Covid-19 times: when the emergency is the new normal

Currency markets confirm consolidated dynamics, while closely monitoring policy-makers’ moves.

Published by Alba Di Rosa. .

Exchange rate Dollar Euro Uncertainty Exchange rate risk Oil Central banks Eurozone Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The past week has been characterized by relative stability on financial markets, which are settling into the new normal of the state of emergency. In terms of exchange rates, most currencies did not show dramatic fluctuations, both in terms of appreciation (see the case of the dollar) and depreciation (see the case of the currencies of emerging countries), as it happened at the beginning of the global health emergency. On the other hand, minor fluctuations have been observed, related to pandemic-related news, but not only.

Euro: uncertainty and negotiations

With regard to the euro, this week has been marked by strong uncertainty linked to the negotiations among the Eurozone finance ministers, in order to launch a joint fiscal response to the Covid-19 crisis. As a result, forex markets basically remained in wait-and-see mode, and the euro did not show significant variations.

After three days of negotiations, an agreement was reached last night for a € 540 billion plan. Its three main lines of action can be summarized as follows:

- Countries are granted access to the European Stability Mechanism credit line, without conditions, in order to face the health-related expenses linked to the Covid emergency, for a total amount of €240 billion.

- €100 billion funding is allocated for the labour market, in support of national redundancy funds, through the SURE mechanism launched by the European Commission.

- Loans to businesses - especially SMEs – are granted by the European Investment Bank, amounting to €200 billion.

Today the euro has shown a slight strengthening against the dollar, signalling a lukewarm market approval fot the agreement, after days of controversial negotiations.

Various factors weigh on the dollar

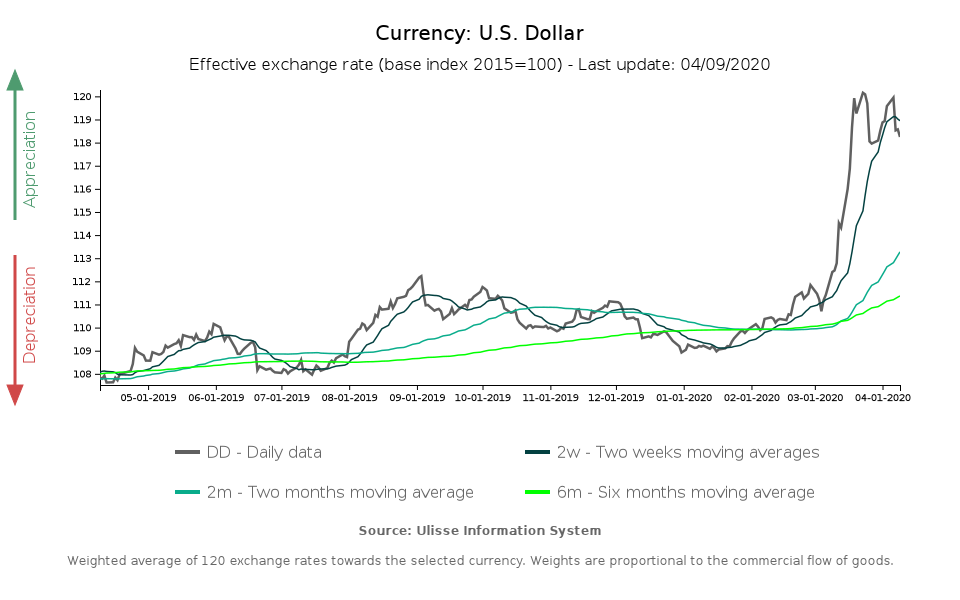

As far as the dollar is concerned, we can see that the currency is preserving its relative strength, compared to the currencies of the main trading partners of the United States1; nonetheless, some fluctuations can be noticed. While last week the dollar showed upward fluctuations, this week various factors pushed the greenback slightly lower, leading it to lose 1.4% of its value in terms of effective exchange rate.

From the standpoint of the labour market, weekly data released today by the US Department of Labour on initial jobless claims are not comforting, confirming a trend started in mid-March: last week, another 6.6 million US workers applied for unemployment benefits, slightly surpassing general expectations.

As regards capital flows, a key determinant of the dollar's dynamics, mixed effects can be observed. In fact, although the dollar is still the main safe-haven currency in this period of uncertainty, according to analysts this week the demand for dollars may have slightly decreased, in the face of growing expectations that the pandemic might be about to reach its peak in the main epicenter countries. Another element that may have reassured markets, and thus reduced the demand of dollars, is the new Federal Reserve intervention, announced on Thursday, of a new $2.3 trillion aid package to counter the effects of the pandemic on the economy.

More oil effect

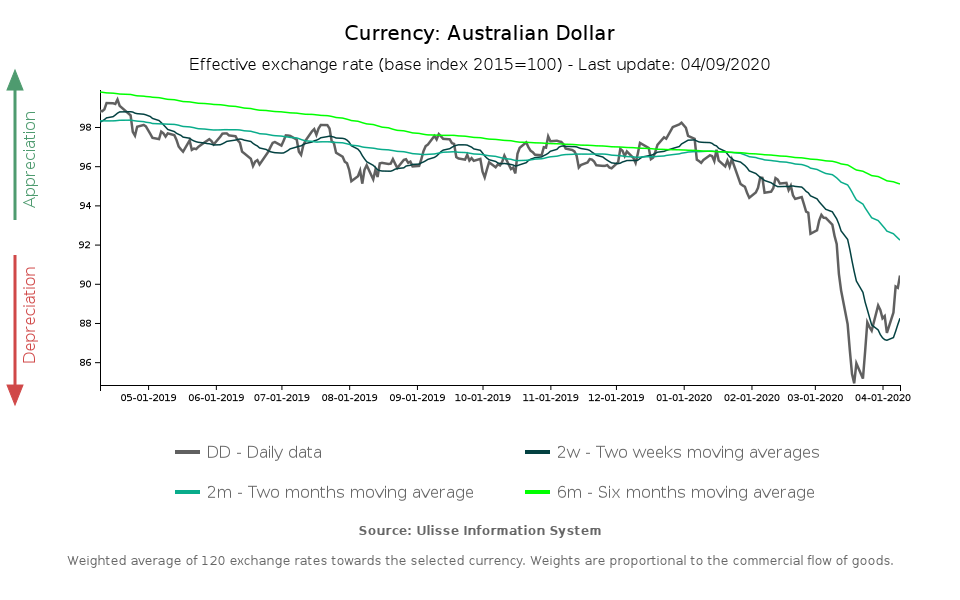

As we reported last week, tensions and uncertainties in the oil market are impacting on currencies. This week commodity currencies such as the Australian dollar, but also the Norwegian krone and Canadian dollar, kept on strengthening, supported by the oil production cuts announced this morning by Opec, but already widely expected since the end of last week.

In May and June, daily oil production will be reduced by 10 million barrels, in order to counteract the drop in prices due to lower demand in this global emergency phase.

1. ExportPlanning effective exchange rate is calculated as the weighted average of the bilateral exchange rate of the currency concerned against the currencies of its main trading partners.