World trade in Pasta: some Blue Ocean Markets

The increasing celebrity of the Mediterranean diet worldwide has led to a significant growth in demand for pasta. A focus on some emerging markets

Published by Marzia Moccia. .

Food&Beverage Consumption pattern Export markets Foreign markets Foreign market analysis

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

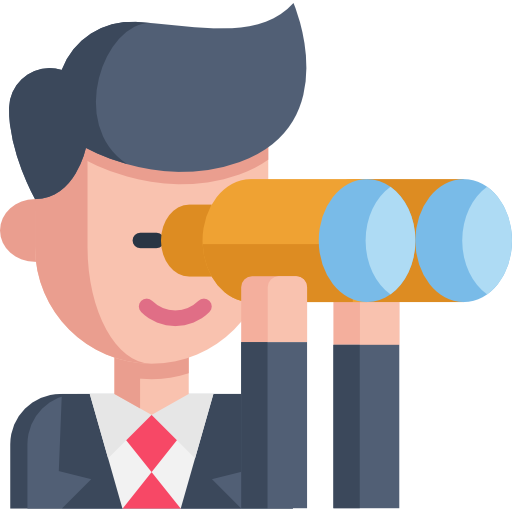

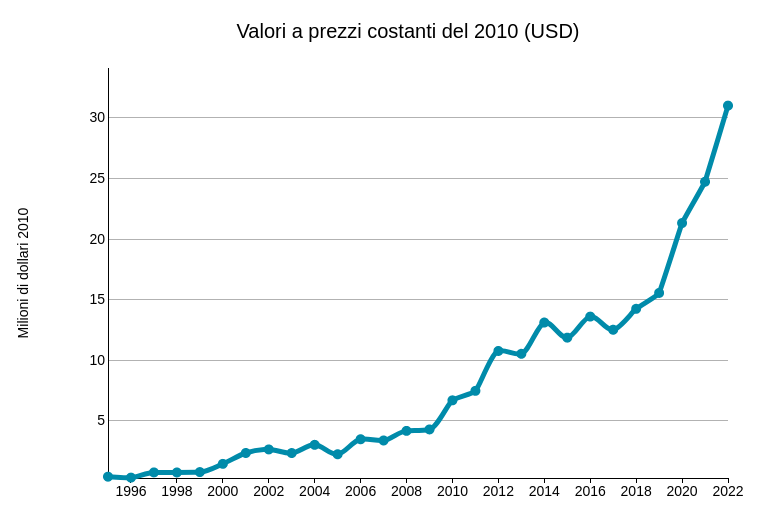

Over the past 20 years, world demand for pasta has experienced robust growth: while at the beginning of the century, world trade in the product was worth less than USD 2 billion, by 2022 it had reached an all-time high of USD 9.3 billion, for an average annual growth rate of 7.6%, and a further acceleration sprint experienced in the past few years.

Fig. 1 - Global demand for pasta (1995-2022)

Particularly remarkable was the result recorded during the pandemic year, when the sector grew by 20%, supported by the pandemic-induced shift in consumption preferences.

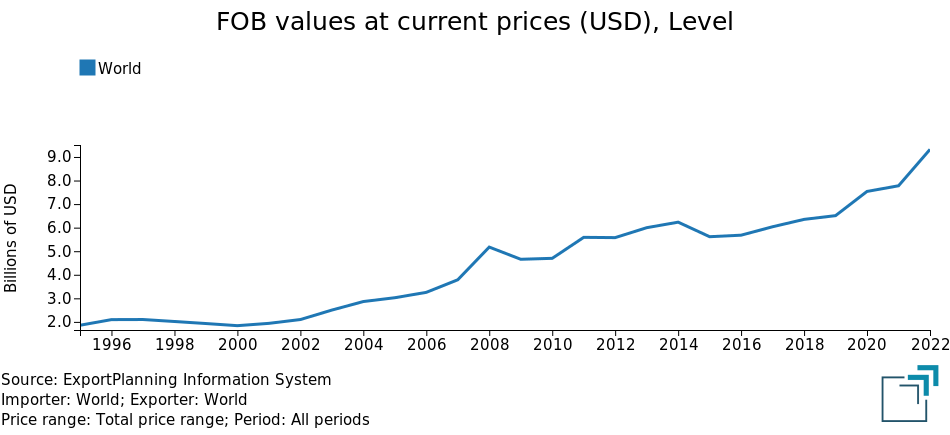

The increase affected all major types of pasta, but was mainly driven by world trade in wheat pasta (see Fig.2), which now accounts for around 70% of world demand in the sector.

Fig.2 - World demand for different types of pasta (1995-2022)

Italy undoubtedly plays a leading role, holding around 40% of world trade in the segment and firmly occupying first place in the ranking of major world exporters, followed at a distance by Turkey and China. Pasta is in fact among the agri-food products that hold high the Italian flag in the world, together with wine, and is perhaps among the most representative goods of Made in Italy on an international scale, thanks to its high quality standards and extraordinary appeal to foreign consumers.

Given the centrality of the sector for the Italian country system, it is particularly interesting to intercept those geographies that loom as highly promising for the best orientation of commercial strategies and investments. These are the so-called BLue Ocean (BLOC) markets, characterised by a demand that is growing at a particularly accelerated rate, in the face of structural factors.

