World Trade in Euro of Decorative Stones Reached a New High in 2022

Almost all segments have returned to pre-pandemic levels, driven by several BLOC (BLue OCean) markets

Published by Marcello Antonioni. .

Home items Conjuncture Global demand Consumption pattern Export markets Foreign markets International marketing International marketing

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The dynamics of sectoral world trade

In 2022, the world trade in Decorative Stone Works1 reached - according to ExportPlanning pre-estimates - a new high point, reaching almost 14 billion euros.

This is a strong relaunch after years of weak growth and - above all - after the pandemic year 2020 (which had seen world trade flows in the sector fall below 10 billion euros). In the most recent two-year period, growth has been significant, especially in values denominated in euro (+40.3% in cumulative terms2).

Almost all segments of the sector are back

above pre-pandemic levels in euro values

(but not if measured at constant prices)

As of 2022 as a preliminary balance, all the main segments of the sector (with the exception of blocks and slabs for paving) show a recovery in levels of world trade in euro values compared to pre-pandemic levels.

In particular, the most dynamic segments are - in order - other cutting or building stones (+59.8% in euro values compared to to 2019), worked slate (+43.4%), marble and granite smooth surface (+38.6%) and worked marble and granite (+30.7%).

If measured at constant prices, however, world trade in the sector shows decidedly more contained dynamics. Partial exceptions are the performance of significant growth also in quantities for smooth surface marble and granite (+18.5 percent compared to levels at constant prices of 2019) and, above all, other cutting or building stones (+21.2%).

World trade of Decorative Stone Works

| Values 2022 | % changes at current prices [€] |

% changes at constant prices |

|||

| Segment | (Bn €) | 2022/2021 | 2022/2019 | 2022/2021 | 2022/2019 |

| Marble and granite, wrought | 7.4 | +23.4 | +30.7 | + 3.2 | - 7.8 |

|---|---|---|---|---|---|

| Marble and granite with a smooth surface | 2.8 | +27.5 | +38.6 | + 7.2 | +18.5 |

| Blocks and flagstones | 0.9 | +15.0 | -12.1 | - 2.8 | -56.0 |

| Worked slate | 0.7 | +20.7 | +43.4 | + 1.1 | + 2.2 |

| Mosaic cubes | 0.3 | +12.7 | +15.1 | - 4.3 | - 0.3 |

| Other monumental or building stones | 1.9 | +23.3 | +59.8 | + 0.1 | +21.2 |

| TOTAL | 14.0 | +23.3 | +31.6 | + 3.3 | - 5.1 |

Source: ExportPlanning-Annual Datamart

The growth of world trade in the sector sees the presence of various BLue OCean (BLOC) markets in an acceleration phase.

BLOC Markets

Marble and granite, wrought

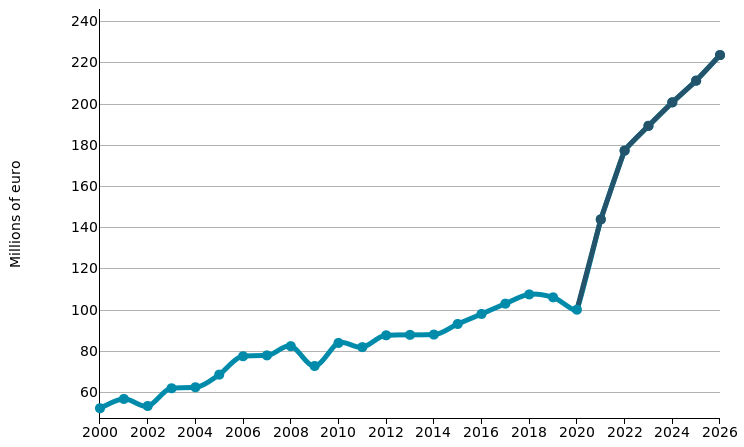

In 2022 world trade in the marble and granite, wrought segment showed an estimated increase of 1.4 billion euros compared to 2021 (+23.4%), rising maximum values, almost 31 percent higher than pre-pandemic values.

This performance originates in several accelerating markets in its imports.

- France: with its estimated 177 million euros in 2022, it is the 6th importing country in the segment. It is a market that has shown dynamics of constant growth, but which in the most recent two-year period (2021-2022) has experienced a very intense phase of acceleration (+77.1% in euro values). In the 2026 scenario, further increases are expected, albeit smaller in size (+46 million euro), reaching around 224 million euro;

- Morocco: this is an already significant market, just behind France in the ranking of the main importing countries in the segment, with its 154 million euro of imports in 2022 (pre-estimates ). In the last four years (2019-2022) this market has shown strong growth dynamics (+97 million euros in cumulative terms, corresponding to +170%). This growth dynamic is expected to continue, albeit with a slightly reduced magnitude, in the forecast scenario to 2026, with an overall expected increase of over 66 million euro (+43.1% cumulative);

- Poland: this is the 9th world importer of the segment in 2022, with an estimated value of around 127 million euros. It is a market that saw a very strong surge in its imports in the two-year period 2021-2022 (+49 million euros, equal to +63.2%), after a prolonged phase of latency. In the forecast scenario to 2026 Polish imports of the segment are expected to increase by a further 40 million euros, reaching over 167 million euros.

