CEE Countries in the European Single Market

“International trade theory is nothing other than a science of international location”

Published by Raffaella Intinghero. .

Europe Foreign markets Foreign market analysis

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The manufacturing industry's global landscape, despite variations among countries and sectors, reveals common trends in business practices resulting from the increasing participation in global value chains and the fragmentation of production processes.

In recent years, companies' strategic decisions have been influenced by the 'second unbundling' effect of globalization. This phenomenon began in the late 1980s and is characterized by the involvement of multiple countries in the production of goods and the adoption of offshoring and outsourcing practices by companies.

Member States of the European Union have not been exempt from this trend, especially after the fifth enlargement in 2004, which marked the beginning of a new phase for the EU, not only because of the large number of acceding countries, but also because of the challenge presented by their high degree of heterogeneity with respect to the EU-15. The complexity of integrating Central and Eastern European countries (CEECs) into the single market became evident after the fall of the Berlin Wall in 1989 and the termination of the Council for Mutual Economic Assistance (CMEA). This process required transitioning from a centralized and planned industrial policy to a market-based one, which brought the CEECs closer to meeting the necessary criteria for entry into the single market.

The phase of industrial restructuring in the accession countries has involved European institutions extensively. These institutions have implemented various initiatives to promote investment in these areas (such as the PHARE programme), as well as to establish industrial cooperation between Western and Eastern Europe in order to build a structured dialogue for European industrial policy.

At the same time, there had been a wide-ranging debate in the EU context about the effects that CEEC entry would have on the economies of the EU-15 countries.

The main concern is related to the competitive pressures that may arise in the single European market, particularly with regard to wage differentials between East and West. This could lead to de-industrialization and job losses resulting from manufacturing relocations to CEE countries.

