The BLOC markets push world trade in Home Textiles to All-time high

In pre-final 2022, world trade in the sector reached a new record, both in terms of values and at constant prices

Published by Marcello Antonioni. .

Home items Planning Consumption pattern Foreign markets International marketing International marketing

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The dynamics of sectoral world trade

According to ExportPlanning pre-estimates, the home textiles1 sector experienced record levels of world trade in 2022, estimated at the end of the year for the first time over 51 billion euros. These are values more than 31 percent higher than the pre-pandemic values. The growth in prices along the supply chain and the average annual devaluation of the euro against the dollar certainly contributed to this performance. However, even measured at constant prices (thus neutralizing both the inflationary and currency effect), world trade in home textiles reached a new absolute maximum on average in 2022, on levels of almost 13 percentage points compared to pre-pandemic levels .

Almost all sector segments are back above pre-pandemic levels, even when measured at constant prices

As of 2022 as a preliminary balance, all the main segments of the sector (with the exception of toilet and kitchen linen) show a recovery in levels of world trade both in euro values and at constant prices compared to pre-pandemic levels.

In particular, the most dynamic segments are - in order - awnings (+67.1% in euro values compared to 2019; + 49.7 percent at constant prices), bedding (+39.1% in euro values and +16.9% at constant prices), curtains and blinds for interiors (+28% in euro values and +15.5% at constant prices), cushions and duvets (+28.5% in euro values and +11.6% at constant prices) and, indeed, last but not least, other home textiles2 (+39.5% in euro values and +18.7% at constant prices).

World Trade of Home Textiles

| Values 2022 | % changes at current prices [€] |

% changes at constant prices |

|||

| Segment | (Bn €) | 2022/2021 | 2022/2019 | 2022/2021 | 2022/2019 |

| Pillows and duvets | 12.9 | + 8.4 | +28.5 | - 5.3 | +11.6 |

|---|---|---|---|---|---|

| Bedding | 12.4 | +18.7 | +39.1 | + 1.6 | +16.9 |

| Toilet and kitchen linen | 7.3 | +22.8 | +14.3 | + 5.6 | - 3.2 |

| Curtains and blinds for interiors | 5.4 | + 6.7 | +28.0 | - 5.6 | +15.5 |

| Awnings | 1.9 | +20.5 | +67.1 | + 7.7 | +49.7 |

| Other home textiles | 11.3 | +26.9 | +35.7 | +10.2 | +14.3 |

| TOTAL | 51.3 | +16.8 | +31.2 | + 1.3 | +12.6 |

Source: ExportPlanning-Annual Datamart

The growth of world trade in the sector sees the presence of several BLue OCean (BLOC) markets in an acceleration phase

BLOC Markets

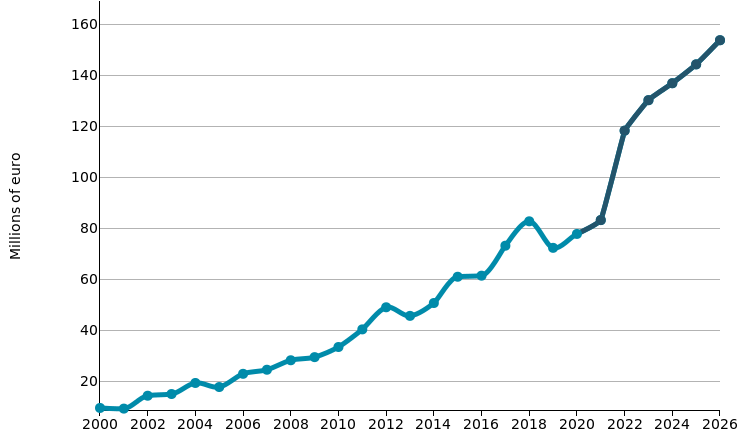

Pillows and duvets

In the two-year period 2021-2022, also due to price increases along the supply chain, world trade in the pillows and duvets segment showed an overall increase estimated at around 3.2 billion euros compared to 2021 ( +32.5%), rising to maximum values, close to 13 billion euros.

This performance originates in several accelerating markets in its imports.

