Winds of change on forex markets?

General strengthening dynamics among emerging markets’ currencies against US dollar.

Published by Alba Di Rosa. .

Exchange rate Dollar Swiss franc Uncertainty Exchange rate risk Japanese yen Chinese yuan Trade war Brexit Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

One of the main themes in this week's economic discussion is the appreciation of the dollar, which may have reached its peak. Looking at major currencies’ exchange rates against the dollar over the past two months, we can see that many of them have appreciated against the greenback.

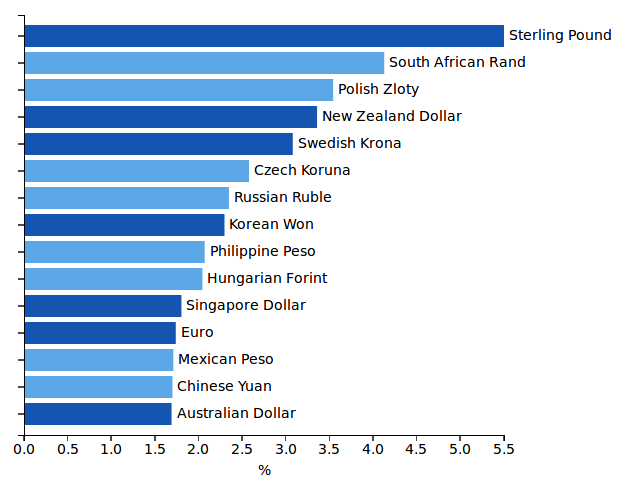

The graph below shows the currencies that recorded the greatest appreciation against the dollar from the beginning of October to date (developed countries and emerging countries).

Major currencies’ appreciation against the dollar (October-November 2019)

Source: StudiaBo elaborations on ExportPlanning data.

British pound

As can be seen from the graph, the British currency showed the strongest recovery. After reaching a point of maximum depreciation at the beginning of September, the pound began to recover in early October, driven by growing expectations for the UK to reach an agreement with the EU by the October 31 deadline.

After actually reaching an agreement with the Union by the end of October and obtaining an extension of the Brexit deadline to January 31 2020, the British PM Johnson announced that, on December 12, the United Kingdom will head to the polls. In recent weeks, the sterling has been supported by markets' hope for an outcome that will guarantee a majority to the current Conservative Party, so as to carry on the plan agreed with the EU and ensure a soft Brexit. However, no outcome is excluded, and the scenario for the coming months is still highly uncertain.

Emerging markets' currencies

Other interesting cases of recent appreciation against the dollar concern the main emerging markets’ currencies. Even if at the base of every dynamics we can inevitably find idiosyncratic factors, their joint analysis suggests that we could be entering a context of renewed appetite for risk. The MSCI Emerging Market Currency Index, one of the leading indicators on the subject, shows a 1.7% growth rate from the beginning of October to date.

In the period considered, South African rand appreciated by more than 4% against the dollar; appreciation exceeded 3% for Polish zloty, 2% for Russian ruble, South Korean won, Hungarian forint and Czech crown. Signs of strengthening from Chinese yuan, as well as Singapore dollar and Australian dollar, which all gained more than 1.5 percentage points against the greenback.

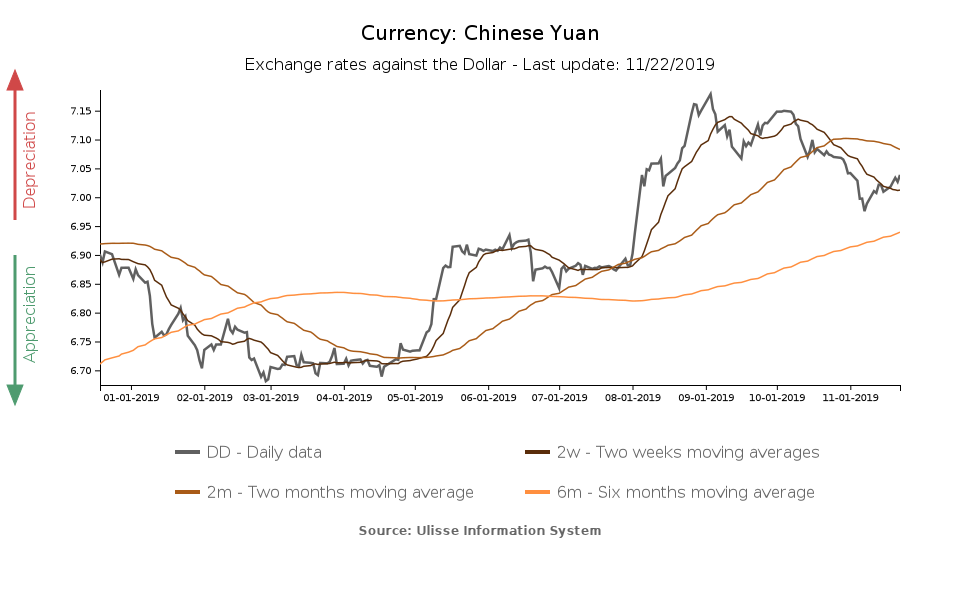

As for the yuan, the chart shows that a phase of recovery has been underway since October; in early November, the currency even briefly fell below the psychological threshold of 7 yuan per dollar.

The recovery of the yuan is allegedly due to the growing expectations for a “phase one” agreement between the US and China, a goal that could prevent the entry into force of the new US tariffs in mid-December.

The appreciation of the yuan brings with it a positive sentiment for other currencies of the Asian area (see the case of South Korean won and Singapore dollar).

On the other hand, the Australian dollar enters the picture due to its role as a cyclical "alarm bell": as a matter of fact, its appreciation generally indicates a renewed appetite for risk. Rather than following the movements of its peer countries’ currencies, the dynamics of the Aussie is actually closer to the one of emerging markets’ currencies, given that most of Australian exports go to emerging countries of the Asian area.

Further confirmation of the possibility of a slight increase in global risk appetite is the dynamics of safe-haven currencies which have shown signs of weakening in recent months: the Japanese yen has lost more than the 2% of its value against the dollar since September, while the Swiss franc, after weakening in September, has remained relatively stable in the last 2 months.