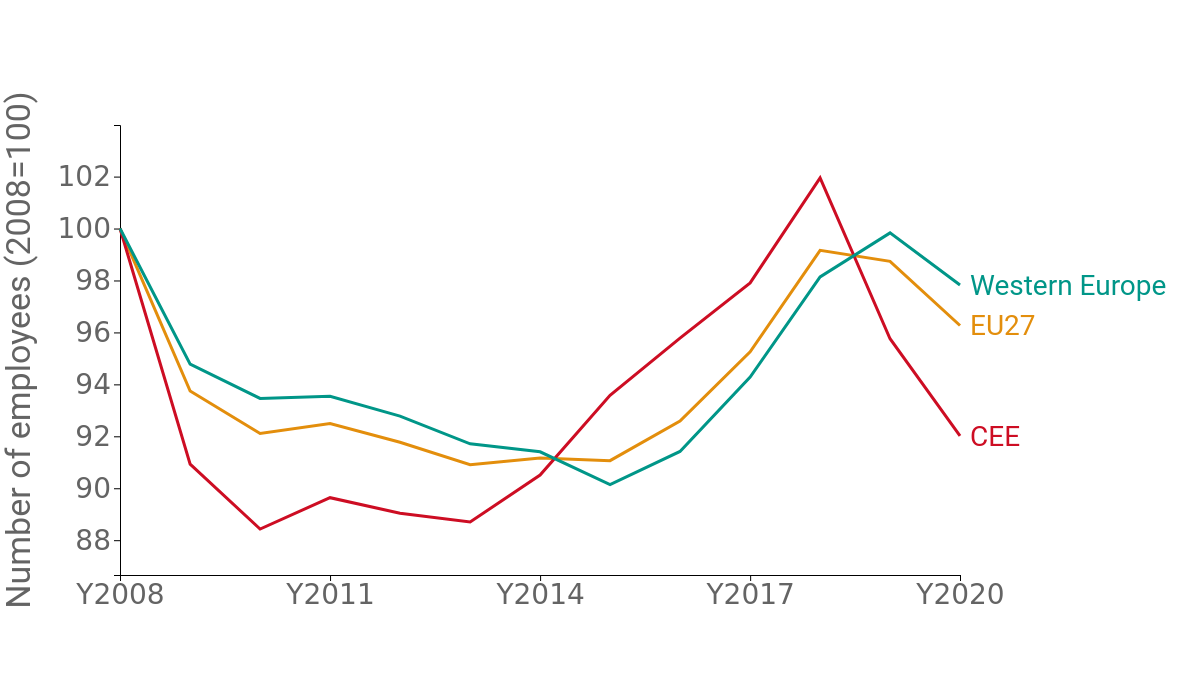

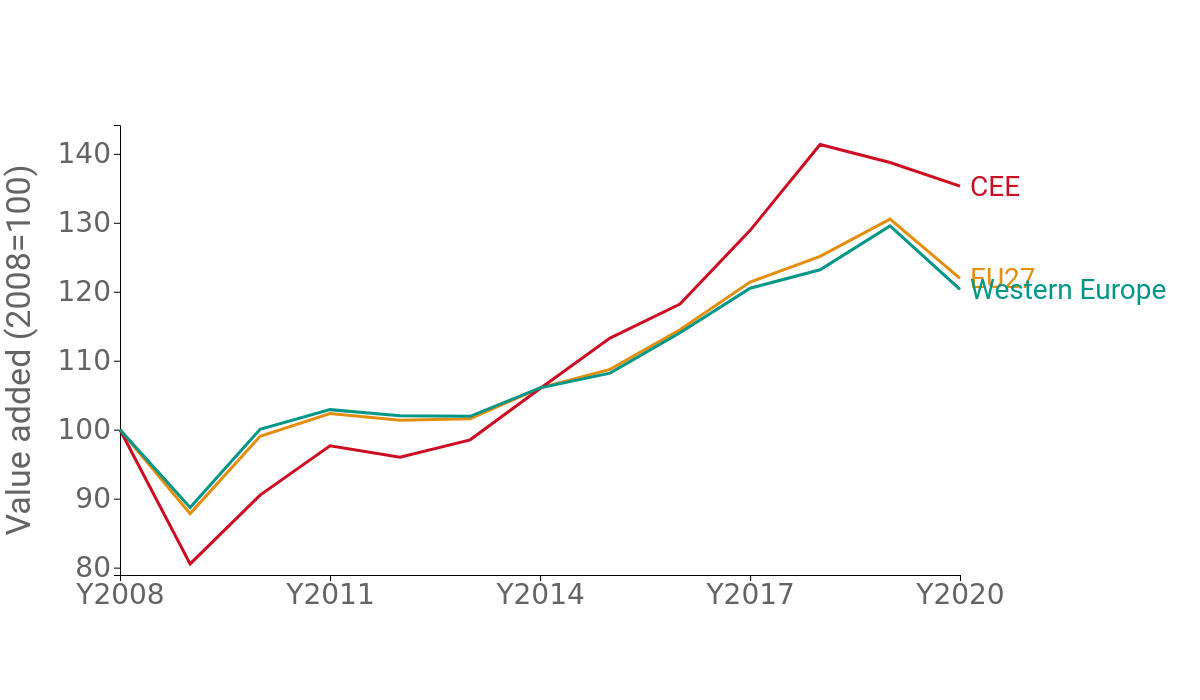

According to data from Eurostat's Structural Business Statistics, the number of employees dynamics in the Western manufacturing industry did not significantly differ from that of Eastern Europe between 2008 and 2020.

Similar results were also found in terms of value added. However, there was a greater increase for Eastern European countries between 2008 and 2020, with a percentage change of 38.7 % (about ten percentage points higher than that recorded for Western Europe).

In absolute terms, however, there is no reduction in value added differentials between the two areas under consideration.

Figure 1: CEE: number of employees and value added dynamics

(annual data, 2008=100)

Source: ExportPlanning

Empirical evidence suggests that the entry of CEE countries into the single market has resulted in a relocation of production processes and task allocation among member states, rather than deindustrialization in the more advanced countries. A more detailed analysis, carried out by analysing the NACE Rev. 2 (2-digit) manufacturing sectors, makes it easier to interpret these results.

