World trade in leather-goods supply chain: largely recovered from pre-pandemic levels for finished goods; not for intermediate goods and machinery

Specifically, still positive trends in Q1-2023 for world exports of finished goods; significant slowdown, however, for products upstream in the supply chain

Published by Marcello Antonioni. .

Industrial equipment Fashion International marketing Uncertainty Conjuncture Check performance Industries Global economic trendsGlobal outlook of the leather-goods supply chain

In the first three months of 2023, the global situation of the leather-goods supply chain, while slowing down, was able to maintain an overall positive tone.

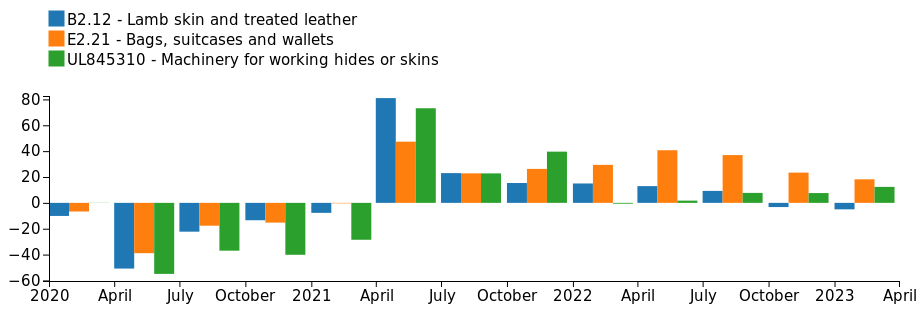

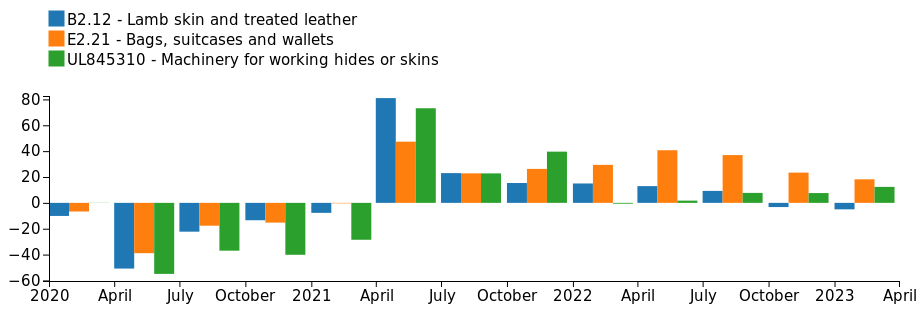

World exports of leather-goods supply chain

(% Year-over-Year changes in euro)

As documented by the data Exportplanning, exports of leather-products (intermediate goods1, finished products2) and related process machinery3 recorded a double-digit increase in values in euro (+14.8%, after the +28.6% average in 2022) and a - albeit more contained - change of positive sign in the measurement at constant prices4 (+6.2%, after the +14.8% of the 2022 average).

World exports of leather-goods supply chain

(% Year-over-Year changes at constant prices)

Intermediate goods

Within the supply chain, however, the products further upstream show the greatest signs of a slowdown.

In particular, world exports of the tanning industry, after having recorded an average annual increase of +8.2% in euro values in 2022 (which, however, analyzing the evolution at constant prices, should be read in a less favorable way: see the graph above, which documents three of the four quarters of 2022 in negative territory), in the first quarter of this year they marked a negative trend both in euro values (-5%) and at constant prices (-9.6%).

It is likely to hypothesize that the increased phase of uncertainty of the international economic cycle5 has had a greater impact on the sales of intermediate goods, in a natural process of destocking along the production chains.

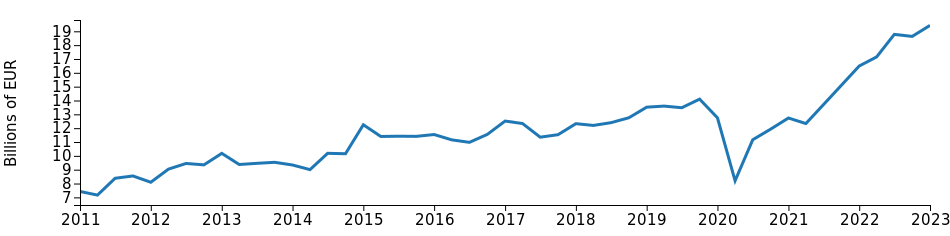

It should also be underlined that the current levels of world sales of intermediate goods in the leather goods supply chain are still well below the pre-pandemic levels (see the graph below): if we compare the first quarter of 2023 with the corresponding period of 2019, the difference is -9.4 per cent in euro values and almost 20 percentage points in the measurement at constant prices.

