President Draghi’s Legacy: it’s QE Time Again

Rate cuts in the US, as well.

Published by Alba Di Rosa. .

Slowdown Exchange rate Dollar Euro Uncertainty Exchange rate risk Economic policy Trade war Central banks Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

Latest news in global economic discussion mainly focus on monetary policy.

On September 12, the European Central Bank (ECB) announced the restart of the Asset Purchase Programme (APP), “at a monthly pace of €20 billion as from 1 November”. The goal is to stimulate the flagging Eurozone economy, affected by downside risks and an inflation rate continuosly below 2%.

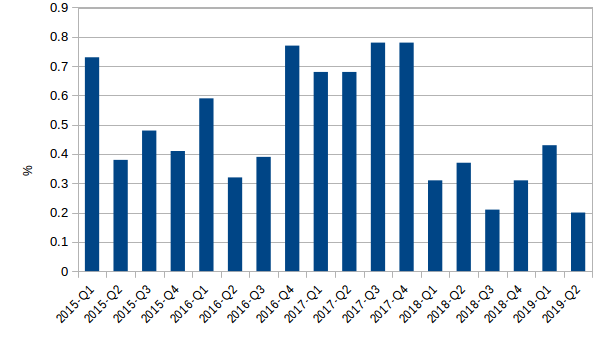

In Q2-2019, Euro area GDP grew by 0.2% (quarter-on-quarter), down from 0.4% in Q1. According to the ECB, “This slowdown in growth mainly reflects the prevailing weakness of international trade in an environment of prolonged global uncertainties, which are particularly affecting the euro area manufacturing sector.”

As can be seen from the graph, growth recorded in the last quarter is the lowest in recent years.

Euro area GDP: Quarter on quarter growth rate

(2015Q1-2019Q2)

Source: StudiaBo elaborations on European Central Bank data.

In addition to the APP, the interest rate on the deposit facility will be decreased by 10 bps to -0.50%, while the interest rate on the main refinancing operations and the rate on the marginal lending facility will remain unchanged (0.00% and 0.25% respectively).

The restart of the QE was widely expected by markets, as suggested by the ECB in the last few months.

An element that struck international observers is the lack of a deadline to the program: the ECB expects to run it “for as long as necessary to reinforce the accommodative impact of its policy rates”.

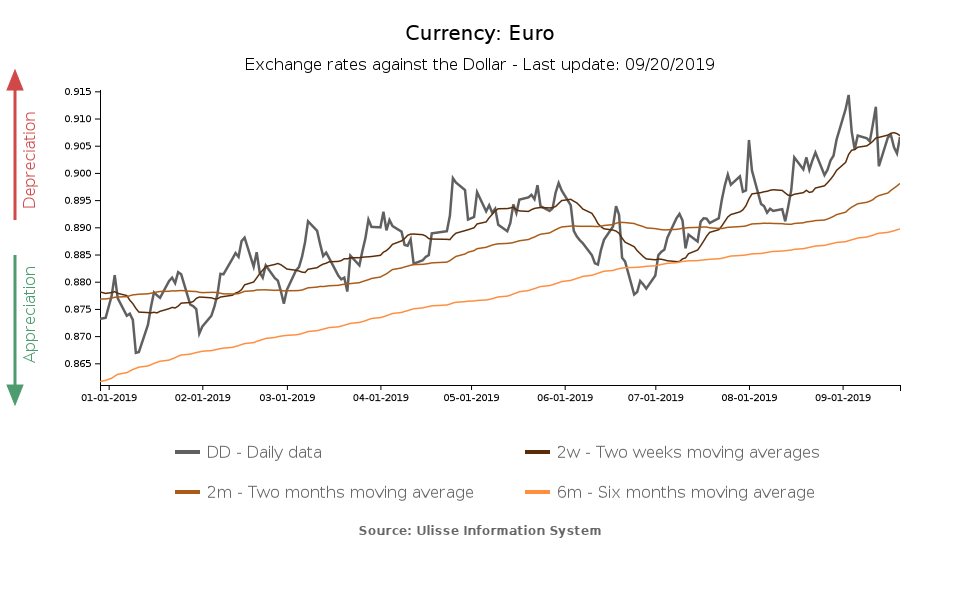

The immediate reaction of the single currency has been a slight appreciation, even if the long-term effect of a quantitative easing should be the opposite: a strongly accommodative monetary policy actually tends to weaken the currency, sustain export and therefore support the economy through the commercial channel, together with the financial one.

Given the American administration’s sensitivity for the theme of currency manipulation, the reaction of president Trump to the ECB monetary policy decision has not been positive. In a tweet, he accused the ECB to actually pursue an an exchange-rate policy aimed at weakening the euro.

European Central Bank, acting quickly, Cuts Rates 10 Basis Points. They are trying, and succeeding, in depreciating the Euro against the VERY strong Dollar, hurting U.S. exports.... And the Fed sits, and sits, and sits. They get paid to borrow money, while we are paying interest!

— Donald J. Trump (@realDonaldTrump) September 12, 2019

Such an accommodative monetary policy could therefore worsen the state of EU-US relations, namely in the current context of continuous tensions caused by tariff threats.

The FED counterstrike

The week after the decision of the ECB, the Federal Reserve Open Maket Committee met, as well, and cut the target range for federal funds rate by 25 bps (to 1.75%-2%). Even if the ECB action might have contributed to the decision, the actual technical elements cited by the FED behind its decision were:

- The weakening of exports and business investments

- An inflation rate below 2%

- The impact of "global developments" (first and foremost, trade war) on the domestic economic outlook

Common feature of the FED and ECB decisions is therefore the influence of external elements, which cause uncertainty at a global level. On the other hand, the approach towards future monetary policy actions differs: while the ECB expresses a forward guidance, the FED declares that it will progressively evaluate economic developments that will emerge from data and indicators.

However, the FED action was not welcomed by President Trump, who judged the cuts as being not sufficiently aggressive.