Export Readiness Assessment as a pivotal step for a successful International Planning

The assessment of the Internal Factors is a key point for both Market Selection and Market Entry Strategy

Published by Marcello Antonioni. .

Planning Bestpractice Internationalisation International marketing Internationalisation tools

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The success of a company's internationalization process is significantly determined by:

- Export Readiness of the company, in terms of competitiveness and resources;

- correct evaluation of the company's Internal Factors, which is fundamental in order to be able both to identify the foreign markets in which the company is most likely to succeed and the related entry mode.

The Assessment of Internal Factors as a prerequisite

for both Market Selection and Market Entry Strategy

The assessment of company's internal factors is preparatory both to to the optimal choice of target markets (Market Selection)6 and to the definition of the Market Entry Strategy.

As indicated in "Export Checkup: preparatory activity for internationalization planning", for a comparative analysis of market potential, the factors of Opportunity, Reliability and Accessibility of the several markets should be weighted differently according to the specific characteristics of the company.

Similarly, the choice of mode of market entry tends to be conditioned, typically, by the following company's internal factors:

- existence of competitive advantages (differentiation or cost side) able to absorb or not any additional costs associated with internationalization;

- level of customization of the product, able to adapt more or less quickly to the specific characteristics of the market;

- relevance of services (pre- and/or after-sales) associated with the product, which may or may not constrain the options available in terms of how to enter the market;

- available resources: financial, technological, organizational (skills and commitment of dedicated human resources).

Export Readiness Assessment (ERA) as a pillar of the Int'l Business Plan

Not all companies are ready to start a process of development on foreign markets in the short term.

It is therefore necessary, in the first place, to make a structured evaluation on the degree of adequacy of the company to face foreign markets.

Starting from the analysis of internal company characteristics, the aim is to understand if they can allow internationalization to become an opportunity for growth and development. Should the company present significant elements of weakness, it is in fact preferable to resolve these aspects first, in order to be able to face foreign markets with the necessary determination.

The ExportPlanning ERA tools allows a company to identify these possible weaknesses through a questionnaire, composed of different sections1, to be filled in together with one or more persons belonging to the top management of the company.

Through the filling in of the questionnaire and a subsequent comparison of the results, the company can take note of its level of "readiness" to foreign markets and draw the necessary consequences.

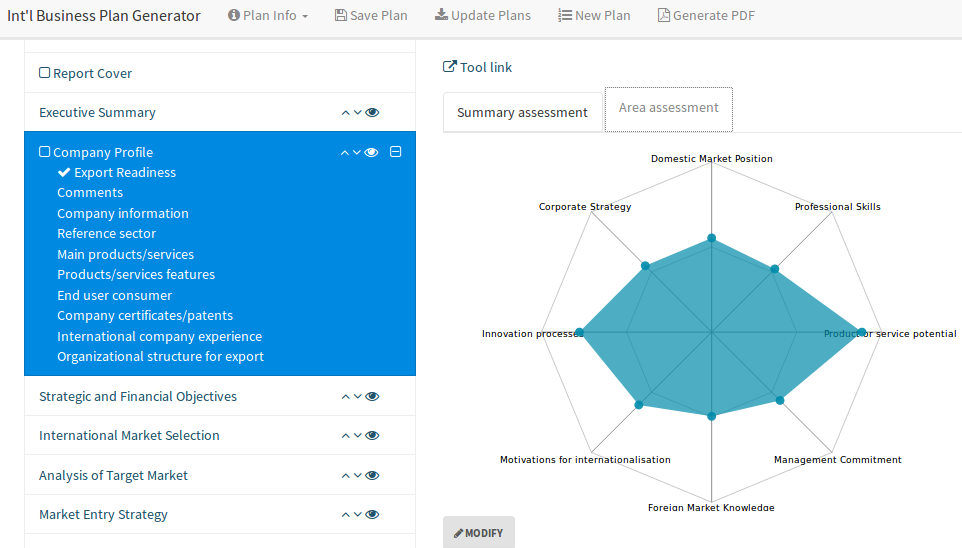

Export Readiness Assessment: areas of evaluation

Source: ExportPlanning - ERA

ExportPlanning's Int'l Business Plan Generator tool allows a user to recall a previously saved ERA session when writing an International Business Plan.

