Global sales of Graphic and Papermaking Supply chain: growth Momentum

Quite differentiated trends by segment: excellent performance for packaging and converting; moderate recoveries for graphics and publishing

Published by Marcello Antonioni. .

Intermediate goods Industrial equipment Check performance Industries Export Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

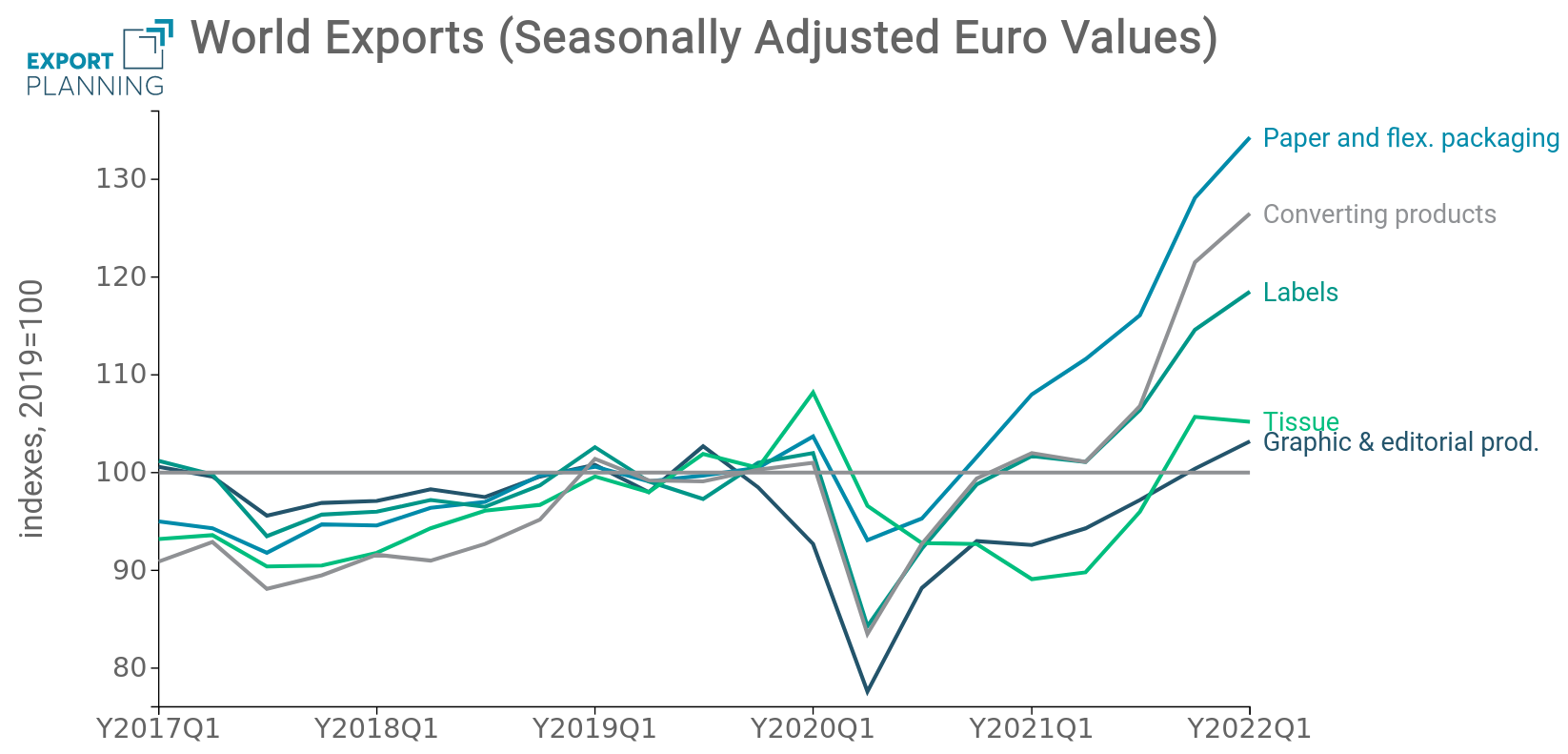

In the first quarter of the year, the recovery phase of world exports of products from the graphic and paper industry continued, but with somewhat differentiated trends at the level of individual sectors.

