Home Furnishing: World Trade and Major Competitors in Q1-2020

Significant growths of Vietnam's and Malaysia's exports of Furniture; positive results for Polish exports of Lighting

Published by Marcello Antonioni. .

Home items Conjuncture Global demand Check performance Competitor analysis Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

In the first three months of 2020, global demand for furnishing products showed a deterioration, albeit relatively limited, which is likely to intensify in the second quarter of the year. However, it should be noted that export performance varies a lot between the several competing countries, indicating a rapidly evolving competitive context.

This article documents the dynamics of global demand and the performances of the main worldwide exporting countries, regarding the Furniture and Lighting segments.

Furniture

World Trade

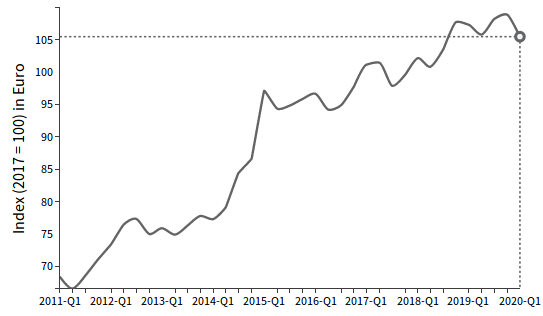

After reaching a record in seasonally adjusted values in euro in the last quarter of 2019, the first three months of the year have shown a relatively small reduction in Furniture1's world trade, quantifiable in approximately 2 percentage points.

Furniture: Evolution of World Trade in euro

(seasonally adjusted index; 2017=100)

Source: ExportPlanning - Market Barometer

Competitors' Performances

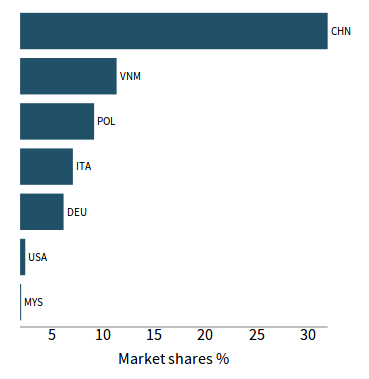

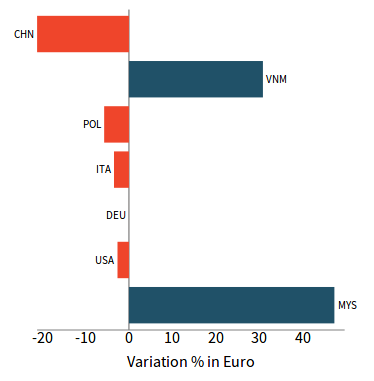

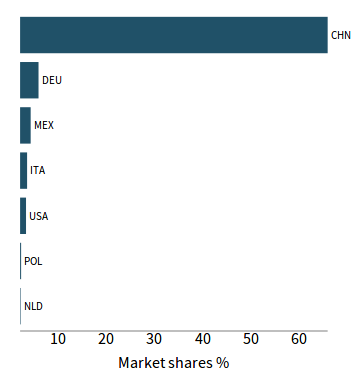

In a context of deteriorating demand, however, there are (even very) significant differences in the performance of the main furniture exporting countries, with a shift in the competitive structure of Asian competitors.

Significant growth of Vietnam's and Malaysia's exports

(at the expense of China) in the Furniture segment

In the first quarter of the year, given the weak export performance of Poland, Italy, and the United States and the steady results of German furniture exports, the sharp drop in Chinese exports (-21.1% YoY in euro in Q1-2020) should be noted. The contraction in Chinese sales greatly benefits exports from Vietnam (+30.8%) and, above all, Malaysia (+47.3%).

|

|

Source: ExportPlanning - Market Barometer

However, there is an important difference between the export performances of Vietnam and Malaysia to point out. In the case of Vietnamese exports, long-term growth took place: Vietnamese furniture exports have increased - almost uninterruptedly - throughout the last decade, at an average annual rate of +20% in euro3.

In the case of the Malaysian exports, instead, their recent acceleration seems to be strongly related to a "substitution phenomenon" of Chinese exports, penalized by the protectionist policies of the Trump Administration on the US market. If we observe the dynamics of the last decade, Malaysian furniture exports have remained substantially stable4, but in the last 4 quarters - in correspondence with the beginning of the "trade war" between the USA and China - Malaysian exports have started to increase at a +33% YoY rate in euro (against a corresponding YoY decrease in Chinese sales close to 13%).

Lighting

World Trade

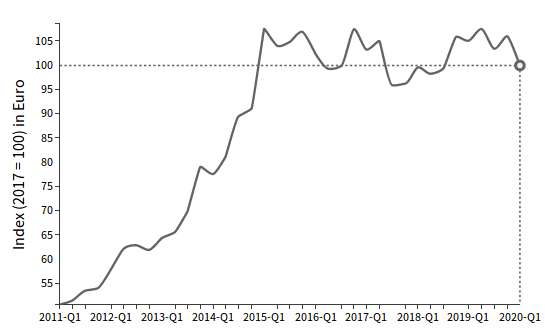

In the Lighting technology segment5, world demand was substantially stable during 2019, then fell back in the first three months of 2020 by around 5.4% YoY.

Lighting technology: Evolution of World Trade in euro

(seasonally adjusted index; 2017=100)

Source: ExportPlanning - Market Barometer

Competitors' Performances

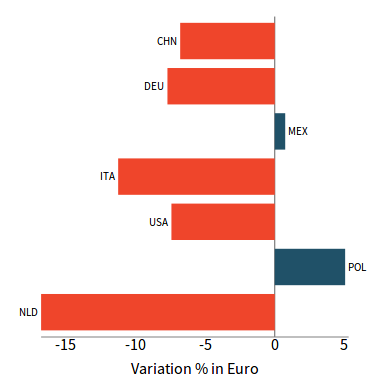

The Lighting technology segment also shows very variable results at the level of competing countries.

Positive results for Polish exports in Lighting

Given China's decline in sales (-6.8% YoY in the last quarter in euro), Germany (-7.7%), United States (-7.7%) and, above all, the Netherlands and Italy (down by more than 11%), we note the positive countertrend performances of Mexico and, especially, Poland (+5.2%), which - although slowing down - confirms the expansion phase of its exports in the Lighting segment.

|

|

Source: ExportPlanning - Market Barometer

In particular, Poland moved up to sixth place in the world ranking of major exporters of the segment5, thanks to an acceleration since the middle of the last decade and a particularly dynamic trend (with double-digit growth rates in euros) even in the last quarters.

Conclusions

The fall in world trade in the first quarter of the year6 also had an impact on the furnishing sector, which - especially in the Lighting segment - recorded a downward trend in demand.

However, the very differentiated performances of the main competing countries tend to signal a rapidly changing competitive environment. Especially in a phase of strong turbulence such as the current one, it may be very valuable to constantly monitor markets and competitors7.

1) See the list of the products included in this segment in the related

products' description.

2) In terms of values, Vietnamese furniture exports increased from less than 1.4 billion euros in 2009 to around 9 billion last year.

3) Indeed, Malaysian furniture exports had remained around 1.5-1.6 billion euros per year over the last decade.

4) See the list of the products included in this segment in the related

products' description.

5) At the end of 2019, Polish exports of Lighting technology were worth almost 1 billion euros, more than doubled in just 5 years.

6) See the related article.

7) The MarketBarometer tool of ExportPlanning, from which the information presented in this article has been extracted, provides the economic dynamics of the different relevant markets at international level by product/sector/industry, both in terms of total imports and imports from the main competing countries.