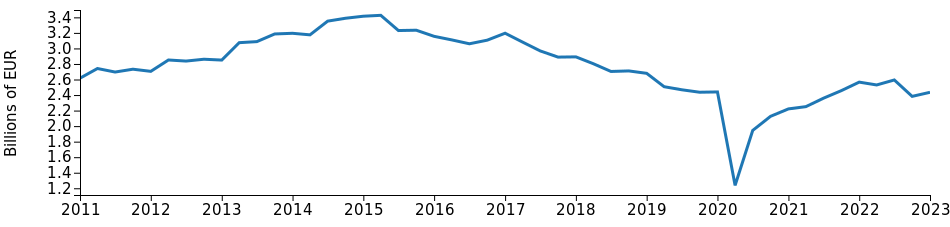

Quarterly world exports of intermediate goods in the leather-goods supply chain

(seasonally adjusted euros)

Finished products

Along the leather-goods supply chain, the products further downstream, on the other hand, show greater sealing capacities.

In particular, world exports of handbags, after having recorded an average annual increase of +24.3% in euro values and +13.5% at constant prices in 2022, in the first three months of 2023 marked a trend increase still double-digit percentage in euro values (+16.9%) and good dynamism even at constant prices (+8.8% ).

The same goes for the world export of bags and travel bags, in trend increase in the most recent quarter by +16.4 percent in euro values and by +7.8 percent at constant prices.

Not least, the recent trend increases of other leather goods6 (+31.2% in euros and +21.4% at constant prices), which confirm the excellent performance already highlighted in the 2022 average.

On the other hand, the relatively less favorable trend performance of world sales of wallets and objects should be noted - in negative countertrend from pocket or handbag, which in the first quarter of 2023 showed a weak growth in values in euro (+4.7%) and a decline at constant prices (-3.8%), moreover retracing the unfavorable dynamics of the 2022 average (+6 per cent in euro values; -4.1 per cent at constant prices).

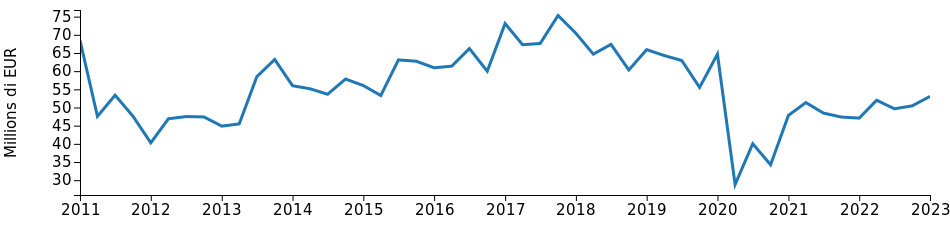

Quarterly world exports of finished goods in the leather-goods supply chain

(seasonally adjusted euros)

Overall, however, the levels reached by world exports of finished products in the leather-hide-leather goods chain are well above pre-pandemic levels (see the graph above): this is a positive difference of almost 14 percentage points in the measurement at constant prices and - thanks to the increases in the costs of raw materials that occurred in the two-year period 2021-2022 - even more than 42 percentage points in values denominated in euros.

Process machines

For suppliers of technology in the leather-goods supply chain (leathergoods and tanning machinery), the data for the first quarter of 2023 provide an economic picture marked by a positive outlook, with world exports in trend growth both in euro values (+12.4%) and in measurement at constant prices (+3.4% ).

However, it should be highlighted that the values achieved in the first quarter of the year by world exports of the sector are still well below pre-pandemic levels (see graph below): -20.3 per cent in euro values; -32.6% at constant prices.

It is a clear sign of how the post-pandemic recovery that the downstream products of the leather-goods supply chain (i.e.: finished products) have been able to sharply ricover globally has not implied significant investments in new capacity production (or in a significant modernization of the existing one) at an international level.

