Focus United State: the deficit factor on dollar expectations

Analysis of the effects of the US trade deficit on medium-term exchange rate expectations

Published by Gloria Zambelli. .

Exchange rate Exchange rate risk Central banks Macroeconomic analysis Uncertainty Trade balance Great Recession Dollar Euro Foreign market analysisIn the article "Focus United States: the Federal Reserve's monetary policy" we review the main monetary policy tools used by the FED over the last decade, providing a forecast of the dollar exchange rate in the short term, in case the central bank decides to move the needle of monetary policy towards the quadrant "restriction".

Based on what has been argued, it is possible that the greenback's appreciation trend that has been in place for a few weeks may continue for the next few months.

However, broadening our time horizon in a medium-term perspective, there are other variables that may come into play. If we consider that the exchange rate is established by the intersection of supply and demand of currency in the forex markets, in the short term these curves tend to be subject to strong fluctuations, in relation to capital movements by financial operators, often offset by central bank interventions. These movements, in the medium term, tend to rebalance, bringing out a demand and supply of dollars more strictly related to trade imbalances and relative price adjustments.

Analyzing these aspects, it clearly emerges that relative price adjustments are substantially neutral towards the dollar, while trade balance imbalances are strongly characterized by a structural deficit.

The structural deficit in the U.S. balance of payments

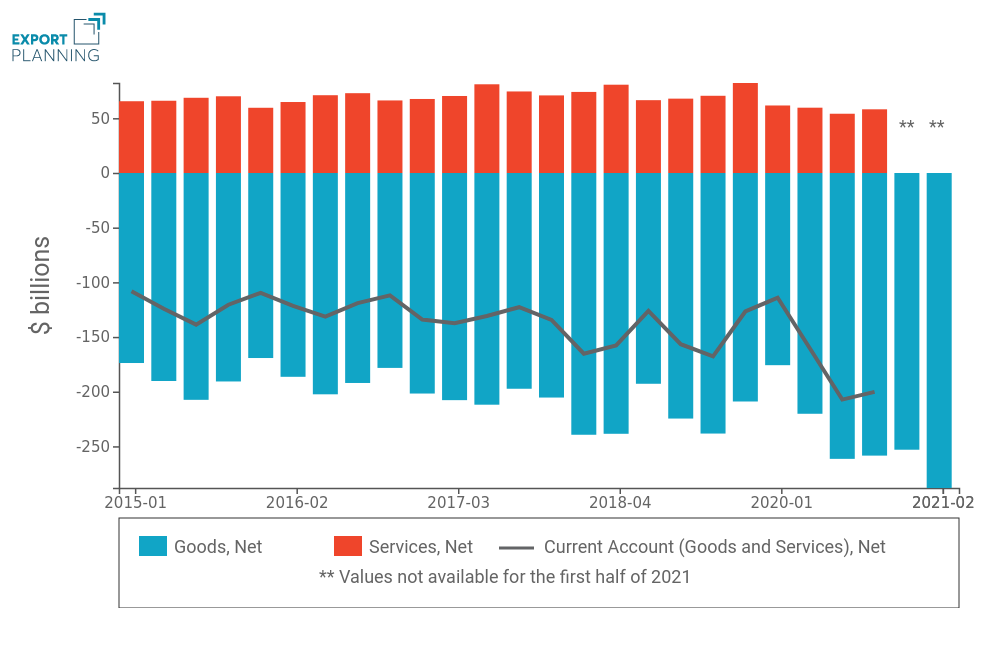

The chart here shows the goods balance and services balance of the U.S. balance of payments updated through 2020. Due to the availability of exportplanning data on U.S. foreign trade ( access to "US Trade datamart") it is possible provide a preliminary picture of the first two quarters of 2021 as well.

