Exchange rates in the year of Covid-19

The strength of the euro and portfolio strategies driven by uncertainty

Published by Luigi Bidoia. .

Covid-19 Exchange rate Dollar Euro Chinese yuan Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The strength of the euro

The euro is confirmed as the strongest currency in the year in which Covid-19 disrupted the global economy. The dollar/euro exchange rate ended 2020 at 1.23.

From the point of view of economic fundamentals, 2020 was undoubtedly the year of China, the only country to record a positive economic growth, with a clear acceleration in the second half of the year. However, on currency markets, the Yuan showed a slightly weaker performance, compared to the Euro. The control of capital movements and the Chinese government's objective of containing the appreciation of its currency in order to support the competitiveness of Chinese companies explain the modest appreciation in effective terms of the Yuan, but do not explain the strength of the euro in terms of effective exchange rate. Considering that 10-year interest rates on the dollar have been, on average, more than one percentage point higher than those in Europe in 2020, and that the American stock exchange has outperformed the average European stock exchange by 15%, the strength of the euro can be explained only by the high current account balance in the euro area and, probably, by financial markets' growing confidence in the important steps taken this year in terms of governance and economic integration of the EU.

A comparative analysis of major currencies

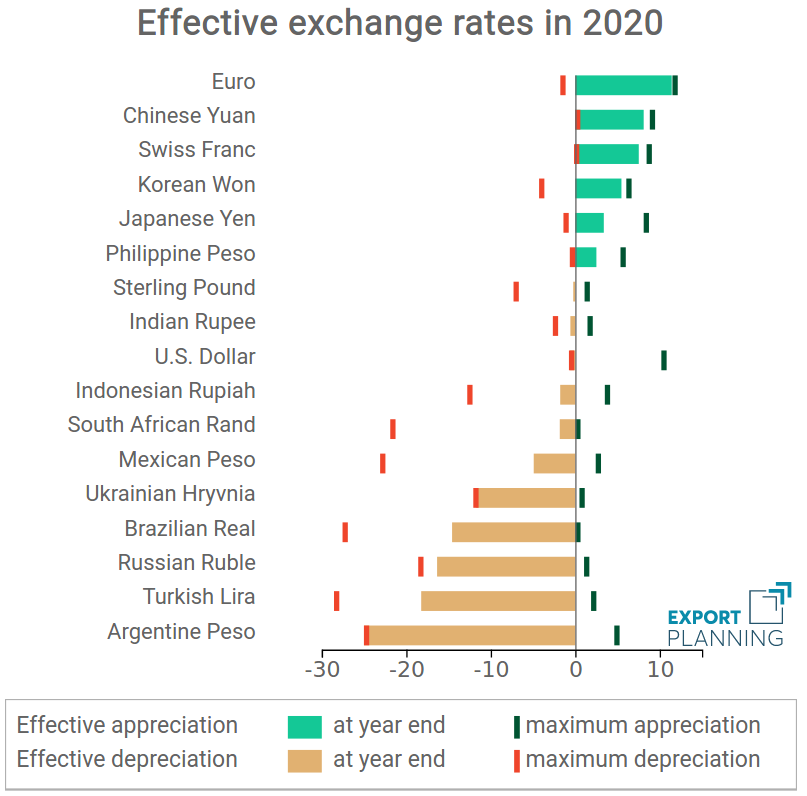

The following chart allows for a comparative analysis of the relative strength of the various currencies over the course of this year. This chart shows not only the accumulated appreciation/depreciation at the end of the year, but also the maximum appreciation/depreciation points recorded. They therefore allow to distinguish between currencies that have followed a constant direction during the year and currencies that, on the contrary, have been characterized by significant trend reversals.

At the top of the chart we can find the currencies that have appreciated the most on a relatively steady trend. In addition to the euro and the Yuan, this group includes the traditional safe-haven currencies, i.e. the Swiss Franc and the Japanese Yen. At the bottom of the chart we can find the currencies that have followed a steady trend of depreciation, such as the Argentine Peso, the Russian Ruble and the Ukrainian Hryvnia. At the bottom of the chart there are also two other emerging market currencies, the Turkish Lira and the Brazilian Real, which have overall shown a sharp depreciated but, for a relevant period of the year, managed to reverse their direction.

In the central part of the chart are positioned those currencies that close the year substantially in line with the values of early 2020, but running in opposite directions in different periods. Among these are:

- the dollar, that after an initial phase of strong appreciation has recorded a long period of depreciation;

- the currencies of emerging countries that went in the opposite direction: after a phase of strong depreciation, they gradually returned to the values of the beginning of the year. Three of them, in particular, are characterized by this path: the Indonesian Rupee, the South African Rand and the Mexican Peso.

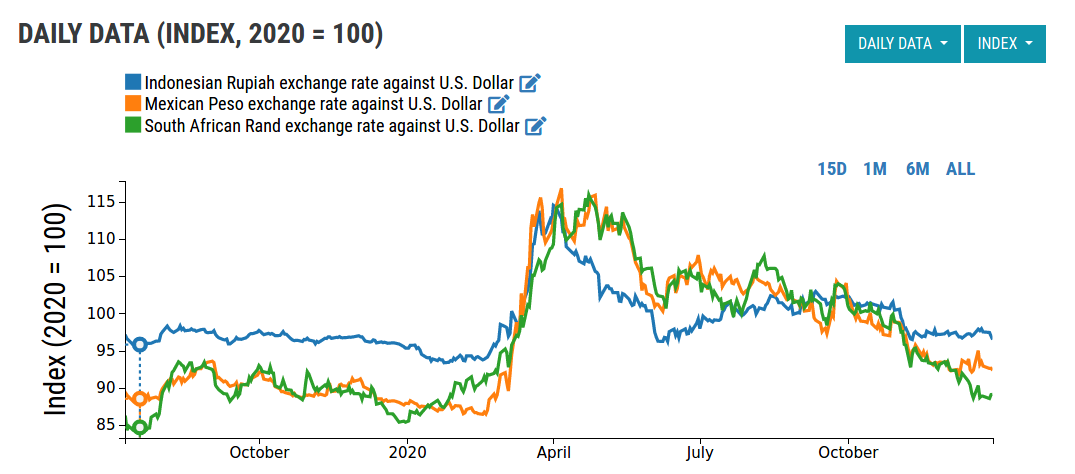

The opposite path followed by these three currencies with respect to the dollar is particularly evident if we analyze the dynamics of their exchange rate against the dollar, shown in the following graph.

Uncertainty-driven portfolio strategies

The strong alignment of the exchange rate dynamics against the dollar of these currencies (for the Rand and the Peso, the alignment is almost perfect) suggests the existence of some cross-currency factor. This factor does not seem to be found in the economic characteristics of the three countries, which are very different from each other, as much as in the different portfolio strategies implemented by financial operators during the year. In response to the strong uncertainty generated by the outbreak of the pandemic between mid-February and mid-March, financial operators took massive refuge in the dollar, leading to its effective appreciation of 10% in less than a month.

Subsequently, the effectiveness of the lockdown actions and the formidable worldwide response in terms of investment for the research of a vaccine, have progressively brought the uncertainty on the markets back to more "normal" values. At the same time, an new process, opposite to the one which had characterized the first months of the year, began on currency markets, leading to a progressive appreciation of those EM currencies that had been particularly penalized in the first phase.