Excluding the manufacture of petroleum products (where the country's availability of raw materials is the most significant factor), the map below shows how CEE countries have gained shares in terms of the number of employees in sectors such as the manufacture of rubber and plastic articles (22) - for which the East's share accounts for 33.5 % in 2019 -, the manufacture of electrical appliances (27) - in which the East's share accounts for 30.4% in 2019 (and 26% in 2008) - and the manufacture of paper and paper products (17) - for which the East's share increased by about six percentage points between 2008 and 2019, from 18.5% to 24.9%.

Figure 2: Share of employees: map of changes for CEE countries

Source: ExportPlanning.

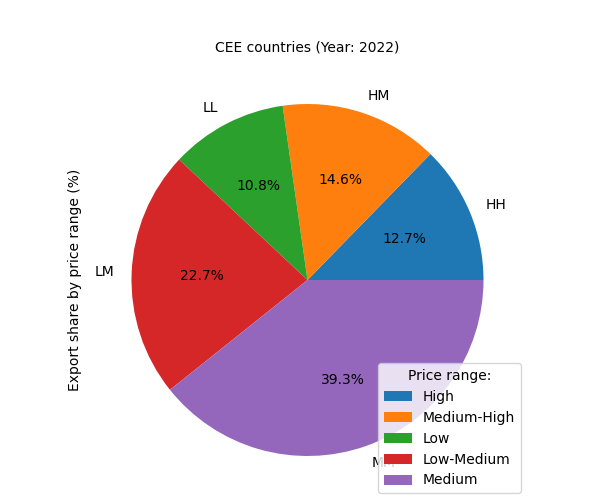

However, despite the gradual and overall increase in the role of the PECO economies on the European scene, the different availability of capital and labor compared to the economies of Western Europe has led to a specialization in more labor-intensive segments.

The integration of information obtained by international trade data is a further confirmation of this finding.

Figure 3 shows how an increasing share of exports from CEE countries is oriented towards intermediate goods trade, indicating a growing participation of these countries in production chains and, more specifically, in upstream stages of the value chain. The descreasing tren of this share for Western Europ reflects a specialization of the two areas in very different positions of the production process.

Figure 3: Share of intermediate goods in total exports

Source: ExportPlanning.

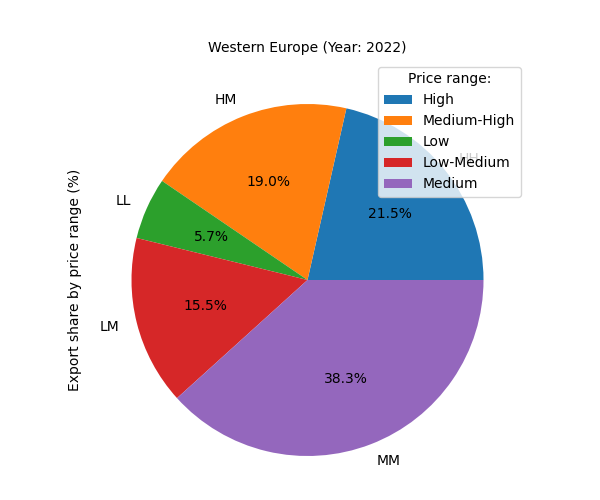

Price range analysis also documents that Western export flows are mostly concentrated in high- and medium-quality goods, suggesting that increasing competitive pressures have led countries in this region to adopt a non-price competitive strategy. In contrast, there is less strong evidence for CEE countries, where more than 65% of exports are concentrated in the lower price ranges.

Figure 4: Export distribution by price range

Source: ExportPlanning

To sum up, the European integration of the CEECs marked the beginning of a process of significant structural changes for European manufacturing that, without negatively affecting aggregate production in Western Europe, led to a reshaping of the strategic choices for participating in an increasingly integrated and cooperative European market. In particular, there have been changes in the relative specialization between more capital-intensive and more labor-intensive stages of the production process, with a shift in the location of the various stages of the production process and a change in the distribution of tasks among the member states.