Post-pandemic economic conjuncture: outlook for international trade

The sanitary crisis could accelerate or scale down processes already underway, painting new scenarios. The case of differentiated goods

Published by Gloria Zambelli. .

Macroeconomic analysis Uncertainty Forecast Global demand Total goods Global economic trendsThe Covid-19 pandemic and the ensuing measures to contain the virus have left deep scars on international trade, highlighting the vulnerability of the current model of globalization. Even before the pandemic, world trade was experiencing a period of serious uncertainty due both to the crisis of multilateralism in economic relations and the protectionist wave, thus bringing the economic debate to the issue. The spread of vaccines allow us to reflect on the possible scenarios of post-pandemic recovery and the prospects of international trade in the next few years. However, before focusing on the debate, it is essential to discuss the three models that constitute the core of foreign trade theories, with the aim of explaining why countries do benefit from the international exchange of goods and services.

Ricardo's model of comparative costs

According to classical economists, exchange is convenient between those countries that have different technological capabilities, leading to differences in the relative productivity of labor. Therefore, gains from international trade mainly stems from the possibility, for each country, to specialize in the production of those goods that exploit the available resources in the most efficient way.

The Heckscher-Ohlin factor proportion model

The Heckscher-Ohlin theory has the merit of going beyond the classical theory, identifying the determinants at the origin of differences in relative labor productivity between countries. It does so thanks to the introduction of the concept of different resource endowments of countries. Each country will have an interest in specializing in the production of goods that require a relatively greater use of the productive factor which the country has an excess of. FOr this reason, richer countries, where the capital factor is relatively more abundant than the labor factor, will specialize in the production of goods that require a more intensive use of the capital factor, while developing countries will specialize in the production of goods that require an intensive use of the labor factor.

These first two models are particularly well suited to explaining the benefits of international trade in terms of resource optimization. Moreover, international trade dynamics have empirically validated them. However, they do not consider an additional reason according to which the exchange of goods between countries may be convenient: the possibility for consumers to choose from a greater variety of products.

Krugman's differentiation model

Among the three theories mentioned, it is the most recent and is able to explain why countries with no technological differences and the same endowments of productive factors can benefit from opening up to foreign trade. In this context, Krugman does not disagree with the previous theories: on the contrary, it complements them. As a matter of fact, it aims to explain why countries almost identical in terms of production factors and resources, such as, for example, the United States and Germany, find it nonetheless convenient to exchange goods and services.

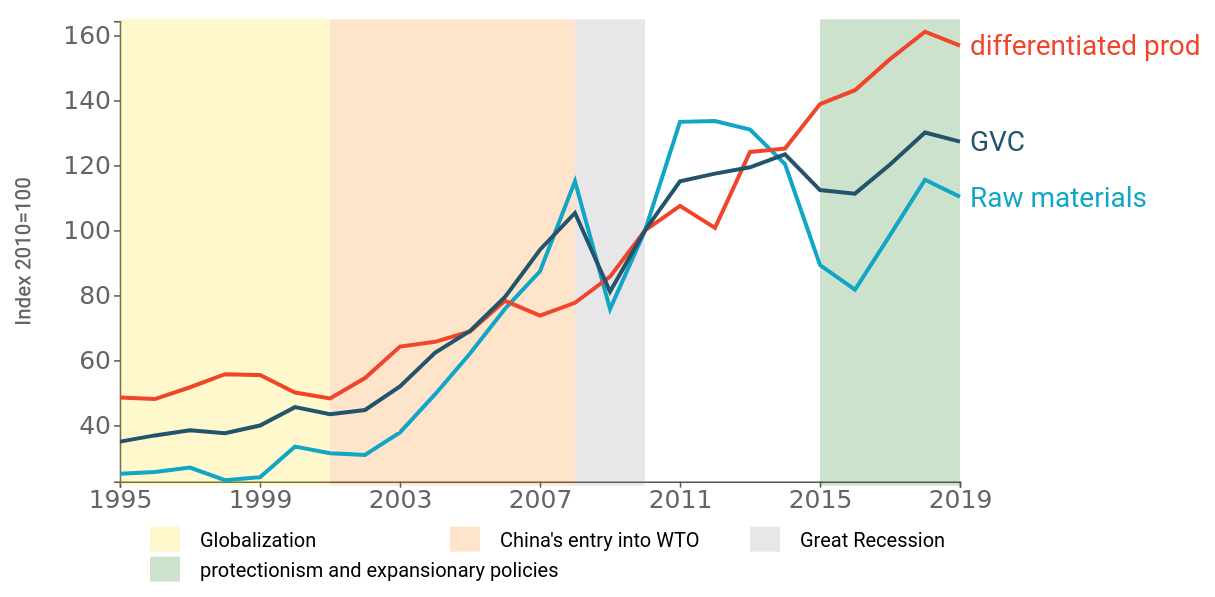

In light of the models that have guided economic theory on the subject, it is useful to look at the dynamics of world demand for three types of aggregates - raw materials, global value chains (or GVCs) composed mainly of intermediate goods, and differentiated products. This is crucial to analyze which types of products have boosted international trade in the last quarter century. According to the OECD , 70% of global demand is represented by supply chains and CGV, while the remaining 30% is represented by final products.

Thanks to the data on foreign trade of ExportPlanning information system, it was possible to construct the aggregates of interest using 6-digit codes. In particular, the cluster formed by differentiated products was elaborated by selecting the "quality" final goods sold by countries with high labor costs. In order to have a comprehensive economic picture of the dynamics of international trade over the last quarter of a century, it is useful to analyze the trend in world demand, assuming the value of exports in 2010 to be equal to 100.

Dynamics of global demand for differentiated products, raw materials and global value chains

Index= 2010, (1995-2019)

Raw materials and global value chains

In terms of relative performance, China's accession to the World Trade Organization has led to the exponential growth in global demand for supply chains and CGV, which was interrupted by the economic recession of 2008. Following this collapse, there has been a gradual recovery of trade in these products. However, that has been characterized by a growth dynamic more limited than the pre-crisis expansion and subject to several ups and downs. Empirical evidence shows, in fact, that the increase in uncertainty on the international stage has had a strong impact on aggregates, leading to a normalization of their demand.

Differentiated goods

In contrast, this downsizing phenomenon does not seem to have involved differentiated goods, which showed greater resilience during the 2008 recession, maintaining a continuous relative growth trend through 2019. Although the aggregate estimate shows that differentiated goods correspond to only 10% of world demand, their trend is particularly interesting as it gives the impression that their weight in international trade will become increasingly relevant.

Conclusions

It is clear from the analysis conducted that changes in the dynamics of international trade were already underway before the outbreak of the pandemic, assisted by an overall climate of uncertainty in international relations. In this context, the health emergency could either accelerate or curb the processes already in place, designing new scenarios in international trade.