Sterling Pound: Optimism and Uncertainty

Published by Alba Di Rosa. .

Covid-19 Exchange rate Pound Economic policy Brexit Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

This week's currency columns focuses on the pound, the floating currency in the cluster of developed countries that has shown the greatest strengthening against the dollar since early 2021. Which factors are driving this dynamics?

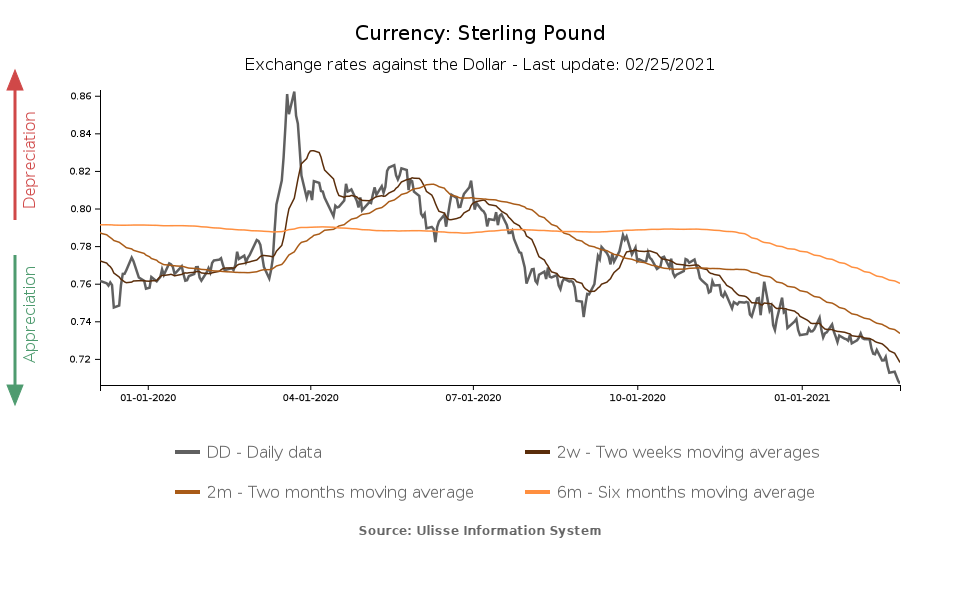

In 2020, we left the British currency at the mercy of uncertainty related to Brexit, which hung in the balance until the end of the year, and the difficulties in managing the pandemic, which hit the UK particularly hard between late 2020 and early 2021. During the last peak of the infection curve, reached in early January, the country reported more than 60,000 new confirmed cases per day.

The outlook has brightened in the weeks since, with a gradual reduction in Covid-19 confirmed cases (currently below 10,000 cases per day, as seen in the graph below) and a vaccination campaign that is proceeding faster than in the rest of the EU: with 27 out of every 100 people vaccinated, the UK currently ranks first in Europe (source: Statista).

United Kingdom: Covid-19 confirmed cases

Source: DailyDataLab

Progress on the vaccination front, bringing the prospect of economic recovery closer, together with the removal of uncertainty thanks to a last minute agreement on Brexit at the end of December, are among the elements that are sustaining a fair amount of market confidence in the UK. However, these elements are not sufficient on their own to explain the rally of the sterling, which has gained 3.6% against the dollar and over 4% against the euro since the start of 2021.

British economic data are, indeed, still not encouraging: the latest information released by the Office for National Statistics shows that, in the last 3 months of 2020, the unemployment rate continued to rise and the employment rate to fall; the same indication comes from the first estimates for January 2021. As for retail sales, they were negatively impacted by the January lockdown, albeit less severely than during the first lockdown: compared to December, retail sales fell by 8.2%, returning to May 2020 levels.

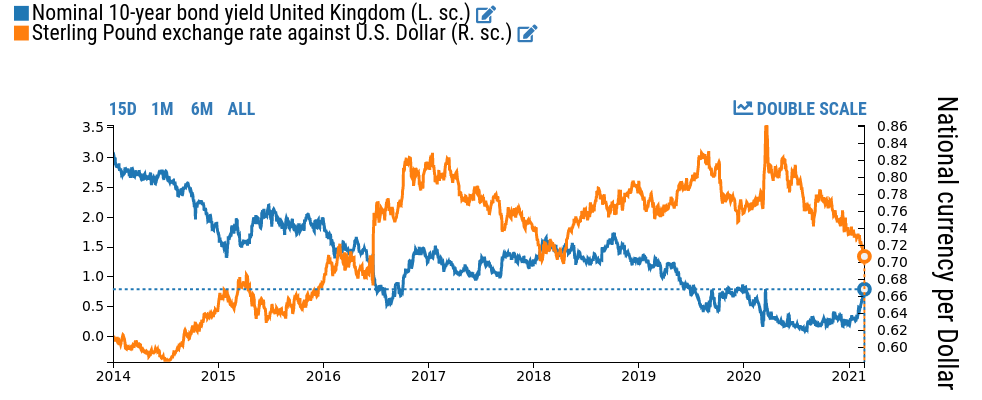

One key element to consider in order to get a more complete picture of the exchange rate concerns bond yields: in February, in the wake of optimism over the distribution of vaccines, which will hopefully finally trigger a sustained economic recovery, a phase of government bonds sell-off began, generating a reduction in prices and an increase in yields1. Britain has been involved in this phenomenon, also quite significantly compared to other European countries: the yields on its 10-year bonds rose during February from 0.322% to 0.787% yesterday, for an overall increase of almost 50 basis points; Spain recorded an increase close to 40 basis points, Germany and France were close to 30 basis points and Italy to 20.

Economic theory and history show the presence of an inverse correlation between the exchange rate and government bond yields, as can be seen in the chart below for the case of the UK.

United Kingdom: 10-year bond yields and exchange rate against the dollar

Source: DailyDataLab

Although, for the moment, the British economy does not seem to proceed full steam ahead, investors appear to be more focused on the future than the present, betting (and pricing) a faster than expected recovery. Optimism, however, could always be disappointed, with a virus not yet defeated and a global economic recovery that seems far from synchronized.

1. The sell-off in the government bond market began as early as January in the United States, as the prospects for a $1.9 trillion stimulus package materialized; this trend then spread and accelerated in February, as investors became more optimistic about the outlook for the global economy.