Japanese Yen: not so safe, anymore

Coronavirus epidemic and economic weakness weigh on the Yen, as its dynamics deviates from the “safe-haven” group.

Published by Alba Di Rosa. .

Slowdown Exchange rate Uncertainty Exchange rate risk Japanese yen Central banks Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

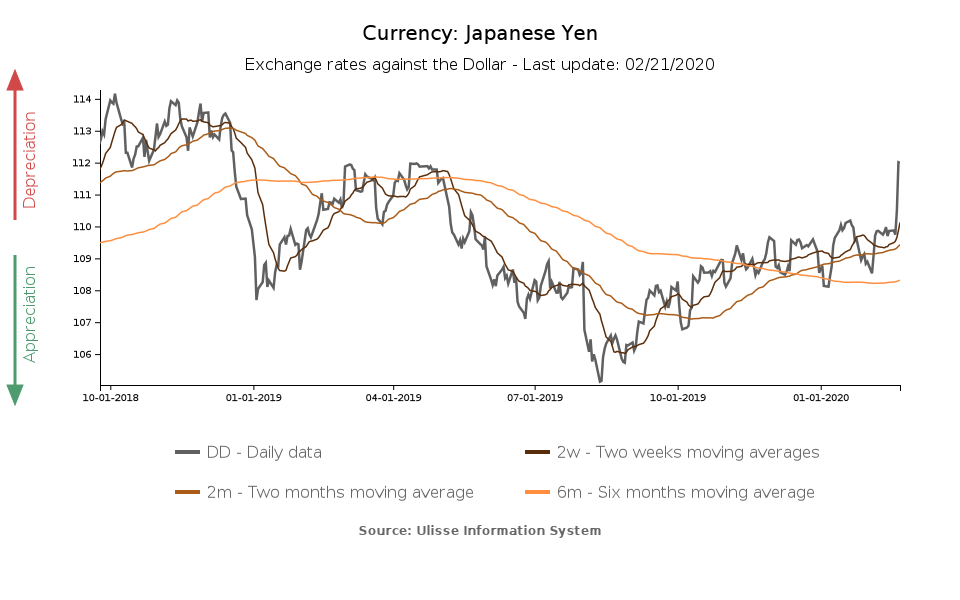

The trend that has caused rumor in forex markets this week is the reversal of fortunes of the Japanese yen, which seems to have entered a phase of weakening. Safe-haven currencies genereally strengthen in the face of widespread uncertainty, as it happened to the Yen at the end of January, in the first phase of the Coronavirus epidemic outbreak. The trend of the Japanese currency was therefore in line with the one shown by the other safe-haven currencies but, from February 3, this trend was reversed. On that day, quarantine started for the cruise ship Diamond Princess (off Yokohama, not far from Tokyo); from that day, the currency weakened, then stabilized for a few days and finally suffered a sharp depreciation since February 18.

Safe-haven currencies: Effective exchange rate

Looking at the long-term dynamics of the Japanese currency, we can see that, since August 13, the Yen has lost more than 6% of its value against the dollar. The exchange rate of the yen against the greenback is now at peak levels, last recorded in December 2018.

Coronavirus effect

Japan's strong exposure to the spread of 2019-nCov therefore seems to be one of the factors driving the weakening of the yen, leading to the loss, for the time being, of its safe-haven currency status. At the moment, Japan is the third country in the world in terms of confirmed cases (preceded by South Korea), while it rises to second place considering the more than 600 international cases of the Diamond Pricess ship.

In recent days, criticism is also emerging about how Japan has managed quarantine and prevention, on the ship and on land: the accusation is that Japan’s measures have not been sufficiently restrictive, therefore fuelling a climate of tension.

Japanese economic slowdown

The Coronavirus issue is not the only market worry weighing on the yen; the Japanese economy's performance is also quite alarming.

In the last few days data on the performance of the Japanese economy in Q4-2019 have been released: after a progressive slowdown of the (already weak) GDP growth rates during 2019, Japanese GDP growth entered negative territory in Q4 (QoQ). The contraction recorded in the last quarter is particularly worrying because it would translate, on an annual basis, into a contraction greater than 6%.

Industrial production also deteriorated in the last quarter, reaching almost -4% QoQ, preceded by a weak contraction in Q3. Looking at YoY % change, industrial production had already contracted in early 2019, a trend that exacerbated in the last quarter.

Japan: QoQ GDP and industrial production % change

This scenario of pre-existing weakness, combined with the current sanitary emergency and the consequent Chinese economy slowdown, can only put further pressure on the Japanese economy and its currency in the coming months, given the negative impact of an epidemic especially on consumption and services. Analysts' widespread fear is now that Q2-2020 will see negative GDP growth and that the Japanese economy will enter a technical recession.

Japan’s low yields

Taking into account the factors just mentioned, and the fact that US bonds offer higher returns compared to Japanese bonds, it is therefore clear that the dollar emerges as the best option in terms of safe-haven asset. Comparatively, Japanese assets are less attractive.

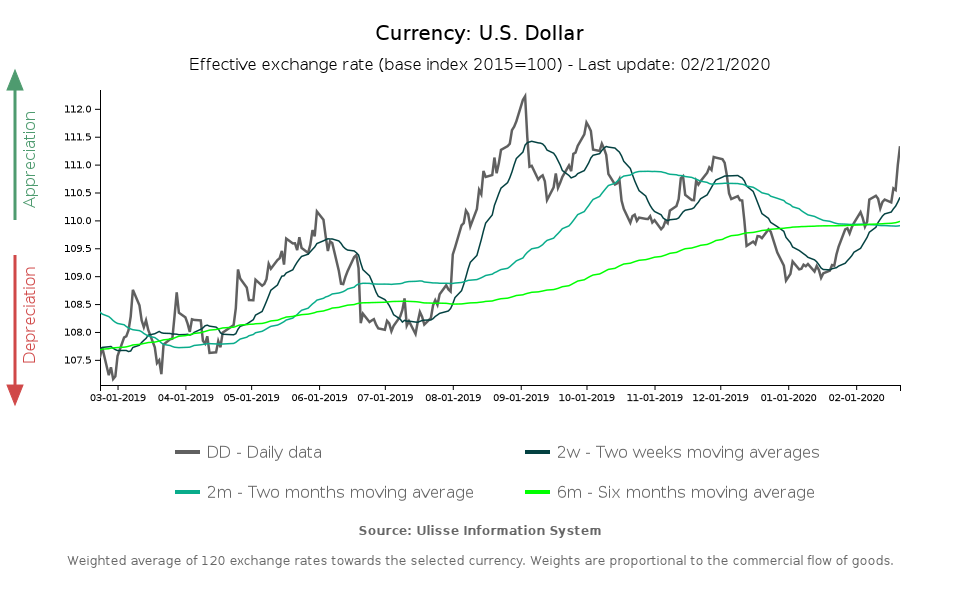

This is confirmed by the trend of the dollar, which keeps on appreciating (+1.9% in the last month in terms of effective exchange rate). While at the end of November the dollar seemed to have reached its peak, also thanks to the decrease in uncertainty over the trade war, with the emergence of a new international crisis the king dollar seems to have fully regained its supremacy.