Quarterly world exports of machinery in the leather-goods supply chain

(seasonally adjusted euros)

World exports of leather-goods supply chain sectors

| Levels 2022 | % Y-o-Y at current prices |

% Y-o-Y at constant p. |

|||

| Sector | (Bn €) | 2022 | Q1-2023 | 2022 | Q1-2023 |

| Shaved and treated skin | 13.0 | + 8.2 | - 5.0 | - 4.1 | - 9.6 |

|---|---|---|---|---|---|

| Handbags | 36.1 | +24.3 | +16.9 | +13.5 | + 8.8 |

| Travel sacks and bags | 23.7 | +33.3 | +16.4 | +21.5 | + 7.8 |

| Wallets and pocket or handbag items | 8.2 | + 6.0 | + 4.7 | - 4.1 | - 3.8 |

| Other leather goods | 15.8 | +66.4 | +31.2 | +55.4 | +21.4 |

| Leathergoods and tanning machines | 0.3 | + 4.2 | +12.4 | - 6.8 | + 3.4 |

| TOTAL | 97.1 | +28.6 | +14.8 | +16.7 | + 6.2 |

Source: ExportPlanning Information System

From the pandemic crisis to today, the leather-hide-leather goods chain has been able to highlight particularly significant recoveries, but very uneven at the product level: finished products very well, intermediate goods and machinery less well

Conclusions

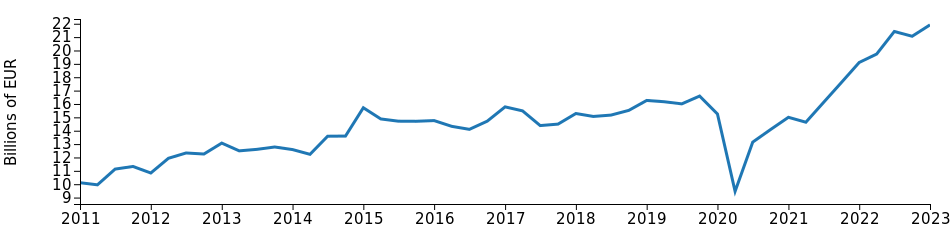

The levels reached by world exports of products from the leather-fur-leather goods chain in the first quarter of the year represent a new absolute maximum point for the historical experience of the chain, with a significantly different positive (+33 percent) in euro values and moderately positive at constant prices (+7%) compared to pre-pandemic levels.

Quarterly world exports of total leather-goods supply chain

(seasonally adjusted euros)

However, the analysis presented here has documented a very uneven economic situation along the leather-skins-leather goods supply chain:

- high dynamism in the post-pandemic restart for world sales of finished products, also confirmed (albeit with a slight slowdown) in the first quarter of 2023;

- greater difficulties in the post-pandemic recovery for world sales of intermediate goods and machinery, confirmed also in the first three months of the year at levels well below those of 2019 and - above all with reference to intermediate goods - in a phase of marked slowdown.

The expected worsening of the international situation, in the light of the most recent macroeconomic signals7, will tend to question the dynamism of the first cluster of products and, at the same time, to accentuate the difficulties of the second cluster.

In such a scenario, the ability to monitor the situation of the various international markets at the sectoral level (and specific business area) will be an important critical success factor for optimizing the markets portfolio.

1) For a description of the products included therein, see the related industry profile.

2) For a description of the products included therein, see the related industry profile.

3) For a description of the products included therein, see the related industry profiles:

- machinery for working hides or skins;

- machines for the manufacture or repair of manufactured products of leather or leather.

5) In this regard, the Index of the global industrial cycle from the PricePedia source, which measures the degree of utilization of industrial production capacity worldwide, shows a downward trend in the first part of 2023 (-4% in the period January-May 2023 compared to the corresponding period 2022), on levels about 5 percentage points lower than the high of June 2022.

6) This item includes the following products: trunks, suitcases, briefcases. See the related industry profile.

7) As documented by the worldwide Purchasing Managers Index, published on the PricePedia platform, in June 2023 it reached a new low point (46.7), for the tenth consecutive month below the neutrality threshold (values below 50 indicate economic activity in a contraction phase).