Entry Strategy Assessment: a new tool to support the Market Entry Strategy

To identify optimal ways of entering the target market

Published by Marcello Antonioni. .

Planning Internationalisation International marketing Internationalisation tools

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The choice of entry mode into a market is crucial for the success of an export project. Given a specific project, different entry modes can have very different cost/benefit ratios.

The multiplicity of possible entry options

The growth in world trade over the last 30 years, the participation of more and more companies from different countries and the studies carried out have enriched the options of possible strategies. Analysing all possible strategies can be a burdensome task when it comes to identifying the optimal strategy for a specific export project.

Map of the different options for market entry strategies1

Source: ExportPlanning.

ESA: a tool to rank the entry strategy options best suited

to the internationalization project

In order to provide support in the choice of the market entry strategy that tends to optimize the cost/benefit ratio, the new Entry Strategy Assessment (ESA) tool has been developed in ExportPlanning.

The ESA tool2 allows, through the compilation of a rationale of questions, to obtain a ranking of the strategic options considered best to enter a given target market, taking into account:

- RESOURCES of the company: the choice of the method of entry into a given target market tends to be conditioned by the type of resources at a quantitative (financial, technological, organizational) and qualitative level (skills and commitment) available as part of the market entry project;

- PRODUCT/SERVICE of the company: the choice of how to enter a given target market tends to be conditioned by the characteristics and type of product / service, including:

- existence of competitive advantages (on the differentiation side or on the cost side), capable of absorbing or not any additional costs associated with export;

- level of product customization, able to adapt more or less quickly to the specific characteristics of the market;

- relevance of services (pre- and / or post-sale) associated with the product, which may or may not bind the options available in terms of how to enter the market;

- MARKET of reference: the choice of the entry strategy on a given target market tends to be conditioned, typically, by the characteristics of the market itself, in terms of size, dynamics, prospects, competitive structure, distribution structure;

- STRATEGY of the company: the choice of the method of entry on a given target market tends to be conditioned by the strategic objectives of the company, in terms of reasons for the internationalization process, time horizon of investment in market entry, degree of hierarchical control, financial risk, interest in developing collaborative relationships with other subjects as part of the internationalization project.

- commercial strategies:

- Indirect Export: this option is characterized by a limited degree of control and level of investment; it has as possible channels: (a) buyers, (b) brokers, (c) trading companies, (d) export consortia or business networks;

- Direct Export with Limited Investments: this option is characterized by the degree of control and intermediate investment; it has as possible channels: (a) contact development and direct negotiation, (b) foreign agents, (c) foreign distributors, (d) e-commerce, (f) representative offices, (g) piggy back;

- Commercial Partnership: this option is characterized by the degree of control and level of intermediate investment; it has as possible channels: (a) commercial dealers, (b) international franchises, (c) market-oriented joint ventures;

- strategies for know-how transfer:

- Licensing: it is characterized by an intermediate degree of control and level of investment; this option is particularly suitable for SMEs without adequate financial, organizational and personnel resources, necessary to expand commercially on foreign markets, but with highly specialized production knowledge, which can be sold at a profit. It may also be suitable for companies that want to penetrate low / medium income markets, whose potential customers do not have adequate resources to purchase high-end products, but may have a high propensity to purchase locally produced goods, sold at a lower price;

- Contract Manufacturing: this option is a cross between Licensing and Product-Oriented Joint-Venture. It allows rapid international expansion without high investments, high market control, the use of its own brand and integration with after-sales services. The greatest risk of this strategy is to transfer production know-how to the foreign partner who, once the contract is not renewed, can be transformed into a competitor;

- production strategies:

- Product-Oriented Joint-Venture: this option is suitable for an SME that wants to grow on foreign markets not only as a pure export, but with a productive investment to exploit the advantages of localization in the foreign country . The foreign countries of interest are those that allow a reduction in production costs or due to the presence of raw materials and low-cost labor. It finds support in the policies of many developing countries where it is encouraged as it is considered a vehicle for acquiring know-how and technical skills;

- Direct Investment: this option is characterized by a high degree of control and level of investment; it has the following channels as possible: (a) commercial subsidiaries, (b) foreign subsidiaries.

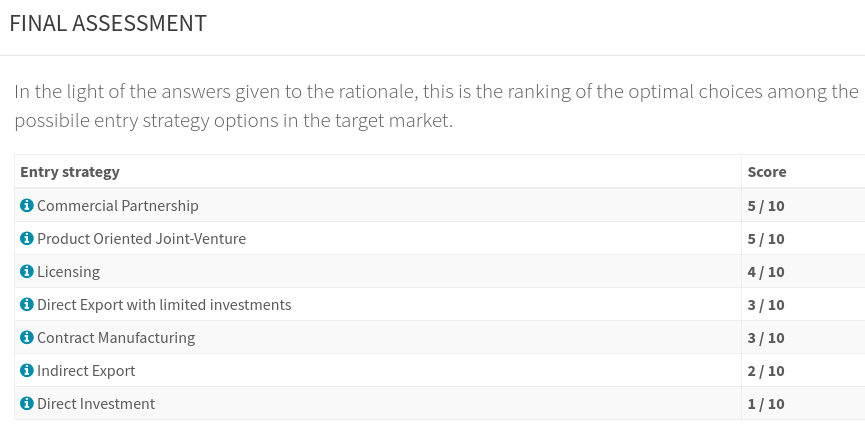

In the ESA tool, the compilation of the rationale of questions presented to the user will allow to evaluate the entry strategy options with the highest degree of success expected.

The result of the assessment will consist of a ranking of the aforementioned entry strategy options, ordered according to the optimality with respect to the specific case being assessed.

Example of ranking created using the ESA tool

Source: ExportPlanning.

For the entry strategy option (or, in the event of a tie, of options) with the highest score, a strategy description sheet will be shown.

Conclusions

In order to be successful, the internationalization process requires good corporate decision-making skills. The choice of how to enter the target market is one of the most relevant. This choice is of a strategic nature, in the sense that it implies the execution of several coordinated actions with delayed effects over time. Therefore, it requires the shared definition of objectives, consistent with the corporate strategy, and a sufficiently high commitment to overcome the not short wait for the results to become significant.

The identification of a specific market entry strategy is very useful because allows you to refer to the possible

best practices associated with it and therefore to have a model from which to start to define one's own operational plan.

For example, if the entry strategy is to export via an agent, the best practices associated with it suggest clearly defining what is expected of the agent in terms of knowledge and updating of the market, and to be clear that the role of an "active sensor" of the company on the market can be performed better if the agent is a single agent.

With the ESA (Export Strategy Assessment) tool, ExportPlanning intends to support this very important decision-making phase of the internationalization project planning process, proposing a structured model for the choice of the market entry strategy.

1. For a description of the different options for choosing the market entry mode, please refer to the related ExportPlanning section.

2. Access to the ESA tool is provided for ExportPlanning registered users.