Latin America Update: How is Brazil Doing?

A pension reform, at last.

Published by Alba Di Rosa. .

Slowdown Exchange rate Emerging markets Latin America Brazilian real Uncertainty Exchange rate risk Oil Central banks Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

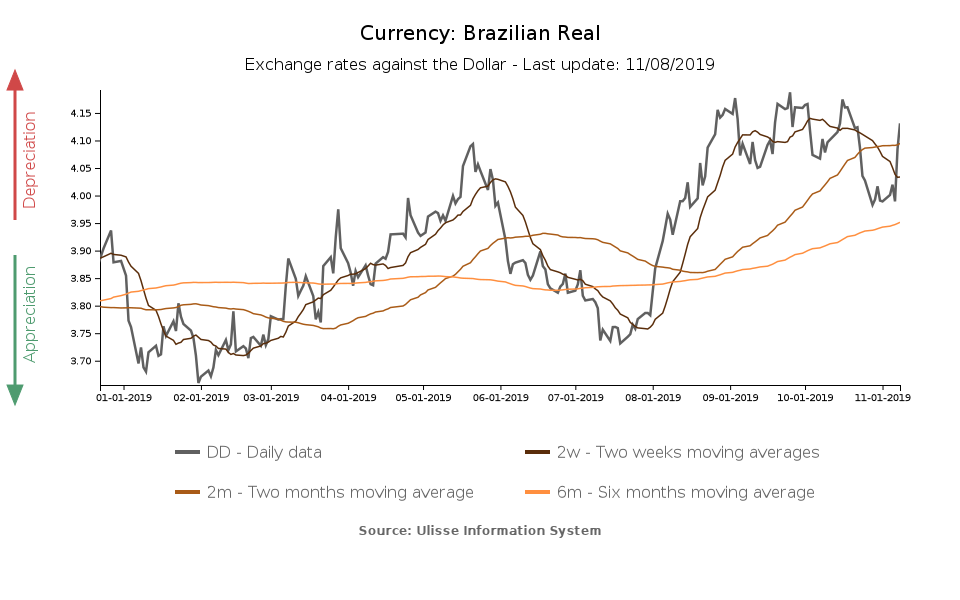

After a period of relative stability, in the last week the Brazilian real entered a new phase of fluctuations against the dollar.

As you can see from the graph, the currency moved in opposite directions in a few weeks time:

- At the end of October the real showed a strengthening, due to the approval of the long-awaited pension reform, necessary to rationalise an excessively expensive system, thus supporting public finances. The stock market and the currency greeted this goal: in particular, the real appreciated by almost 2 percentage points against the to the dollar between October 22 and 24, crucial days for the approval of the reform.

-

In recent days the real weakened instead, due to the disappointing outcome of two relevant oil auctions. The state-controlled oil company Petrobras has in fact tried to sell oil licenses, in order to support public finances with a significant dollars inflow and free the national oil industry from excessive statism (in 2015 a corruption scandal hit Petrobras, worsening the recession of the Brazilian economy).

However, the two auctions proved to be a total failure: only a third of the licenses were awarded, all of them to Petrobras.

The reaction of the currency was immediate, with a 3.5% weakening against the dollar in the last three days.

The economic framework

Currency fluctuations, mainly related to contingent events, are part of a wider picture of economic recovery, and yet substantial weakness. Although positive, GDP growth does not proceed at a sustained pace: +0.5% in Q1-2019, +1% in Q2. According to forecasts by the Banco Central do Brasil, Brazilian economy is expected to keep on growing in Q3, while an acceleration is expected to take place in the coming quarters.

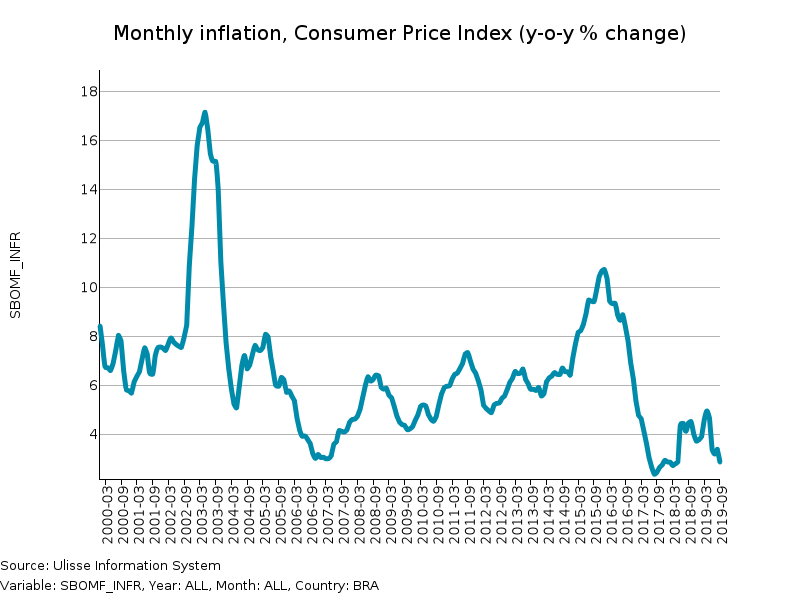

In turn, inflation shows a weak dynamics: it has been slowing down since spring, and it is now below the 4.25% target set by the central bank.

Nonetheless, analysts express moderate optimism about the prospects of the Brazilian economy. This outlook is supported by the general accommodative climate in terms of monetary policy, which is good for emerging economies, and the expected improvement in the fundamentals of the Brazilian economy, if the Bolsonaro government will succeed in carrying out structural reform projects.

According to the central bank, uncertainty lies in:

- The global growth slowdown trend

- The possibility of an increase in international investors’ risk aversion, which could cause their flight from emerging markets’ assets

- The inability of the government to carry out necessary reforms

In the framework just described, the Central Bank of Brazil has therefore deemed appropriate to cut its reference interest rate (Selic) for the third time in a row on October 30, to 5%.

What about the rest of Latam?

Although the economic situation in Brazil is not among the best, all in all it looks more encouraging compared to several other Latin American countries. A few weeks ago we described the situation of Argentina, which is still in the grip of the crisis. As regards Chile, the country has been plagued for weeks by popular protests, mainly linked to growing anger due to strong social inequalities. As for Mexico, latest economic data show that GDP has contracted in Q3-2019 (-0.4% y-o-y): it looks like the first year of López Obrador's presidency is not closing under the best auspices.