Graphics, Packaging and Paper Converting

In the first quarter of the year, world exports of graphics, packaging and paper converting products1 recorded an overall trend increase of +19 per cent in euro values, continuing the expansionary phase already recorded in the average of 2021 (+10.3 per cent in euro values). Overall, world sales of this aggregate reached levels in euro value that were more than 17 per cent higher than pre-pandemic levels (2019 average).

Source: ExportPlanning-World Trade Datamart

However, there are also very significant differences down to the level of individual segments: on the one hand, minimal recoveries are reported for world exports of graphic and editorial products (+3.2 per cent compared to the 2019 average in euro values) and tissue products (+5.2 per cent); on the other hand, strong expansion phase for world exports of packaging in paper, cardboard and flexible materials2 (+34.3 per cent compared to the 2019 average); sustained average growth, moreover, for world exports of labels (+18.5 per cent compared to the 2019 average) and especially of other converting products3 (+26.5 per cent).

Differentiated dynamics in the printing and converting chain: strong development of global sales of packaging...

Machinery for the Printing, Paper and Converting Industry

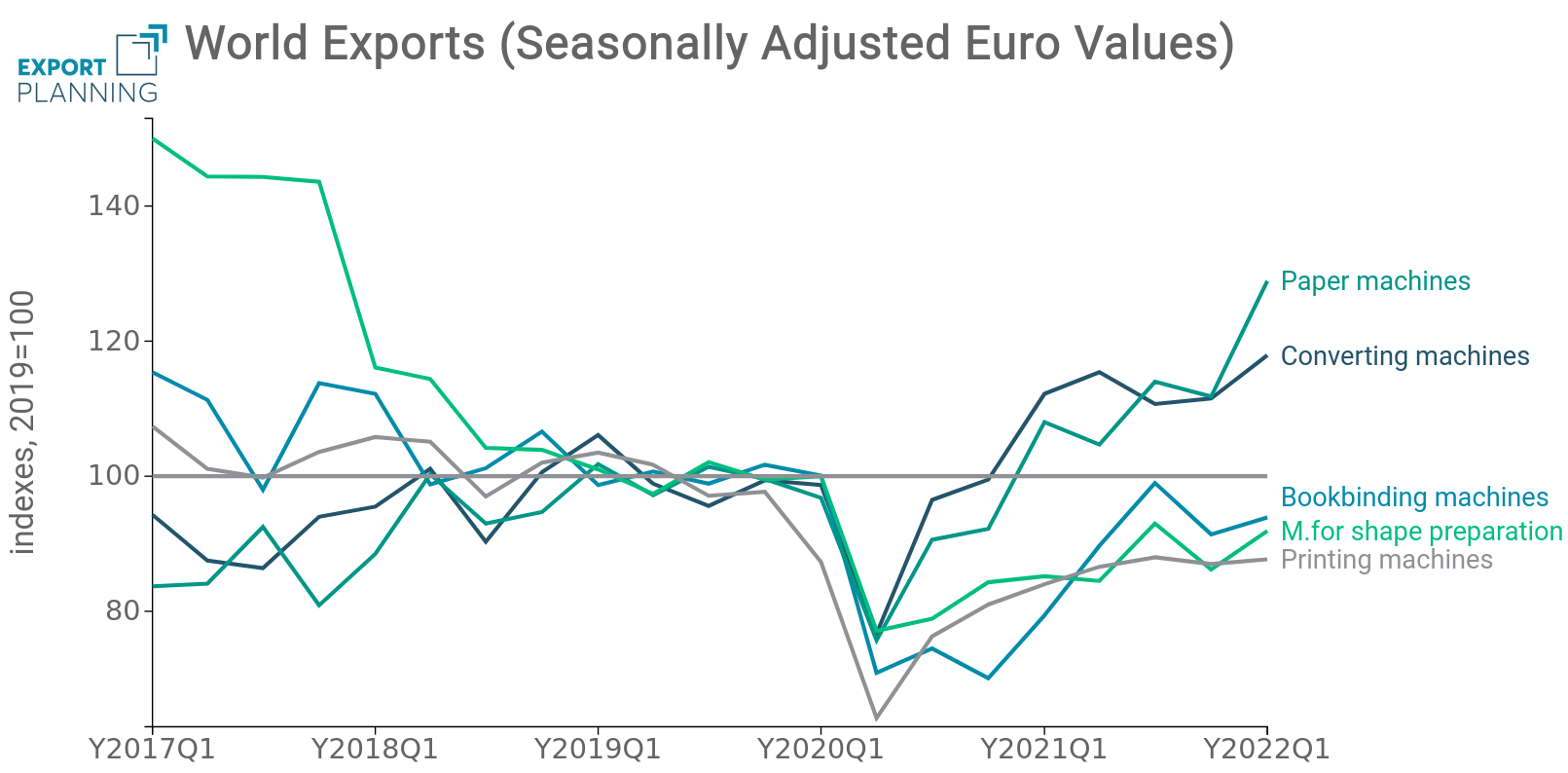

In the first quarter of the year, world exports of machinery for the printing, paper and converting industry4 posted a moderate increase of around 7 percentage points in euro terms. This performance follows the recovery phase initiated in 2021 (+14.8 per cent on average for the year), which followed the fall experienced in the pandemic year (-16.4 per cent on average for 2020).

Source: ExportPlanning-World Trade Datamart

...in the face of much less brilliant dynamics

for world exports of printing machines

Against this overall performance, which places the sector's world sales at a level that is still slightly lower than the 2019 average (-4.2%), there are - also in this case - quite different trends in terms of products. In particular, we note - on the one hand - the excellent growth performance of world exports in the paper machines segment (+29% compared to the 2019 average, with the most recent quarter showing a trend increase by +19.4 per cent) and, albeit relatively less dynamic, in the converting machines segment (+18 per cent compared to the 2019 average), both driven by the favorable evolution of the downstream packaging and other paper products; on the other hand, on the other hand, levels are still lower than the pre-pandemic ones for the world export of bookbinding machines (-6.1 per cent compared to the 2019 average), machines and materials for shape preparation (-8.1 percent compared to 2019) and, above all, printing machines (-12.3% compared to the 2019 average).

Printing machines

