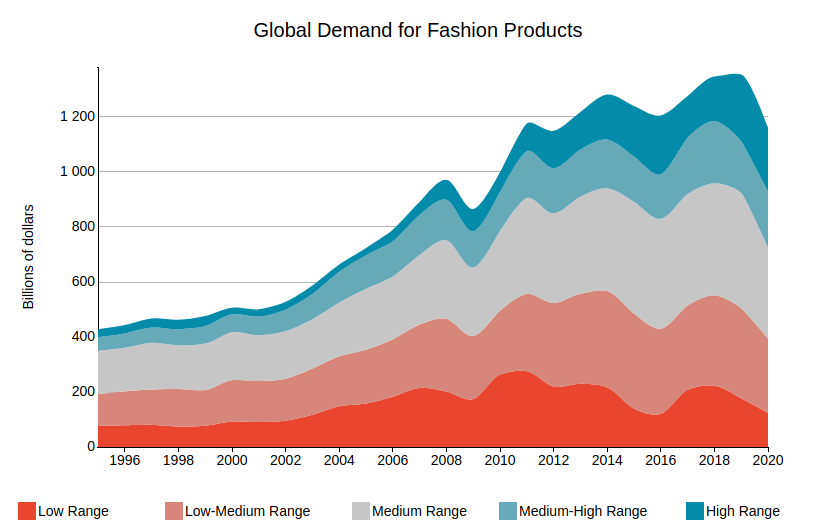

Also international trade data disaggregated by price level are particularly informative. For annual data, the ExportPlanning Information System allows to differentiate the dynamics of demand by price levels, as in the following graphs, which show the world demand for the Home and Fashion industries from 1995 to 2020.

Source: ExportPlanning

Particularly significant is the growth between 2019 and 2020 in the premium price brackets (high and medium-high) of global trade in Home&Furniture, compared with a substantial stability of demand for Fashion goods.

The use of international trade data allow to document and to intercept changes in international consumption choices in order to adapt business strategies. In this context, it will be particularly crucial to be able to distinguish short-term changes from the permanent changes that will accompany the post-Covid life, and which will therefore be fundamental in the definition of an optimal strategy. Monitoring up-to-date information that captures structural changes in demand is therefore a highly strategic exercise.

For further information, see for example the catalogues of the following brands: Armani, Versace, Dolce&Gabbana.