The volatility comeback

Published by Alba Di Rosa. .

Exchange rate Dollar United States of America Uncertainty Exchange rate risk Oil Central banks Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The week now drawing to a close opened confirming a trend recently highlighted in the article "Euro, dollar and pound: an update": a cautious but general optimism on financial markets for a gradual return to normal, some renewed appetite for risk and a decrease in the demand for dollars as a safe haven asset. In the meantime some commodity currencies (see the cases of the Canadian, Australian and New Zealand dollar in the graph below), as well as EM currencies, showed a partial or full recovery from the fall occurred in March - until the beginning of the week.

Effective exchange rate

In effect, it looked like a positive scenario, perhaps even too optimistic in the absence of solid signs of a recovery on the economic front. With the FED meeting on June 9-10, a sharp change of course took place. In spite of the cautious tone adopted by the central bank, the combined action of its announcements and other factors generated unforeseen effects on the markets, causing a negative turn in sentiment.

On Thursday, major stock exchanges fell worldwide: the S&P500 index posted a -5.9% decrease, the Dow Jones closed with a 6.9% contraction, the Euro Stoxx 50 fell by -4.5% and the Nikkei 225 by -2.8%; at the same time the VIX, the “fear index”, recorded a 48% jump. Oil prices also fell by about 8 percentage points, an effect perceived by both WTI and Brent.

Currencies have also been involved in this change of mood: in the last two days, safe-haven currencies showed a general strengthening in terms of effective exchange rate (+1.2% for the dollar, +0.6% for the Swiss franc and the Japanese yen); opposite trend for EM or risk-sensitive currencies.

“We’re not even thinking about raising rates”

According to most analysts, the words of the FED have only represented a catalyst for this change of mood on financial markets, as the tones adopted were cautious and no particularly strong or unexpected announcements were made. Indeed, Chairman J. Powell announced that the FED will continue with an expansionary monetary policy until the end of 2022 ("We're not even thinking about raising rates," he said). While this is reassuring for the markets, at the same time no new massive liquidity-providing measures were announced, measures that had strongly supported the rebound of optimism in recent months. Forecasts for US economic growth in 2020 have also been revised downwards to -6.5%. Powell also said that the economic recovery could be longer and harder than expected, dampening markets' hopes for a potentially quick and painless rebound; the chairman finally warned of the recovery's strong dependence on the success in containing the virus.

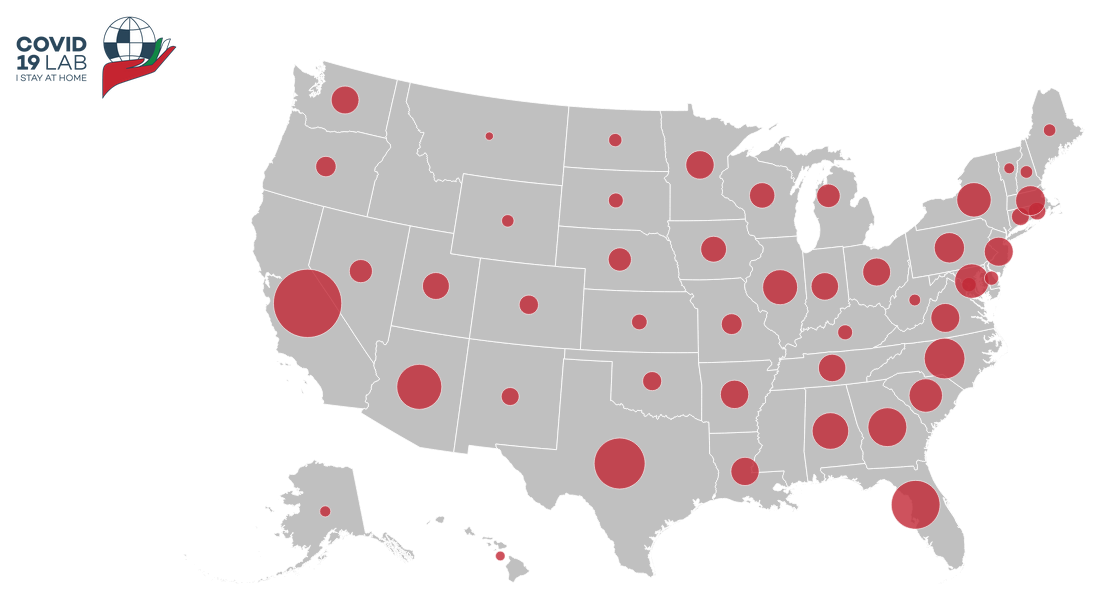

Just between June 10 and 11, the danger of a second wave has actually materialized in the United States as tangible fear for the markets, with increases in contagions in several US states, in particular Florida, Texas and California.

USA: Daily confirmed Covid-19 cases, June 11 2020

Source: Covid19Lab.

The cautious stance of the central bank, the fear of a second wave of contagion, combined with the lack of a sound economic foundation to sustain investors’ optimism, has therefore led to a change in market sentiment. While, since April, accommodative monetary and fiscal policies and an improving epidemiological framework had sustained the stock market recovery, in the last few days the precariousness of this rally emerged, in a context still marked by deep uncertainty: uncertainty about the evolution of the virus, but also about US-China relations, US presidential elections and the negotiations in Europe for the approval of the Next Generation EU. All these factors will inevitably continue to influence markets’ dynamics in the months to come.