Marble and granite, wrought: main BLOC markets

| FRANCE | MOROCCO |

|

|

Source: ExportPlanning-Forecast Datamart

Marble and granite with a smooth surface

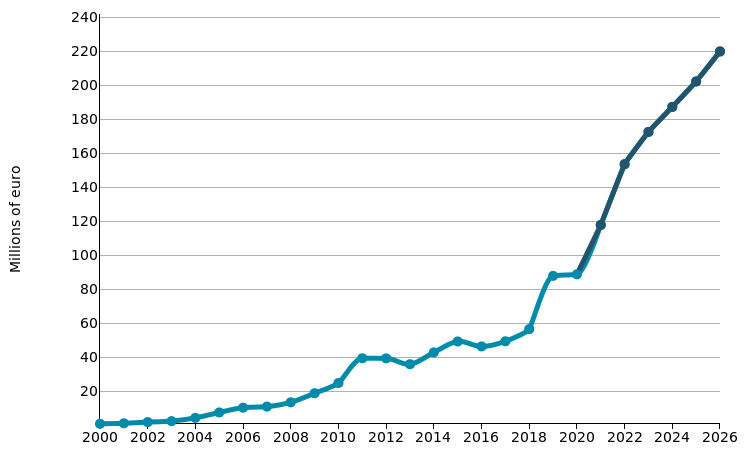

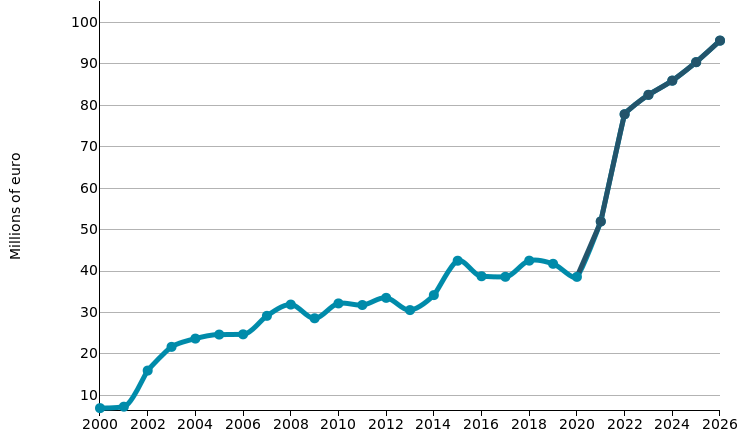

In 2022, world trade in the marble and granite with a smooth surface segment experienced an estimated increase of over 1 billion euros compared to 2021; compared to pre-pandemic values (2019), the increase is close to 1.7 billion euros.

This performance originates in many accelerating markets in its own imports.

- Vietnam: this is a relevant market as it is the 3rd world importer of the segment in 2022 (pre-estimates). After a phase of prolonged latency, this market is showing particularly accelerated growth dynamics of imports in the segment, having gone from 9 million euros in 2018 to almost 156 million euros in 2022 (pre-estimates). In the 2026 scenario, further increases are expected (+84 million euros in overall terms), reaching around 240 million euros;

- France: this is the 7th world importer of the segment in 2022 (pre-estimates), which has shown an overall increase of around 57 million euros (+127%) in the last five years , reaching over 100 million euros in the final balance for 2022 (pre-estimates). In the 2026 scenario, a further overall increase of around 31 million euros is expected, reaching the threshold of 132 million euros in imports for the segment;

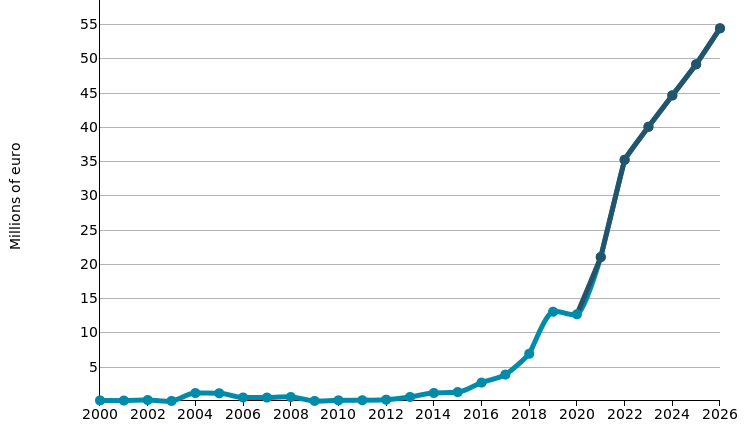

- Nepal: in this case it is a relatively smaller market, even if already positioned in 15th place in the ranking of the main importing countries in the segment. Starting from the second half of the last decade, this market has shown strong growth dynamics, going from decidedly low values to exceeding 35 million euros in 2022 (pre-estimates). This growth dynamic is expected to continue in the forecast scenario to 2026, with an expected value of imports in the segment exceeding 54 million euros.