Company Evaluation Dashboard in ExportPlanning

Source: ExportPlanning - Int'l Business Plan Generator

This feature allows the following previously saved information to be loaded and displayed:

- Summary Assessment: it is a synthetic representation, consisting of a pair of scores (X,Y) associated with the dimensions Resources2 and Competitiveness3;

- Area Assessment: represented by a radar graph with a score associated with each of the following areas:

- Domestic Market Position, determining the level of company competitiveness in its domestic market as a precondition for assessing its potential in the internationalization process;

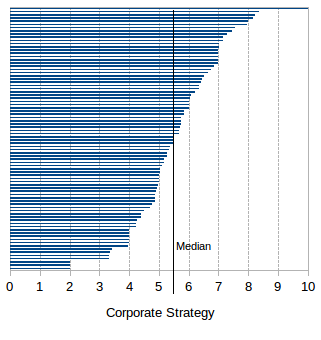

- Corporate Strategy, evaluating the viability of the medium/long-term vision;

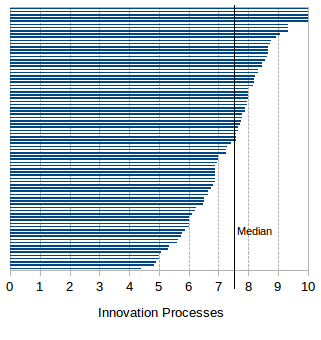

- Innovation Processes, assessing the level of innovation in place that underpins the competitive position of the company;

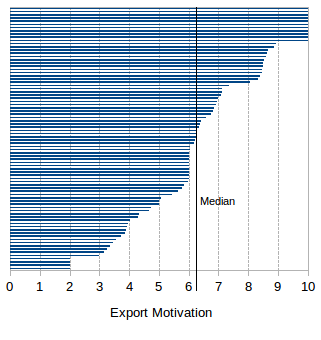

- Export Motivation, highlighting the factors behind the decision to go abroad;

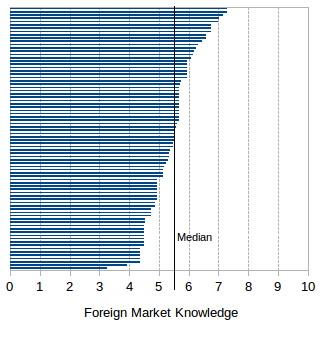

- Foreign Market Knowledge, assessing the level of company knowledge about foreign markets;

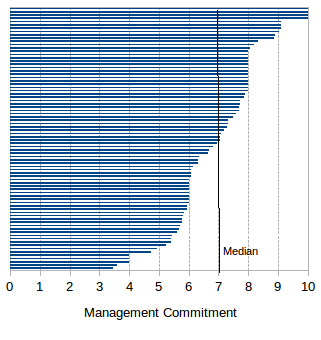

- Management Commitment, assessing the motivation level of company management for the international project;

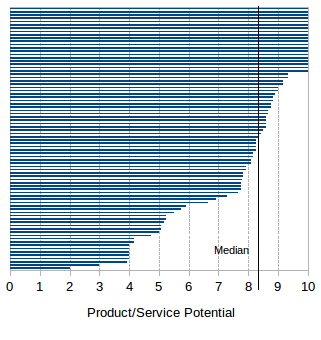

- Product/Service Potential, evaluating the potential of company products/services;

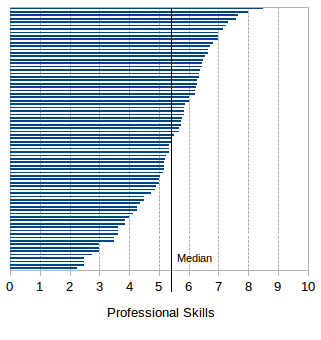

- Professional Skills, assessing the competence of human resources available to the company for the project.

Export Readiness: an overview

of ExportPlanning's assessments

Analysis of ERA-ExportPlanning respondents

EXPORT READINESS

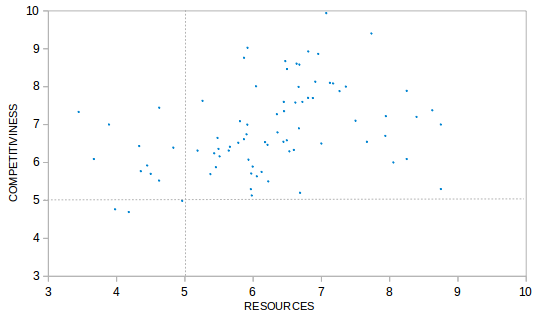

The analysis of a sample of about 100 Small-Medium Enterprises responding to the In-depth level of the ERA-ExportPlanning's questionnair shows that there is a positive correlation between the dimensions Resources and Competitiveness, but not particularly strong4.

ERA-ExportPlanning: syntetic assessments (scores, min=0/max=10)

Each respondent is represented by a pair of scores associated with Resources and Competitiveness.

Source: StudiaBo's data processing on a sample of ERA-ExportPlanning respondents

As documented in the graph above, which represents the positioning of the sample of SME respondents, there is a low presence of "excellent" enterprises in both parameters. The most recurrent case study (43%) consists of enterprises with "intermediate" Resources and Competitiveness5, followed by that (27%) with "intermediate" Resources and "high" Competitiveness.

