Exchange rates in 2019

The appreciation of the currencies of emerging economies

Published by Luigi Bidoia. .

Exchange rate Exchange ratesThe financial markets closed the last week of 2019 with a relatively calm. Commodity prices are stable if not slightly growing and stock market indices are slowly rising. Also on the currency front there is a year-end with low volatility: in the last week the maximum changes in effective exchange rates were in the range of 1%; no currency has recorded appreciation or depreciation of more than 1.5%.

Also on the basis of a year-end analysis, during 2019 the currency markets were characterised by significant but limited and short-term tensions. If we exclude the drama of Venezuela, where the case of the newborn sovereign Bolivar was yet another failure of the Maduro's government, only two currencies experienced changes of more than 15% during the year: the Argentine peso and the Angolan Kwanza, both depreciated by 35%. All other currencies kept their dynamics within the 15% threshold.

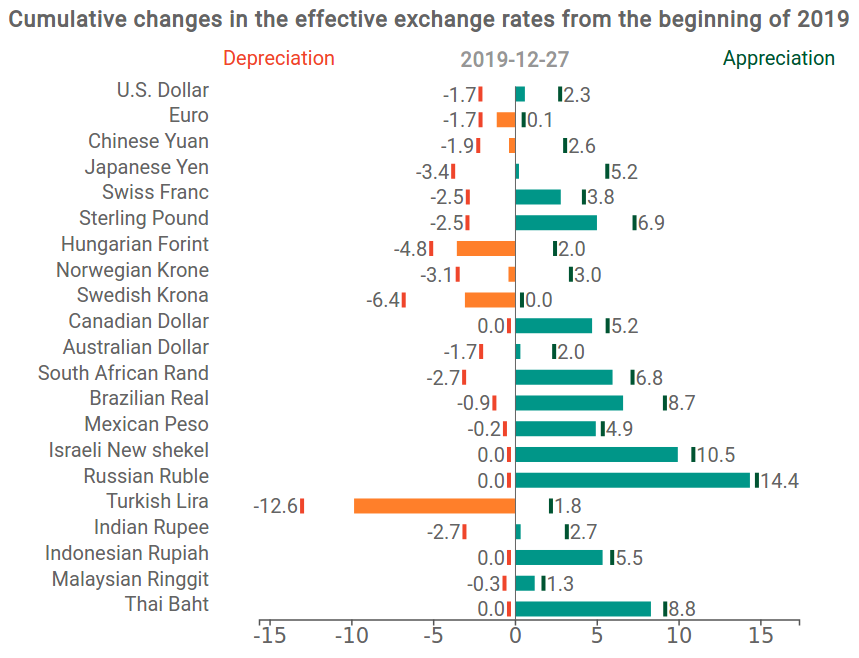

The graph below allows a summary view of the dynamics of the different currencies in 2019. The graph shows a histogram for each currency which represents the change in its nominal effective exchange rate compared to the beginning of 2019. The bar is colored green if the currency is appreciating; red if in depreciation. In the chart are also reported the maximum appreciation (green line) and depreciation (red line) recorded by the currency during 2019. At the bottom of the article there is a graphic animation that allows you to follow the dynamics of the different currencies throughout the year.

The analysis of exchange rates chart clearly points out several facts:

- the three main world currencies (dollar, euro, renminbi) showed a relative stability during the year, with values that have never significantly diverged from 2% compared to the exchage rates at the beginning of the year. All the three currencies end the year essentially at the same values as at the beginning of 2019;

- most currencies of emerging economies closed the year with a significant appreciation, in many cases close to their 2019 highs. This is the case of the Brazilian Real, of the South African Rand , of the Mexican Peso, of the Indonesian Rupee and of the Thai Baht . All these currencies experience an appreciation in the range of 5% to 10%. The Russian Ruble deserves a special mention because its appreciation far exceeds 10%, approaching 15%. For most of these currencies (Real, Rand, Rupee and Ruble) the 2019 appreciation represents a recovery from the depreciations experienced in previous years. For the Baht, however, it is part of the long appreciation phase of the currency;

- among emerging economies, only Turkey is experiencing a depreciation of its currency. However, at the end of the year it is less than 10%, recovering from the peak recorded on 9 May 2019;

- Canadian dollar, British pound, Swiss Franc and especially the Israeli Shekel are the currencies of the developed countries that recorded the greatest appreciation in 2019.

In the case of Pound, the appreciation is linked to the high probability of a formal UK exit from the EU on 31 January 2020. For the Swiss franc, the end-of-year appreciation represents the tail end of appreciation recorded last August. Indeed, during the summer, the high degree of global economic uncertainty had prompted many investors to safe haven currencies as Dollar, Yen and Swiss franc. The animation below highlights that these three currencies have simultaneously and significantly appreciated between the beginning and the end of August.

Animated Graph

Use the relative buttons to play, stop and reset the graph.