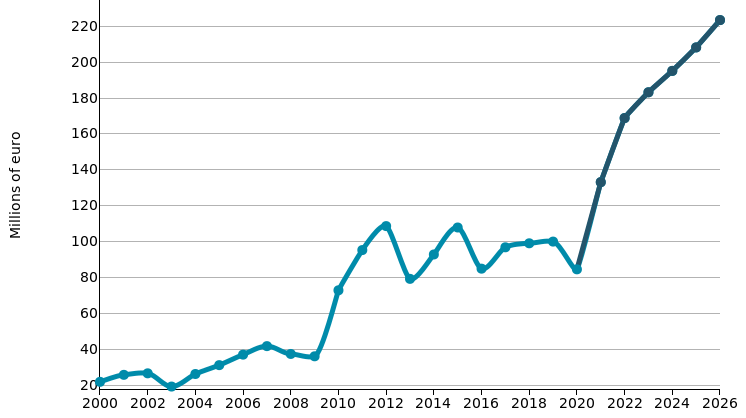

- Mexico: with its estimated 169 million euros in 2022, it is the 15th importing country in the segment (it was just the 21st in 2019). It is a market that had shown phases of growth in the past (with peaks in 2012 and 2015); however, it is in the most recent two-year period that imports from this market have experienced a very intense phase of acceleration, doubling their values in euro. In the 2026 scenario, further increases are expected, albeit smaller in size (+55 million euro), reaching around 223 million euro;

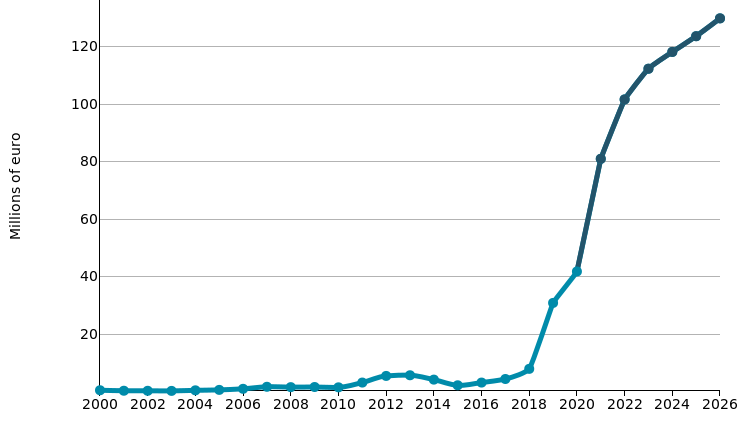

- Kazakhstan: this is a market that has experienced a long phase of import latency, to then begin to grow exponentially starting from 2019. In 2022, with its 102 million euro (ExportPlanning pre-estimates), this market is positioned in 22nd position in the world ranking of the main importing countries of the segment. In the forecast scenario to 2026, a consolidation of the growth phase is expected, with an overall expected increase of over 28 million euro;

- Romania: creator of progressive growth, in the period 2020-2022 this market experienced a phase of acceleration (reaching 75 million euros), making it possible to gain 8 positions (from 37 -th to 29th place) in the world ranking of the main importing countries of the segment. In the forecast scenario to 2026, Romanian imports of the segment are expected to increase by a further 24 million euros, reaching levels close to 100 million euros.

Pillows and duvets: main BLOC markets

| MEXICO | KAZAKHSTAN |

|

|

Source: ExportPlanning-Forecast Datamart

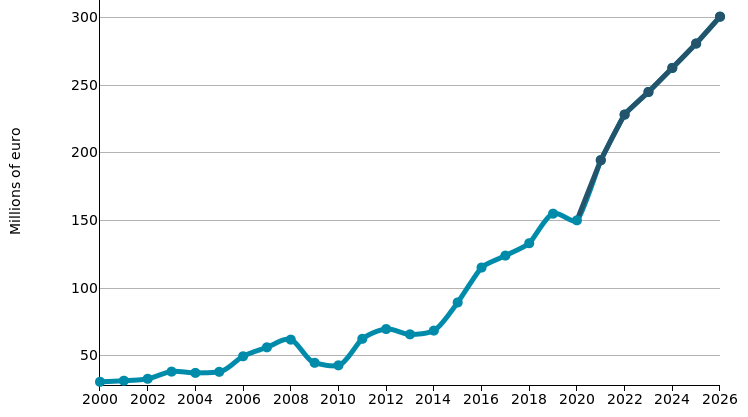

Bedding

In the two-year period 2021-2022, world trade in the bed linen segment showed overall growth estimated at over 3.8 billion euros (+45%); compared to pre-pandemic values (2019), the increase, measured at constant prices, is close to 17 percentage points.

This performance originates in many accelerating markets in its own imports.

