Italian footwear in the cyclone

April 2020, Italian exports: -76%. The factors behind the collapse.

Published by Luigi Bidoia. .

Covid-19 Fashion Made in Italy Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

Uncertain direction for world trade changes

Among economic analysts and the business world there is a growing consensus that the current health and economic crisis will bring a big change in the functioning and characteristics of the world economy.

If the probability that "nothing will be the same as before" is high, the more uncertain is the direction of the change. How will consumer preferences in the various markets of the world evolve? How will the competitive positioning of different countries change? How will the rules of world trade change?

These are some of the many questions that analysts and entrepreneurs are asking themselves. Unfortunately, no previous historical experience can be of much help in predicting the direction and intensity of the change. A possible source of information is the economic analysis of foreign trade flows, trying to infer from their dynamics the trends that will characterize the markets in the near future.

The ExportPlanning Information System was recently updated to April 2020. The month of April is particularly important because it is the month in which social and productive restrictions have affected the largest number of countries in the world and therefore allows a first measure of the depth of the crisis.

Recently, some articles have been published about the intensity of the world trade collapse at an aggregate level [1] and its high dispersion in results by sector/product [2]. This article explores the situation for the Footwear sector, one of the most representative of "made in Italy".

Dramatic collapse in world Footwear demand

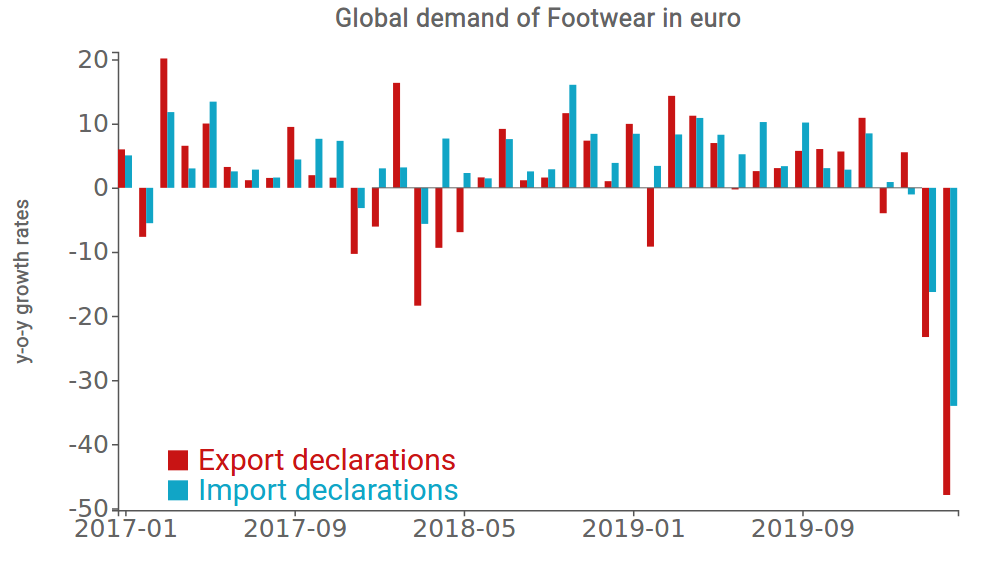

The graph below shows the y-o-y changes of import and export declarations made by a sample of more than 60 countries. With a wider sample, considering every world country, the total value of imports and exports declarations would coincide, since for each export flow declared by a specific country, you can find a mirror (import) declaration made by its partner country.

The sample of countries considered is very effective in approximating the value of total world trade, accounting for more than three-quarters of total world trade in 2019. This significant representativeness and the substantial alignment between the dynamics of import and export declarations allows us to consider the data as a measure of the real figures that occurred in world trade in footwear.

The analysis of the graph highlights two aspects:

- in the first months of 2020, the health crisis in Asia interrupted the growth of world trade in Footwear;

- the collapse of world trade in Footwear is particularly dramatic in April 2020, around 40% in euros, depending on whether you consider export or import declarations.

The intensity of this collapse places Footwear among the sectors most affected by this crisis, confirming the strong vulnerability of the fashion system.

The analysis of the export declarations of several partner countries makes it possible to have a precise assessment of the situation on the import side in the different world markets [3]. Given the strong link between import and demand dynamics, these data can be considered as an indirect measure of the evolution of domestic demand in the various countries.

