The importance of the distribution network as a driver of export growth

The case of Italian versus French large-scale retail trade in the Chinese market

Published by Alessandro Ferrari. .

Food&Beverage Export Import Importexport AgribusinessWhen we talk about international trade and, in particular, the export of a particular product, it is always advisable to take into consideration the factors that can influence the diffusion and the propensity to consume that product in the reference market. For example, the presence of an infrastructure able to distribute the product in a capillary way, the relevance of a middle class sufficient to support the demand for "premium price" products or the existence of an established and well-known distribution network able to attract new customers are essential elements of attention when one intends to enter a new market. All these factors can significantly influence the propensity to import a product from a particular country. In the course of this article, we will focus on an interesting "case study", investigating in particular the beneficial effects that the presence of a large national distribution network, such as Carrefour and Auchan, has had on French food exports.

The Italian large-scale retail trade has always been at the center of a heated debate in which it is blamed for never having been able to internationalize, expanding its interests outside national borders.

In this discussion, the case of the French large-scale retail trade is often included, and specifically the Auchan and Carrefour groups, which have invested heavily abroad, setting up in over 30 countries.

In the course of this short article we will focus on one of the world's fastest growing markets, China, and the effects of French exports resulting from the presence of chains such as Carrefour on Chinese territory.

The Carrefour group entered China in 1995, when, as we can see from figure 1, Chinese food imports were still at an extremely low level, we could say they were at a state of Latency.

Fig.1: Chinese agri-food imports by price bracket

A first change in inclination can be observed starting from 2003, while the decisive acceleration is in 2006, the year in which French exports were at a decidedly higher level than Italian ones, settling among the main trade partners, if not the main one, in the food sector with China. Italy was and still is far behind.

Obviously, with the passing of the years, Italian food exports to China have also increased considerably, reaching a peak in 2021 for a total value of 400 million Euros, just think that it was only 50 in 2006. However, if we compare the value of Italian exports with those of its cousins beyond the Alps, we can see that France reached the same level as Italy in 2007, and by 2021 the value will be over 2100 million Euros. (Fig.2 and Fig.3)

Chinese agri-food imports

Fig.2: from Italy

Fig.3: from France

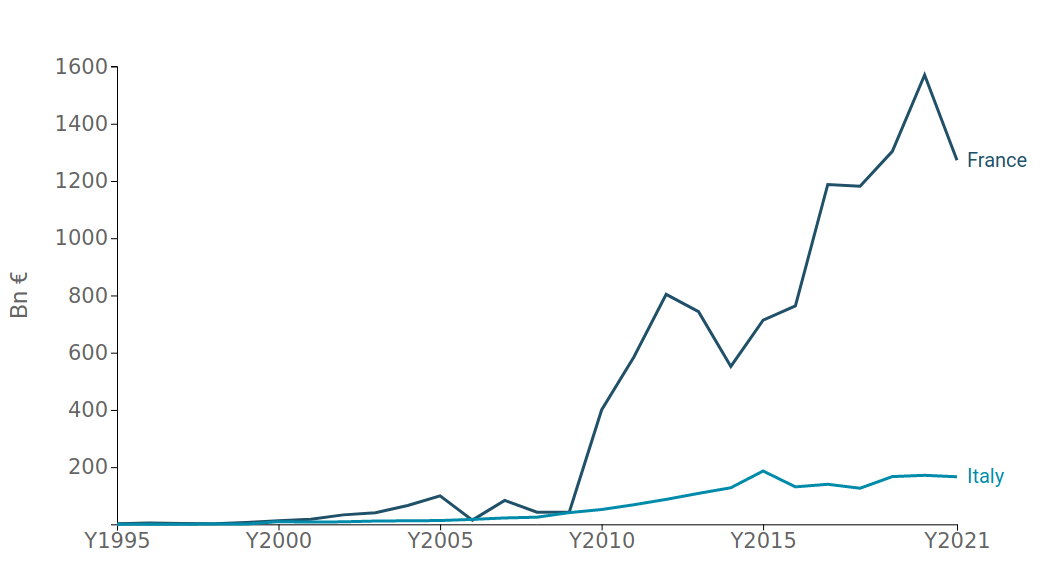

It is also particularly interesting to focus on products characterized by a high and medium-high price range. In this context, the gap between France and Italy increases even further, as can be seen in Fig.4. Even more striking, is the difference in the trend of the two curves. As far as France is concerned, we can see that in 2009 there was a very clear change of pace, with very sustained increases in a very short period of time, which led French exports of high and medium-high-end products to grow almost 30 times in 10 years. The situation is very different for Italy, where growth, although present, is not at all comparable with France.

Fig.4: Chinese agri-food imports: highest price brackets

Source: ExportPlanning elaborations.

Conclusion

In the light of these data, we can say that the presence of French points of sale in China has certainly contributed positively to an increase in the importation of French products. In the retail sector, in fact, the French presence in foreign distribution chains is particularly significant on the Chinese market, and seems to have played a driving role in making French excellent food products, widely known.

However, the Italian food sector seems to be in a more favorable period of growth than its historic French competitor. At an aggregate level, looking at total exports (agri-food), in Figure 4, we can see how France is oscillating around the peaks reached in 2013 and 2018, while Italy, which started out decidedly further behind, has managed in recent years to close the gap that separated it from France.

Export of agrifood

Fig.5: Italy

Fig.6: France

The greater ability to conquer international markets, together with the strong digital transformation that is affecting retail, especially in Asian markets, could represent a golden opportunity for Made in Italy agri-food SMEs to overcome the difficulties compared to their historical competitors and no longer be beaten by large French retailers.