Turkish Lira on the Upswing

Turkey's new monetary policy course finds investors' approval

Published by Alba Di Rosa. .

Exchange rate Emerging markets Turkish lira Uncertainty Economic policy Central banks Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

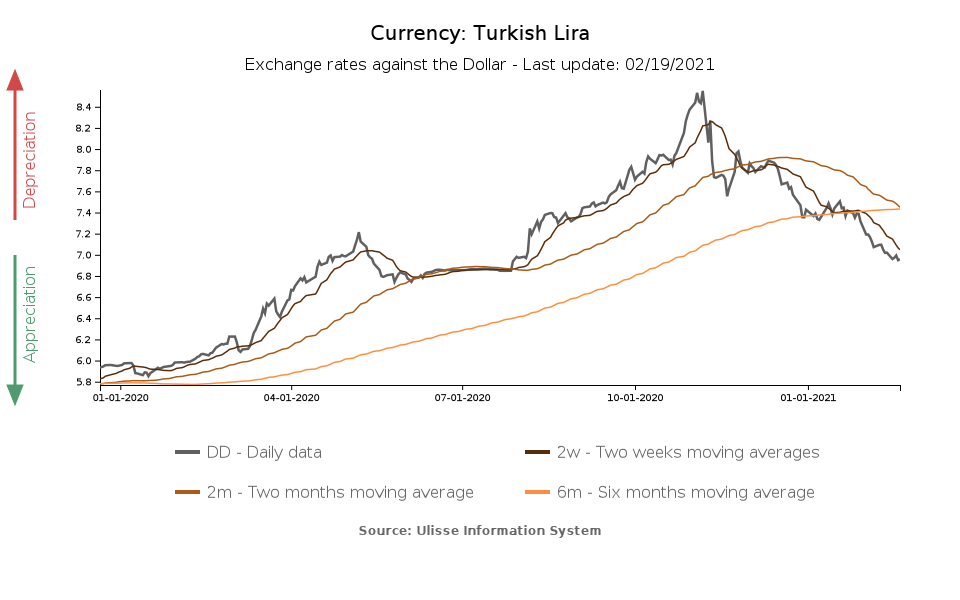

After the significant phase of weakening experienced for most of 2020, the Turkish lira seems to have entered 2021 headed towards recovery. As of today, the lira is the floating emerging currency that has appreciated the most against the dollar since the beginning of the year, marking a strengthening of +5.5%. After breaking the threshold of 8 TRY per dollar at the beginning of November, the exchange rate closes the week below 7 TRY per USD.

As can be seen from the chart, the reversal of course has been substantial and almost continuous since November 2020 when, faced with a situation of rampant depreciation, the Turkish government decided to deliver a strong signal to the markets, promoting a change in the economic leadership of the country and a shift to more orthodox monetary policies (see the article "The Turkish lira roller-coaster").

Now, three months after this change of course, it seems that the central bank is continuing to pursue this approach, as evidenced by the significant recovery of the currency's exchange rate against the dollar, which is back to the levels of last August, and which has overall rebounded by more than 18% since November. After raising the benchmark interest rate by 475 basis points in November, and by further 200 basis points in December, at the monetary policy meetings of January and February, the rate was kept unchanged at 17%. In particular in the February meeting, held yesterday, it was made clear that, in this phase of economic recovery, controlling inflation represents a primary objective, in order to achieve permanent price stability and the inflation target of 5%, thus promoting the reduction of the risk premium and financing costs, as well as the accumulation of foreign exchange reserves.

At the moment, the inflationary target for Turkey still seems far, as can be seen from the graph below, which shows a 15% increase in the Consumer Price Index for January: the index is apparently incorporating, with a certain delay, the currency depreciation of the previous months. Nonetheless, compared to the recent past, the real interest rate is currently in positive territory, attracting investors once again: after having reached historic lows in November, portfolio investment flows of non-residents have in fact shown signs of recovery in recent months, even though they remain well below the highs of 2013 (source: Electronic Data Delivery System, Central Bank of the Republic of Turkey).

Turkey: Consumer Price Index

It is therefore the improving market sentiment towards Turkey, thanks to the change of economic stance announced and pursued, that is supporting the rally of the lira, making it more attractive to foreign investors. The attitude of the central bank, which is rebuilding its credibility, therefore finds approval from investors, while the same does not emerge on the side of economic reforms, which are still judged as lacking.

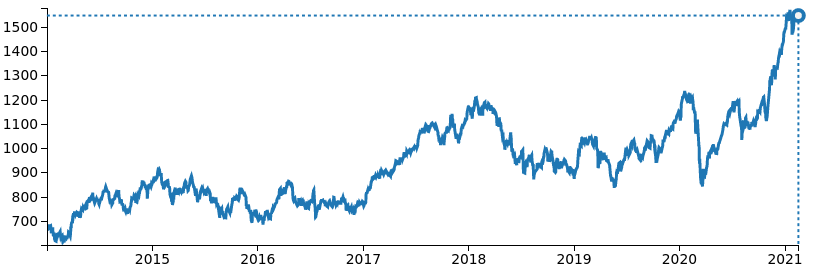

Investors' optimism about Turkey, following the November turnaround, can be read not only from the currency, but also from the dynamics of the stock market, which is also going through a phase of rally.

Turkey Stock Exchange: BIST 100 Index

With the gradual exit from the pandemic, a prosecution of the current risk appetite is expected; however, some elements of uncertainty remain as for the recovery phase of the lira. First of all, we can find president Erdogan's political will: while he might be now supporting an orthodox monetary policy, he could always go back towards his well-known preferences for an economic growth driven by low interest rates. The second element to point out is the current vulnerability of the Turkish lira, in the absence of an adequate reserve buffer, which has been severely eroded during 2020; if rebuilding it is one of the goal of the new central bank governor, the resulting demand for foreign currency could, by contrast, penalize the lira.