Israel and the Shekel: an update

Published by Alba Di Rosa. .

Exchange rate Forecast Exchange rate risk IMF Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

One of the hot topics in recent weeks has been Israeli parliamentary elections, which were held on April 9. The vote counting completed yesterday confirmed Likud as the first party, led by current Prime Minister Netanyahu. The next step will be the formation of a governing coalition. Netanyahu’s chances of obtaining a fifth mandate are high.

We therefore take the opportunity to provide an update about the country's economic and currency situation.

Electoral uncertainty doesn’t weigh on the Shekel

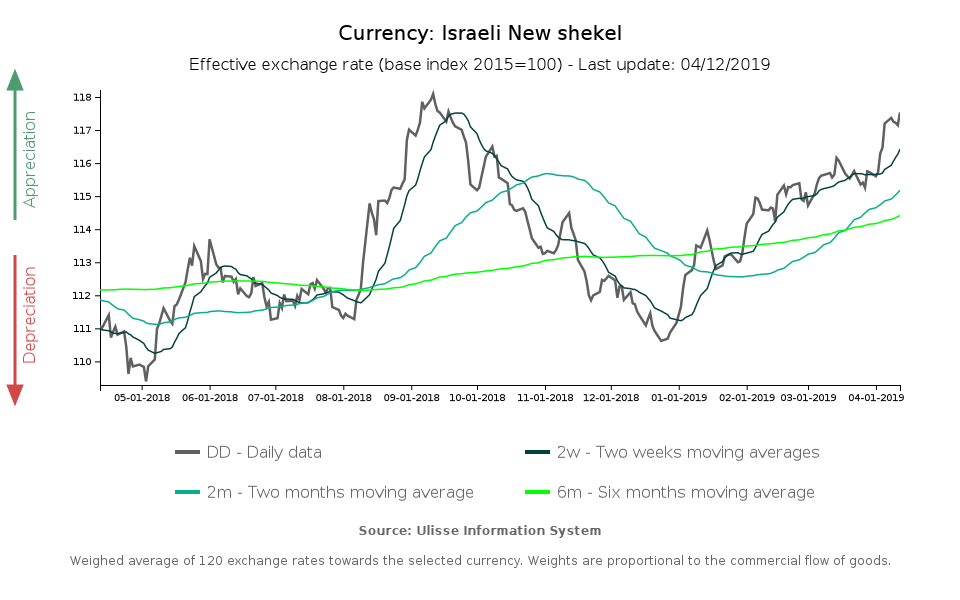

Israeli currency, the Shekel, has not been negatively affected by pre-election uncertainty; on the contrary, from the end of December it has been experiencing a continuous appreciation, in line with the underlying trend of the currency. Overall, the Shekel has appreciated by almost 5% in terms of effective exchange rate from the beginning of 2019 to date, ranking as one of the best-performing currencies among the 120 monitored in our tool.

As you can see from the graph shown above, the recent appreciation of the Shekel may actually be better qualified as a recovery, given the weakening phase that occurred between mid-September and the end of December 2018. At the moment, the Shekel is back to the record highs recorded in September 2018.

Bank of Israel: monetary policy choices

On the eve of the elections, the Bank of Israel (BOI) held its monetary policy meeting. The decision was to keep rates unchanged at 0.25%,

after the first rate hike since 2011

carried out last November.

This choice is part of a slowdown in the process of monetary policy normalization by major central banks (ECB and FED): as a matter of fact, the BOI closely

monitors their behaviour in order to avoid an excessive interest rate gap. As regards BOI’s specific approach, it aims at gradually and cautiously raising rates,

in a manner that supports the stabilization of inflation in the 1-3 target %, as well as economic activity.

Economic outlook: Israel keeps growing

In spite of Israel’s delicate political situation, its overall economic outlook is solid: the economy is growing around its potential, while the slowdown observed during 2018 seems to have been corrected. In particular, the latest data released by the BOI show a recovery in private consumption, indicating the presence of a strong demand.

According to IMF forecasts (World Economic Outlook, April 2019), Israeli economy should keep on growing at a high rate in 2019, above 3%. Similar growth rates far outweigh those of other developed economies (2.33% for the US, 0.98% for Japan, 0.75% for Germany).

A risk factor for the economy, and which the new government will have to face, is the growing budget deficit, which breached the 2.9% threshold in January-February 2019. A high deficit would give the government little room for manoeuvre if stimuli were needed to help a slowing economy.

In addition, the economy faces long-term challenges, as well: the appreciation of the Shekel, which must be contained in order not to penalize national exporters, streamlining bureaucracy, improving infrastructure and the education system.