Opportunities for Italian Exports: the China-US Challenge

In an international arena characterised by US-China vis-à-vis, what dynamics are characterising Italian exports to the two markets?

Published by Marzia Moccia. .

Asia United States of America Foreign markets Uncertainty Made in Italy Trade war Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The United States and China undoubtedly represent two markets with a particularly high potential for Italian exporters, attributable both to the significant size of the two countries and to the relative ability to appreciate quality products and recognize a premium price for products made in Italy.

The relevance of China and the United States as destination markets for Italian exports

The U.S. is one of the main outlet markets for Italian products and represents a historical partner, so much so that it has become the second destination geography for national exports in 2022, with a value of 65 billion euros, undermining neighboring France.

China, on the other hand, has gradually emerged as a market full of opportunities, maintaining an average annual growth rate of 4.7 percent over the past decade, while still being three times lower than that of the United States.

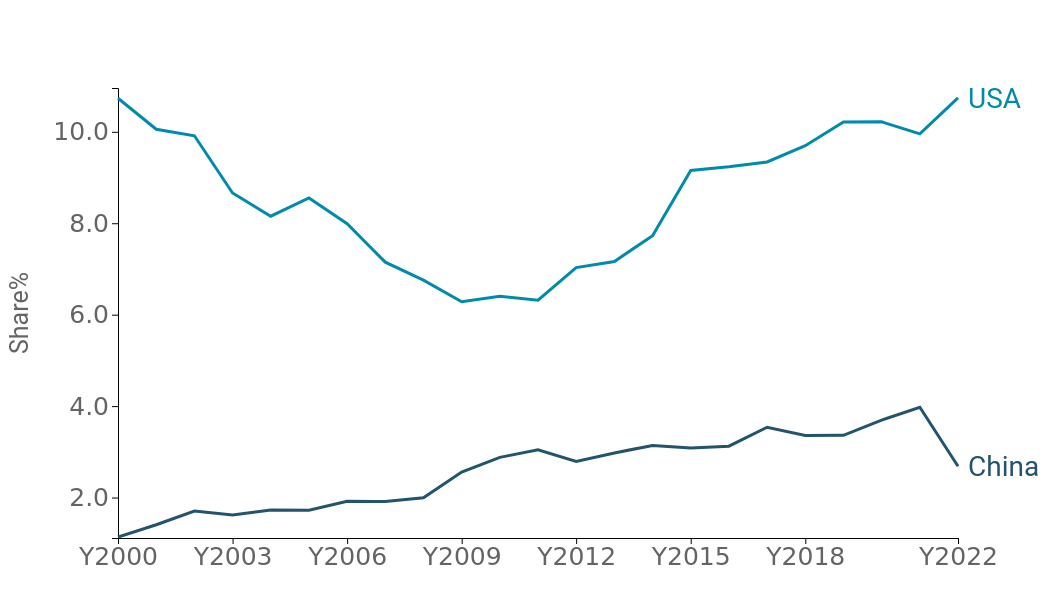

Fig. 1: Italian export destination markets: weight of the United States and China

There is no doubt that the weight of the Chinese partner on the total destination geographies of made in Italy has progressively grown over the century: if in 2001, the year China entered the WTO, the country held a little more than 1 percent of national exports, by 2021 it absorbed about 4 percent. However, as China's economy slows down due to pandemic containment measures, 2022 seems to have interrupted the upward trend that had characterized recent years.

A second factor to take into account is the strong propensity of the two markets to import high-quality products: especially after the Great Recession, the incidence of premium-price brackets on China's total imports from Italy has grown considerably, coming to be substantially comparable to that of the United States, if not higher in recent years. In both cases, more than 50 percent of imports from the Belpaese are in fact premium-price products (Fig.2).

Fig. 2: Incidence of higher price ranges

However, the relative attractiveness of the two markets for Italian firms

has changed over the most recent quarters

Italian exports to China and the United States: a conjunctural analysis

First, the signs of economic slowdown in China throughout 2022, when the country put in place stringent measures to counter the resurgence of the SARS-CoV-2 virus, coupled with further signs of weakness that seem to persist into 2023, have made the Asian Giant a "less attractive" market in an already complex international scenario. In addition, one has to consider the changed international context in which we operate after the pandemic crisis, where the U.S.-China geopolitical and technological confrontation has been worsened by the war in Ukraine, and the relative position of China, as well as the fears of the world's major economies about securing supply chains. All this seems to have led to an increasingly polarized international configuration between "West" and "East," where convergence of orientations and solid diplomatic relations in defining one's trade strategies become increasingly important.