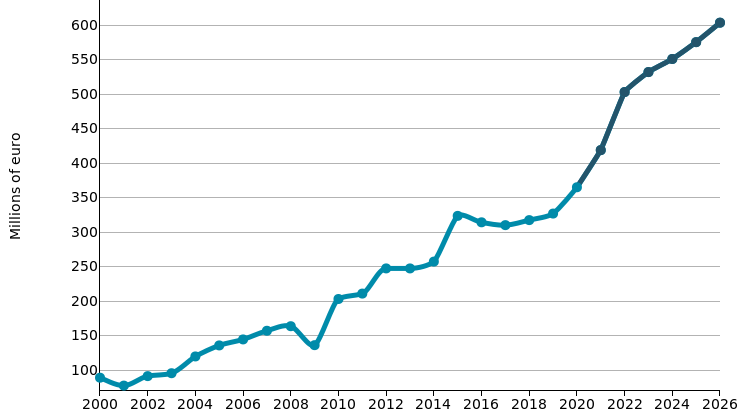

- Australia: with its 505 million euros (pre-estimates), it is the 5th world importer of the segment in 2022. After experiencing a phase of moderate growth in the value of its imports, in the most recent two-year period this market has shown a leap in the value of its imports (+138 million euros in total, according to ExportPlanning pre-estimates). In the 2026 scenario, further increases are expected (+101 million euros in overall terms), reaching around 604 million euros;

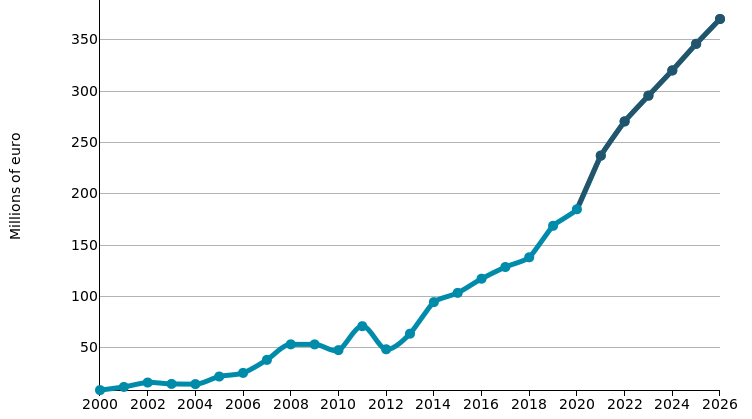

- Poland: with its 271 million euros of imports, it is the 11th world importer of the segment in 2022 (pre-estimates), which has shown a path of growth, which intensified in euro values in the most recent two-year period (+86 million euro). In the 2026 scenario, a further overall increase of around 100 million euros is expected, reaching the threshold of 370 million euros of imports in the segment;

- Chile: thanks to a significant phase of acceleration, in 2022 this market was positioned in 13th position among the importing countries of the segment, with an imported value estimated at 169 million euros. In the most recent two-year period, this market has experienced an increase of over 106 million euros. This growth dynamic is expected to continue - albeit to a less disruptive extent - in the forecast scenario to 2026, with an expected value of imports in the segment close to 228 million euros.

Bedding: main BLOC markets

| AUSTRALIA | POLAND |

|

|

Source: ExportPlanning-Forecast Datamart

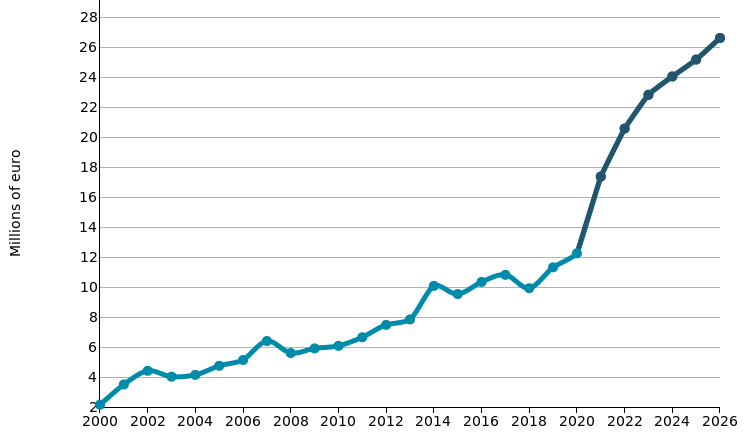

Curtains and blinds for interiors

In the two-year period 2021-2022, world trade in the curtains and blinds for interiors segment experienced a percentage increase of approximately 1.2 billion euros, with a gain compared to pre-pandemic levels of almost 30 points percentages in euro values and by almost 16 percentage points in the measurement at constant prices.

This performance originates in many accelerating markets in its own imports.

