The Preference for Variety in World Trade of Fashion Goods

An analysis of the global demand for differentiated goods with a focus on the fashion industry. Significant growth of the cluster in the period after the Great Recession.

Published by Gloria Zambelli. .

Fashion Great Recession Asia Great Lockdown Conjuncture Export Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

In a previous article we have analyzed the global demand for three kinds of products, namely differentiated products, raw materials and global value chains. That was meant to provide insight into the pre-pandemic economic conjuncture and possible future developments. In particular, we have observed the strong dynamism of demand for differentiated goods in the period following the Great Recession.

Differently from other kinds of goods, differentiated products share individual peculiarities due to which, although they have similar characteristics to other goods, they are not considered perfect substitutes by consumers. A classic example are clothing or automobiles.

Formally, there are two approaches to explaining consumer demand for differentiated products.

- Love of variety

- Ideal variety

Love for variety

According to this approach,each consumer tends to prefer a market which offered more variety of the same type of good. If all consumers share the same love of variety, then the aggregate market will boost demand for many varieties of goods at once.

Ideal Variety

The assumption behind this approach is that each product has a different set of characteristics. For example, each clothing has a different cut, material, color. Since individuals have different preferences, they will choose the good which best suits its ideal variety and the market will support more firms selling similar products.

In order to observe the relevance of differentiated goods in international trade, it may be useful to focus our analysis on a particularly representative sector of the aggregate: the fashion system.

The Differentiated Goods in Fashion Industry

Using the elaboration carried out in the previous article 1, the graph below shows the evolution of world demand for differentiated goods belonging to the fashion industry (E2), taking the value of exports in 2010 back to 100.

Dynamics of global demand for differentiated products in Fashion Industry

Index = 2010, (1995-2020)

We can see that throughout the phase before the great recession, the relative performance of differentiated products was quite similar to that of the total sector; recording a remarkable leap forward in conjunction with China's entry into international trade. However, in the aftermath of the 2008 crisis, global demand for differentiated products has accelerated considerably in relative terms, significantly outperforming the overall industry.

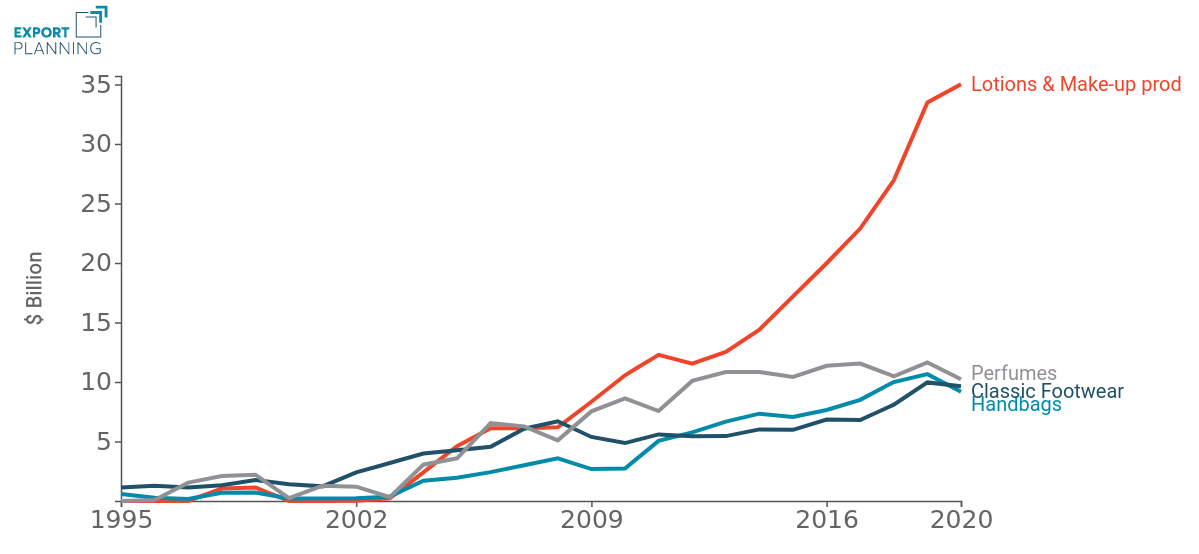

The graph below shows the trend of some particularly representative differentiated products, whose growth has been a driving force for the demand of differentiated goods of the fashion industry. Among the products that have driven the world trade of differentiated products in the fashion industry we certainly find Creams and beauty products, whose trade has grown exponentially since the 2000s, reaching in 2019 more than $30 billion.

More restrained, but still remarkable, was the performance of other differentiated products such as Perfumes, Handbags and Classic Footwear, whose estimated average annual growth rate (CAGR) is between 11% and 23%.

Dynamics of the global demand for the representative differentiated goods of the Fashion Industry

(1995-2020)

Main importing countries

The following chart illustrates the main destination markets for differentiated products of the fashion system in 2019, thus recording the presence of consumers who are particularly sensitive to the issue of variety availability. The picture of the main importing countries turns out to be spread both in countries belonging to the Western bloc (Switzerland, Germany, the United States, Italy, France and the United Kingdom) and in East Asian countries (China, Hong Kong, Japan and Singapore). This can certainly be a sign of the relevance that product variety has taken globally, extending even to typically low labor cost countries like China, as the middle class gains relevance.

Main importing countries

Year 2019

Conclusions

Although the fashion industry was significantly affected by the outbreak of the global health crisis and the necessary containment measures, it is undeniable that in the pre-pandemic period, differentiated goods played a key role in the industry's global trade. The coming months will be crucial to assess whether the diversification trend that has emerged over the past decade will be the driving force behind the industry's post-pandemic recovery.

1. For the elaboration of the cluster formed by the differentiated goods, final quality goods of high or medium-high price range sold by high labor cost countries were selected.