Main importers countries of Footwear

Source: ExportPlanning - Quarterly International Trade Database

Against a high dispersion of the rates of change in imports in Q1-2020 (ranging from a 25% drop for Dutch imports to a 25% increase for Poland [4], among European markets), in April two clusters of countries can be clearly identified: on the one hand, almost all countries in the world with dramatic drops in euro imports (and probably in demand), ranging between -40% and -60%; on the other hand, three Asian countries (Japan, Korea and Vietnam) with positive rates of change compared to April 2019 [5].

In order to understand whether this high drop reflects a similar reduction in terms of production, logistics and distribution difficulties of Footwear that characterized most of the world's countries in April, and not also a change in consumer preferences, we should wait for the figures of the second quarter of the year [6].

The lockdown has frozen the Italian exports of Footwear

As regards the changes in terms of competitive positioning of the different countries, April data alone must be read with caution.

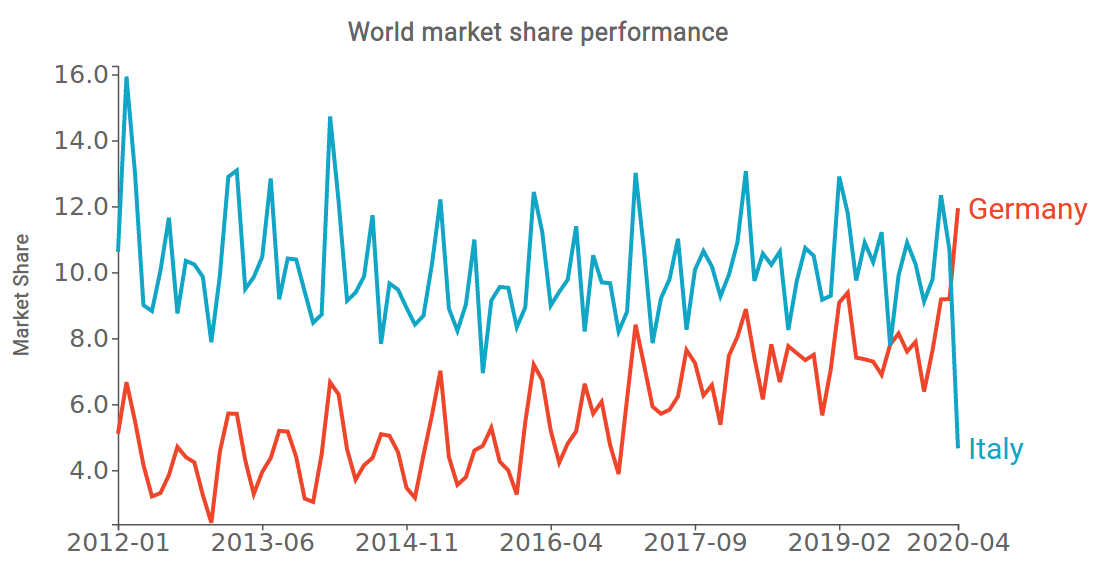

However, the intensity of the change reported in the graph below deserves to be examined: the graph compares the monthly world market share of footwear held by Italian and German exporters.

For many years, the share of trade accounted for by Italian footwear exporters was significantly higher compared to German exporters. Over the last few years this distance has been progressively reduced, until the upheaval of April 2020, when the German market share was twice as high (12%) as that of Italy (5%).

This change in quotas is certainly not structural and reflects the more intense lockdown that has characterised manufacturing activities in Italy. Sales lost in the last months are likely to be recovered in the coming months, returning to a competitive position closer to the pre-Covid19 situation. However, it bears witness to what may be the changes in competitive relations between countries that are forced to introduce different levels of restrictions.

[1] See the article Monthly International Trade Statistics: April 2020

[2] See the article High differences in foreign trade sectoral collapses

[3] When a large sample of exporting countries is available, it is more useful to calculate a country's imports as the sum of partner countries' export declarations than as the importing country's declarations. There are two reasons for this: (1) the use of partner countries' export declarations makes it possible to calculate imports from all countries in the world and not just those in the sample of countries in question; (2) all other things being equal, the possible statistical errors are more limited if an average of declarations from several countries is taken into account rather than a single country's declaration

[4] In order to make the graphic representation more effective, some countries with extreme values are positioned in the edges of the graph without precisely respecting the coordinates derived from their values. However, it is possible to know the actual values through the table that the system presents by positioning the mouse over the circle associated with the country of interest

[5] The factors that have supported this positive dynamic are different among the three countries: for Japan it is a technical rebound compared to the difficulty of the first part of 2019; for Korea and Vietnam it is the continuation of a trend of opening up to footwear imports, which the health crisis does not seem to have interrupted.

[6] By the end of July, the publication on www.exportplanning.com of the early second quarter of 2020 of world trade flows, is expected.