- Australia: in 2022 this market rose to 8th place in the world ranking of importing countries in the segment, with a value of over 118 million euros (pre-estimates). After a phase of moderate growth, this market is showing dynamics of acceleration in the dimensions of the segment, with an overall increase of over 40 million euro in the last two years. In the 2026 scenario, further increases are expected (+35.5 million euros in overall terms), reaching around 154 million euros;

- Israel: Thanks to the progress in the most recent period, this market climbed last year to the 32nd position in the world ranking of importing countries of the segment, with a value of almost 21 million euro (pre-estimates), about double the levels of just 3-4 years earlier. In the scenario up to 2026, the consolidation of the growth phase is expected, reaching the threshold of 26 million euro for the inclusion of the segment;

- Croatia: also in this case it is a relatively small market (9 million euros), positioned in 48th place in the world ranking of the main importing countries in the segment. Even with still low numbers, the market's potential is assessed by a dynamic of strong acceleration, expected in the near future in the forecast scenario.

Curtains and blinds for interiors: main BLOC markets

| AUSTRALIA | ISRAEL |

|

|

Source: ExportPlanning-Forecast Datamart

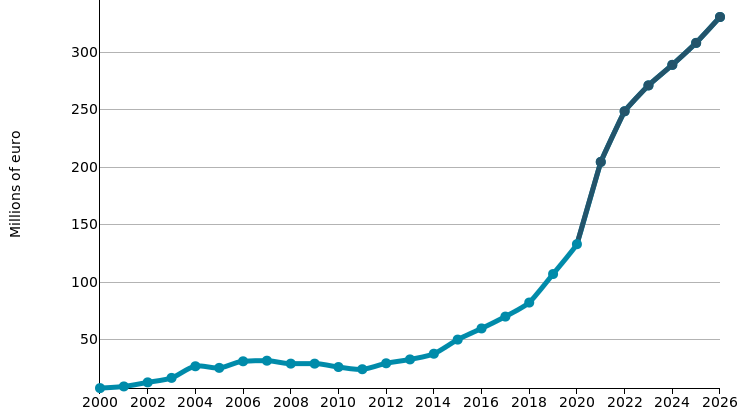

Awnings

In the two-year period 2021-2022, world trade in the sun awnings segment experienced the most significant percentage increases within the home textile sector, earning around 750 million euros compared to 2020, on levels of absolute maximum.

This performance originates in several accelerating markets in its imports.

- United States: in 2022 it took first place overall among the importing countries of the segment, with a value close to 250 million euros. The growth of imports on the US market has already originated for several years, in the pre-Covid era, with a further acceleration in the more recent two-year period (+116 million euros). In the 2026 scenario, further increases are expected, albeit smaller in size (+82 million euro), reaching around 331 million euro;

- Germany: this is the second world importer in the segment, with an estimated value in 2022 of 228 million euros. As the graph below shows, already in the middle of the last decade this market showed a notable progression of its imports, to then achieve an overall increase of almost 80 million euros in the most recent two-year period. In the forecast scenario to 2026, a consolidation of the growth phase is expected, with an overall expected increase of a further 38 million euro;

- Australia: this is a market that is climbing the world ranking of top importers in the segment, reaching 6th place overall in 2022. After a prolonged period of latency, in the middle of the last decade this market showed the start of a growth phase, which in the most recent two years has been exponential (+104% in euro values). In the forecast scenario to 2026, Australian imports of the segment are expected to increase by a further 24 million euros, reaching levels well above 100 million euros.

Awnings: main BLOC markets

| UNITED STATES | GERMANY |

|

|

Source: ExportPlanning-Forecast Datamart

Conclusions

After a particularly dynamic two-year period 2021-2022 for world trade in home textiles (thanks - to a significant extent - to price increases along the supply chain and - with reference to the current year - to the depreciation of the euro), the The prospects for the next four years (2023-2026) are positive but decidedly more selective, with expectations of average annual growth in the order of 7 percentage points in euro values this year and 5% points in the following three-year period (see the graph below).

In such a context of greater selectivity, the search for foreign markets BLue OCean (BLOC), resilient to the cycle, should be a priority for exporting companies in the sector.

The instrumentation made available in ExportPlanning, in the Market Selection tool, can allow you to select the so-called BLOC markets, during the acceleration phase of your imports.

1) For a list of the segments of the sector being analysed, please refer to the relative sector profile.

2) The other home textiles segment includes the following product categories: cotton blankets; synthetic fiber blankets; blankets of wool and other textile materials; table linen; bed cover; furnishing articles of textile materials (knitted, cotton and synthetic fibres), assortments consisting of pieces of fabrics and yarns.