In the field of printing presses, the dynamics of world exports appear lower than the pre-pandemic levels for all the main types. The most penalized sales are those related to the flexographic machines segments (-12.7% in euro values compared to the 2019 average, with also signs of contraction in the first quarter of the year: -4.3% trend), offset machines (-11.8% compared to the 2019 average, with signs of weakness in the first quarter of the year: +1.6% trend) and other printing machines [other than offset, flexo and rotogravure], which in the first quarter of the year marked a negative differential of almost 13 percentage points in the values in euro compared to the 2019 average. A negative differential compared to pre-pandemic levels, but more contained (-8 per cent in values in euro) is finally recorded by world exports of rotogravure machines, which in the first quarter show a trend of marked recovery (+36.4% y-o-y in euro).

Conclusions

The graphics, paper and paper converting industry is showing quite different dynamics in world sales. The most dynamic segments are attributable to packaging products in paper, cardboard and flexible material and related paper and converting

machines, which show global export values values in euro in the order of 30-35 per cent higher than the pre-pandemic levels.

On the other hand, there are difficulties in recovering from the pre-pandemic levels of graphic and editorial products and related machines (for bookbinding, for shape preparation and especially for printing). In particular, in the segment of printing machines, the negative differential with respect to pre-pandemic levels appears to be generalized at the level of single typologies: from offset machines to flexographic machines, to other printing machines (other than the above mentioned and roto machines); world exports of rotogravure machines are only slightly less penalized, thanks also to a particularly dynamic first quarter of the year.

1) The following segments are included in this aggregate: a) graphic and editorial products; b) packaging in paper, cardboard and flexible material; c) labels; d) tissue products; e) other paper products.

2) In the first quarter of 2022, world exports of flexible packaging products (+24.7% y-o-y) reached a new high point in values in euro, on levels more than 33 per cent higher than those before. pandemics. This is the consequence of a resilience of the sector in the pandemic year (-2.5%), a decline - this - soon recovered in the course of 2021 (+19 per cent in euro values) and then consolidated in the first three months of this year. Also in paper and cardboard packaging world exports in the first three months of 2022 showed record values in euro (+21.6% y-o-y), on levels - again in this case - of more than 33 percent higher than pre-pandemic ones.

3) The following products are included in this segment: wallpapers; envelopes of paper or paperboard; envelopes of paper and cardboard for offices and shops; registers, account books; notebooks; binders; blocks and booklets for multiple copies; drums, bobbins; filter paper and paperboard filter, in strips or rolls; paper with diagrams to chart recorders in rolls of a width <= 36 cm; articles of paper obtained by pressing; other paper and paperboard for writing.

4) The following segments are included in this aggregate: a) converting machines; b) bookbinding machines; c) paper converting machines; d) machines and materials for the preparation of forms; e) printing machines.