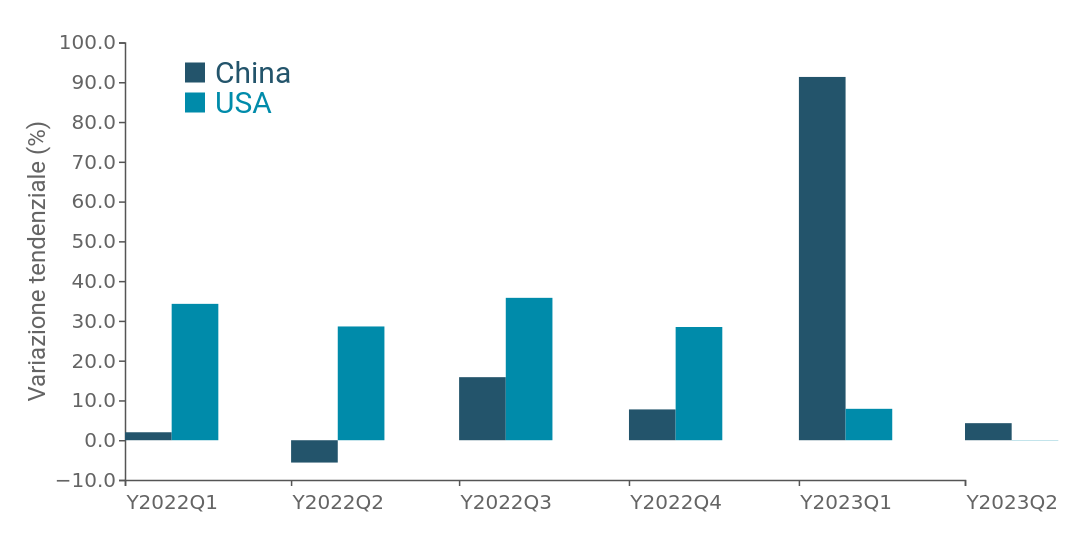

Fig. 3: Dynamics of Italian exports to China and the United States

(Quarterly trend rate of change %, values in euros)

Against the above considerations, Fig.3 makes it clear that in 2022 Italian exports showed a largely more positive dynamic toward the U.S. market than toward the Chinese market, a fact that seems to be partially reversed in the early months of the new year. In 2023, in fact, the U.S. market showed progressive signs of slowing down in the face of a Chinese recovery.

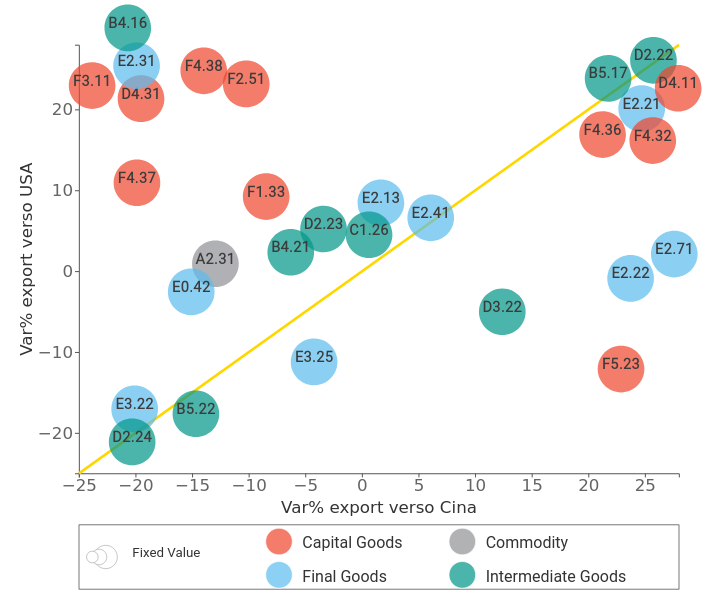

In order to read this information in greater detail, the following graph positions the top 30 sectors of Italian exports to the two countries according to the growth rate recorded by exports to the United States (Y-axis) and China (X-axis) in the first half of 2023 compared to the corresponding period of the previous year.

Fig. 4 – First half of 2023: performance of Italian exports to China and the US by sector

Net of what was a true record result for Italian pharmaceutical exports to the Dragon country, which explains a large part of the double-digit rate of change in Q1 2023, which we discussed in a previous article, differences in terms of the performance of Italian exports in the two markets become more subtle for other sectors and, moreover, appear relatively differentiated in relation to different types of industries:

- in the case of investment goods, the U.S. market seems to be characterized overall as holding up better than the Chinese market, both for imports of machinery for industry (F4), and for the mechanical (F2) and automotive (F3) supply chains;

- overall, all intermediate goods sectors show relatively aligned trends in the two markets, with some evidence of slowdown, in line with the current international economic situation;

- consumer goods show the most heterogeneous picture. For the Fashion System, in the first six months of the year, the U.S. market seems to have been more rewarding for Italian sales of Perfumes and Cosmetics (E2.31) and Outerwear (E2.13), while the Chinese market for Footwear (E2.22), Leather Goods (E2.21) and Jewelry (E2.71), even with a partial rebound from last year's results.

Weak evidence, but more resilient in the U.S. market, is also seen for the Alcoholic Beverages segment (E0.42).

For the Home System, negative performances are found in both markets, both in the Home Appliances segment (E3.25) and the Furnishings and Upholstered Furniture segment (E3.22); in line with the strong downsizing of world demand for these products that has been occurring on an international scale over the past year.

Conclusions

A complex international economy and the economic setbacks experienced by China have changed the relative attractiveness of the two markets for Italian companies in the most recent quarters. Indeed, during 2022 there was an increase in the weight of the U.S. market in the total markets served by Italy.

In the face of a Chinese recovery that still seems to be fragile, a higher riskiness of the Dragon country and lower accessibility, the U.S. market does indeed seem to be a "safer" alternative. However, only timely monitoring of information and proper analysis of one's business sector can tip the balance toward one or the other country.