Europe’s two-speed Export Recovery

Central and Eastern European Member States were characterised by greater resilience and a faster recovery

Published by Marzia Moccia. .

Covid-19 Food&Beverage Europe Intermediate goods Great Lockdown Conjuncture Automotive Made in Italy Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

One of the most significant inheritances of the current economic crisis caused by the Covid-19 pandemic on the recovery of international trade is perhaps the strong heterogeneity that is currently characterising the recovery framework of different industries and geographical areas.

The article EU foreign trade: the final figures for 2020 documented how the different speed of demand recovery in the EU's main trading partners has led to a rather heterogeneous performance in the different target areas.

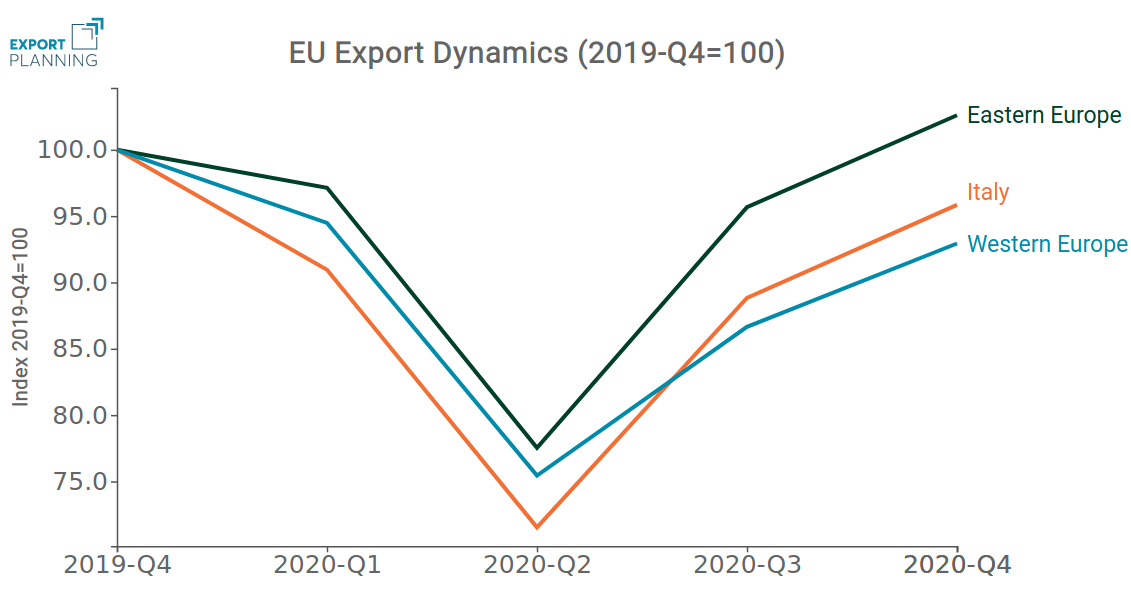

Still on the EU export front, the most recent data, available in the EU International Trade section, also show some differentiation in the export performance of the different Member States. The graph below compares the export performance of Central and Eastern Europe and Western Europe for all quarters of 2020, setting the value of exports in Q4 2019, the last quarter before the pandemic, equal to 100. The performance of Italy is highlighted in orange.

Source: ExportPlanning

We can see that in all quarters of 2020 the export performance of Central and Eastern Europe remained above that of Western Europe. In particular, the export performance of the Central and Eastern Member States was characterised by a greater resilience in the most acute phase of the health emergency (2020-Q2) and distinguished by a faster recovery in the second half of the year. The V-shaped recovery was so pronounced that the area's exports managed to recover in 2020-Q4 the export value of Q4-2019, recording a YoY growth of 2.6%.

Overall, while Western European exports contracted by 10.9% in 2020, Central and Eastern European exports contained their losses and fell by 5.2% compared to the previous year.

Against this backdrop, it is particularly interesting to note that Italy's export performance is roughly in the middle between the two areas under scrutiny. Italy's export recovery is in fact more marked than that of its region and highlights the good responsiveness that characterised Italian exporting companies during the recovery phase.

Central and Eastern European export recovery by industry

On the European landscape, Central and Eastern European countries have therefore emerged in terms of greater resilience to the negative effects of the current crisis. In order to investigate the results from a sectoral perspective, the following graph shows the main export industries in the area under analysis. The map positions the industries according to the overall rate of change recorded for 2020 (X-axis) and the YoY rate of change recorded in Q4 (Y-axis); the width of each ball is proportional to the 2019 value of exports.

Source: ExportPlanning

Firstly, it is important to note that most of the region's export macro-sectors are above the grey line, confirming the strong intensity of their recovery in the latter part of the year. In fact, the Q4-2020 recovery concerns almost the entire consumer goods and investment goods cluster.

Particularly significant is the recovery of the automotive sector, which involves both the transport equipment (F3) and components (D3) sectors. The industry has been one of the hardest hit by the current economic situation: despite a positive performance in the fourth quarter, exports from the sector ended 2020 largely in negative territory, with a drop of around 10%. At the same time, however, the result stands out for its greater resilience compared to the performance of the European automotive industry, which on the export front showed a drop of 18%, according to preliminary data for 2020.

On the consumer goods front, the Finished Personal Products (E2) sector, another industry deeply affected by the negative effects of the crisis, also held up well. Exports from Central and Eastern Europe closed 2020 with a weak contraction of 1.8%, compared to a 13% drop for the EU average.

Exports of those macro-sectors that proved most resilient to the current recessionary context closed 2020 in positive territory: the agri-food sector (B1 and E0), the Health System (E4) and ICT Tools and Services (F1), which respond to new international consumption trends.