BLOC Foreign Markets

The case of the Serbian market

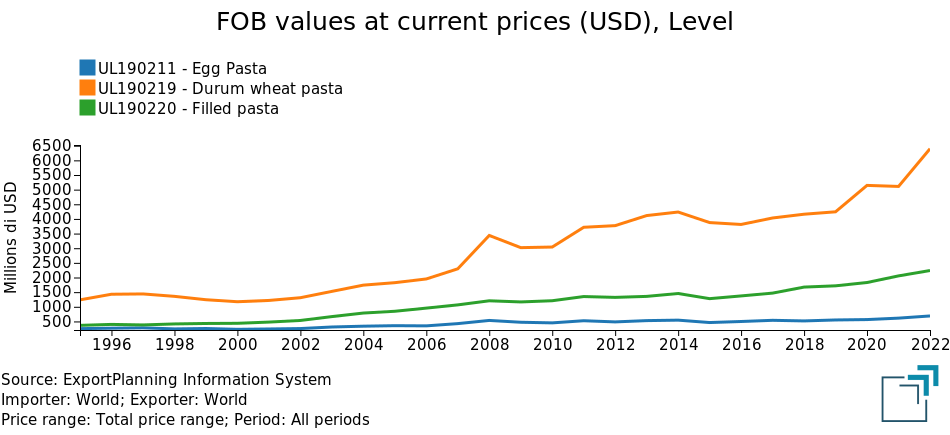

Serbia appears to be a particularly interesting case for the pasta sector. Although it is still a small market, with the value of imports amounting to just over USD 14.7 million in 2022, imports of all the main types of pasta are in a particularly accelerated growth phase in terms of quantity, which has been going on uninterruptedly for about a decade.

Fig. 3 - Serbia: imports of pasta

Durum wheat pasta

Stuffed pasta

Egg pasta

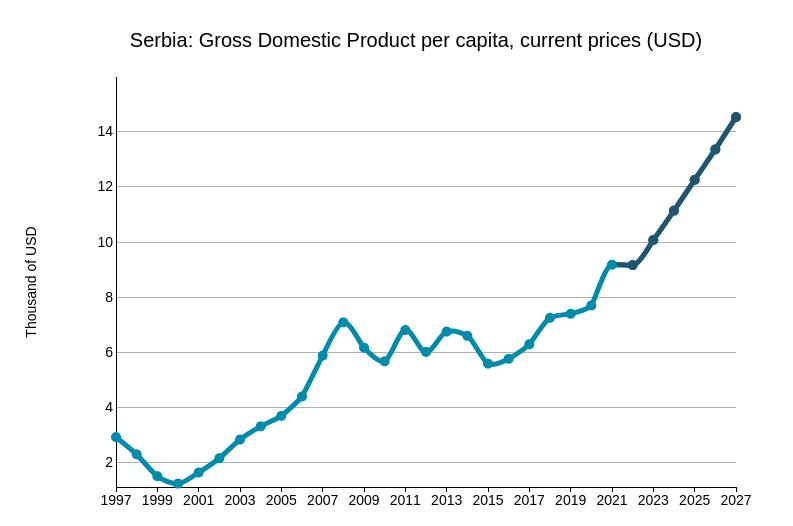

The country's economic growth has become more solid in recent years, leading to a gradual improvement in income conditions: Serbia has gone from a per capita GDP of $5,000 in 2015 to $9,000 in 2022, and is expected to reach $11,000 in 2024.

Durum wheat pasta: the market in Colombia

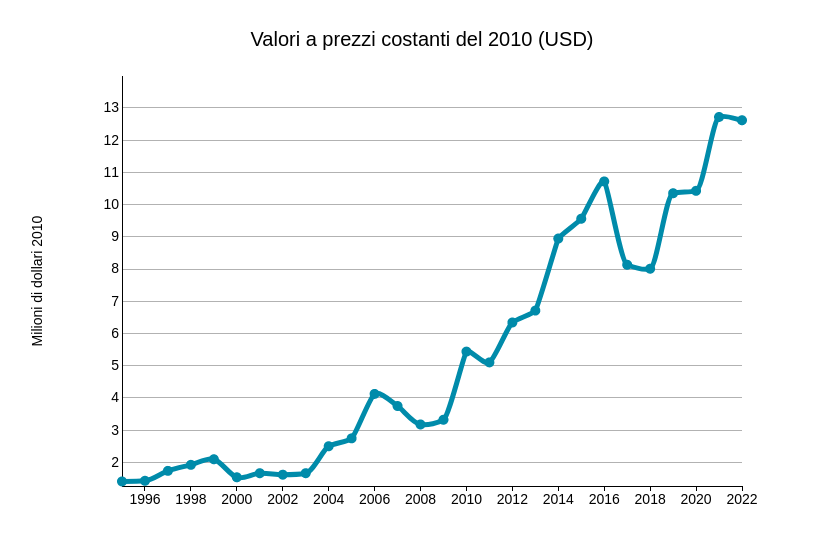

For the wheat pasta segment, a further geography to be monitored is Colombia, where the product's marked growth in imports has become highly dynamic since 2016, tripling in about six years.

Fig. 4 - Colombia: imports of durum wheat pasta

In this case, it is particularly interesting that the market is accelerating in several sub-segments typical of the Italian agri-food industry, such as oil and sparkling wine imports.

The Colombian market, in fact, is characterised by a scarce local supply of products typical of the Mediterranean diet, satisfying domestic demand and the growing attention of local consumers to this type of product through imported products.

Fig. 5 - Colombia: imports of other food products

Import of olive oil

Import of sparkling wine

Conclusions

The process of globalisation in the international Food&Beverage trade and the increasing celebrity of the Mediterranean diet on a global scale has led to a significant growth in demand for pasta. The scouting of the most promising geographies has made it possible to frame some markets, both near and far, in a phase of structural acceleration of their imports, sustained by the consolidation of the middle class and changes in local consumption preferences.

In an international scenario that will also be very differentiated by country, it will be strategic for Italian companies in the sector to start taking into account new geographies and new phenomena.