In particular, the assessment of the Export Readiness of this sample of enterprises highlighted the following characteristic profile in terms of Competitiveness and Resources4.

COMPETITIVENESS

With regard to Competitiveness aspects, the following distinguishing features should be noted:

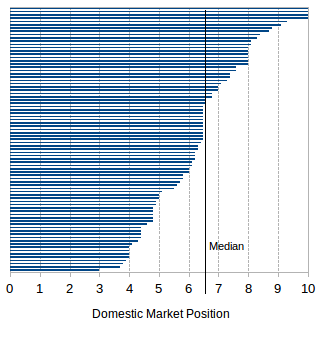

- Niche productions, typically differentiated6. Within the panel of responding companies, more than 50% define their positioning as a niche, indicating the predominance of companies that compete strongly in differentiation strategies. This characteristic is also confirmed by the significant presence of companies that consider their product/service competitive because it is specialized (28%) or competitive because it is better than its competitors (24%).

- Competence and ability to do. Approximately half of the companies evaluated by the ERA-ExportPlanning questionnaire indicate competence and ability to do as the main distinguishing factor of their value-proposition, while market knowledge7 is of secondary importance. This statistic indicates a competitive positioning (and before that a company culture) still mainly based on the product ("product-oriented") compared to a market-oriented approach.

- Product innovation8. Almost 60% of respondents indicated that high product innovation, whereas process and, above all, organisational innovations (for which an interim evaluation is predominant) are less important. This element confirms the prevailing focus on the product of the panel of companies under observation.

RESOURCES

With reference to the theme of Resources, the analysis of the responses to the ERA-ExportPlanning questionnaires highlights the following prevailing elements:

- Commitment "under scrutiny"9. It is a widespread argument, within the panel of companies under observation, to consider internationalization as a necessary process, in a situation of stagnant domestic market: such an evaluation, even if shareable, does not seem sufficient to "validate" the company's committment for a complex path such as that of international development.

Also, to the question How long is the management willing to wait before reaching the break-even point on the investment in the internationalization process? , the majority of respondent companies declares Immediate - pay as you go or Around 6 months, indicating, therefore, a very short investment horizon. - Relatively little experienced skills10. The analysis of the composition of the team for internationalization highlights:

- in more than half of the cases a limited international experience;

- less than a quarter with experience in intercultural relations and negotiations;

- only 30% of cases with work/life experience abroad.

|

|

|

|

|

|

|

|

Source: StudiaBo's data processing on a sample of ERA-ExportPlanning's respondents

(1) Each section of the ExportPlanning ERA questionnaire can be filled in progressively. Only the first question is mandatory. It is obvious that the more complete the questionnaire is, the more robust the final evaluation will be. Operationally it is possible to fill out the questionnaire quickly by answering only the first question and get a first result. This can be useful when the respondent seems not to be willing to spend a lot of time on the questionnaire. However, once you have completed the questionnaire and seen the output produced, the interlocutor becomes more available and agrees to devote the necessary time (about 45 minutes) for a In-Depth assessment. Sometimes, the company manager who has understood the potential of an in-depth check-up asks for the questionnaire to be filled in also by some of his/her collaborators in order to have an overview of the different opinions.

(2) Measures the company's evaluation with reference to the adequacy of the organization.

(3) Measures the company positioning with reference to the adequacy of the product or offer system.

(4) There is no reason why Resources and Competitiveness should present similar levels of adequacy; on the contrary, often in a Small Medium Enterprise a high adequacy on the product corresponds to a weakness in organizational terms and vice versa, precisely because the small size makes it difficult to achieve levels of excellence in both areas.

(5) In the sample of SMEs analysed, there is a median level in the Resources dimension of 6.2/10 and 6.6/10 in the Competitiveness.

dimension.

(6) Product/Service Potential is an area in which, as documented in the relative graph above, the median evaluation recorded by the SME sample analysed is particularly high (8.3/10), although there is a marked dispersion of results.

(7) Foreign Market Knowledge is one of the areas with generally less favorable evaluations within the sample of SMEs analyzed, with a median level of 5.6/10.

(8) In general, Innovation Processes tend to be another area where the evaluations within the sample of SMEs analysed appear generally high, with a median level of 7.6/10.

(9) The Motivations for internationalization and Management Commitment areas, although presenting average favourable evaluations, show a fairly high dispersion of results, confirming - therefore - these elements as potential critical factors in terms of resources available to the project.

(10) The Professional Skills area, with a median level of 5.4/10, highlights (together with that of Corporate Strategy: median level of 5.5/10) the relatively less favourable evaluations within the sample analysed.