Marble and granite with a smooth surface: main BLOC markets

| VIETNAM | NEPAL |

|

|

Source: ExportPlanning-Forecast Datamart

Other monumental or building stones

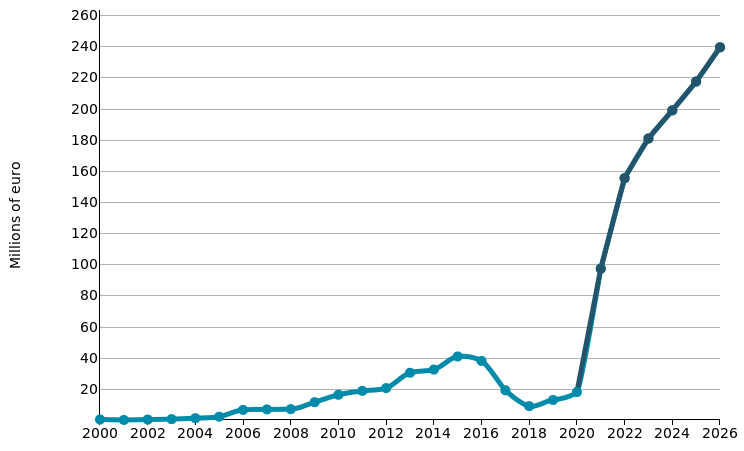

In the two-year period 2021-2022, world trade in the other monumental or building stones segment showed overall growth estimated at 725 million euros (+61.9% ); compared to pre-pandemic values (2019), the increase, measured at constant prices, is more than 21 percentage points.

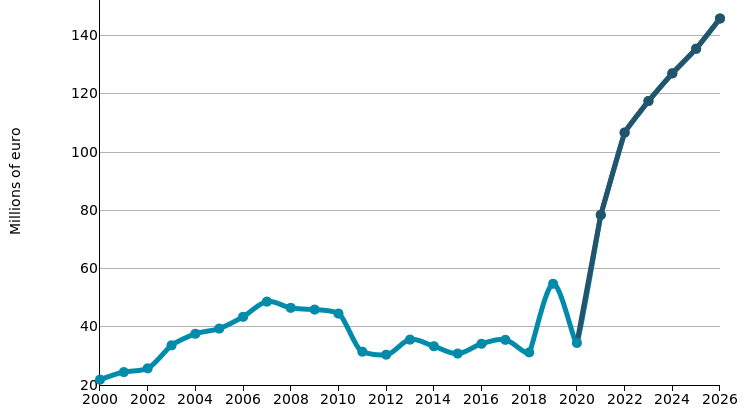

This performance originates in many accelerating markets in its own imports.

- United Kingdom: this is the 2nd world importer of the segment in 2022 (pre-estimates). After losing as much as 37 percent of the value of its imports in the pandemic year (2020), in the most recent two years this market has seen the value of its imports triple (from 34.5 to 106.7 million euros, according to ExportPlanning pre-estimates ). In the 2026 scenario, further increases are expected (+39 million euros in overall terms), reaching around 146 million euros;

- Australia: this is the 3rd world importer of the segment in 2022 (pre-estimates), which has shown an overall increase of almost 40 million euros (+102%) in the last two years , reaching almost 78 million euros in the final balance for 2022 (pre-estimates). In the scenario up to 2026, a further overall increase of around 18 million euros is expected, reaching the threshold of 96 million euros of imports in the segment;

- France: it is the 5th world importer of the segment in 2022 (pre-estimates). In the most recent two-year period, this market has shown strong growth dynamics, with an increase of approximately 27 million euro (pre-estimates). This growth dynamic is expected to continue in the forecast scenario to 2026, with an expected value of imports in the segment close to 93 million euros.

Other monumental or building stones: main BLOC markets

| UNITED KINGDOM | AUSTRALIA |

|

|

Source: ExportPlanning-Forecast Datamart

Conclusions

After a particularly dynamic two-year period 2021-2022 for world trade in worked ornamental stones (thanks - to a significant extent - to price increases along the supply chain and - with reference to the current year - to the depreciation of the euro), the prospects for the next four years (2023-2026) are positive but decidedly more selective, with expectations of average annual growth in the order of 5 percentage points in euro values ( see the graph below).

In such a context of greater selectivity, the search for foreign markets BLue OCean (BLOC), resilient to the cycle, should be a priority for exporting companies in the sector.

The instrumentation made available in ExportPlanning, in the Market Selection tool, can allow you to select the so-called BLOC markets, during the acceleration phase of your imports.

1) For a list of the segments of the sector being analysed, please refer to the relative sector profile.

2) The growth performance of the world trade of worked ornamental stones, measured at constant prices, instead stops at +10.7% in the two-year period 2021-2022 as a whole, thus signaling how the increase in price lists denominated in euro has contributed decisively to the result of a new high in world trade in euro values.