United States: current account balance, goods and services

(from 2015-Q1 to 2021-Q2)

Looking at the chart, it is evident that the pandemic outbreak exacerbated the structural deficit in the U.S. balance of payments. Between the first and second quarters of 2020, the U.S. net balance in services fell to $53 billion (down 20% from 2019-Q2). Restrictions due to the second wave of Covid-19 exacerbated the contraction in the services surplus by pushing the current account further into negative territory, past the $200 billion threshold in the third quarter of the year (-23.6% compared to 2019-Q3). This is the lowest quarterly current account deficit in a decade, for which, however, we signal a slight recovery in the last quarter of the year. Despite the vaccine rollout, it is difficult to expect an improvement in the first half of 2021, due to the difficulties still faced by the service sector and the merchandise balance data that signal a further increase in the deficit (-$288 billion) for the second quarter of 2021.

To conclude, it may be useful to dwell on the effects that the deterioration of the trade balance exerts on the exchange rate risk index.

Exchange rate risk: euro vs. dollar

StudiaBo constantly updates a measure of the exchange rate risk associated with different currencies. The ExportPlanning exchange rate risk index is mainly intended as a long term risk, as it is calculated taking into account structural elements related to countries and their economies. The recent update released in June 2021, incorporates the gradual stabilization of financial markets following the pandemic crisis.

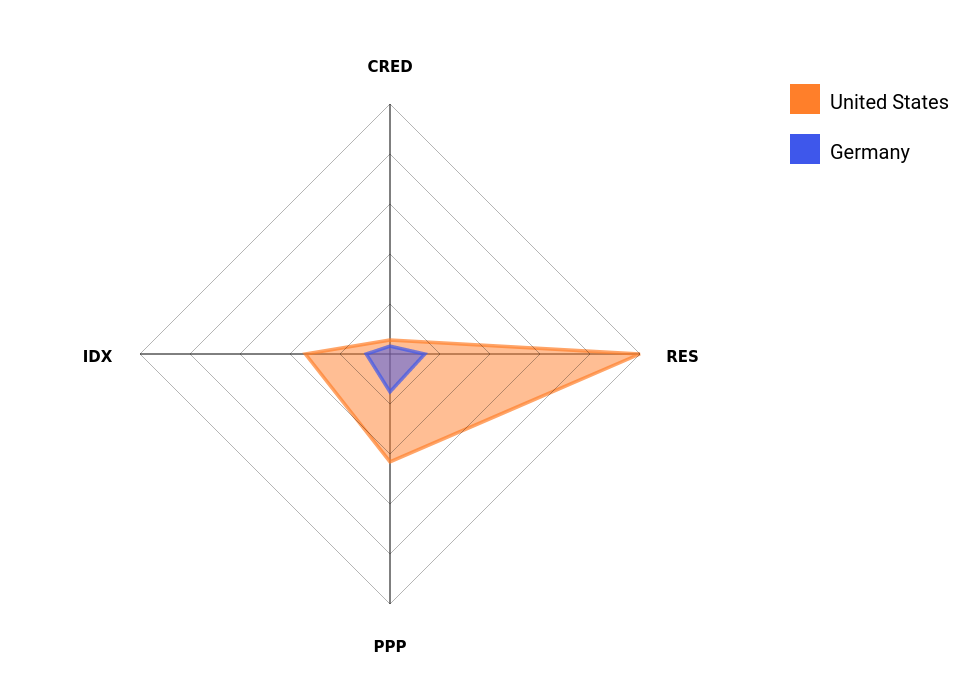

The spider web graph below is a comparison of the various factors that determine the overall score of the dollar and the euro.

Exchange rate risk index: United States and Germany

In a ranking of 152 currencies, ordered from the highest to the lowest exchange rate risk, the dollar conquers the 106th position with a score of 25.6, placing itself before the euro 1 (129th position with a score of only 7.2).

It is evident that the main penalizing factor for the dollar is the lack of resources generated by the structural trade deficit (RES). The presence of a large current account deficit, especially if not compensated by adequate reserves, can in fact be a depreciating factor.

Generally, the presence of foreign direct investment and portfolio inflows mitigate the exchange rate risk of the greenback, as they tend to be net recipients of investment from abroad.

However, the greater exchange rate risk associated with the dollar relative to the euro leads us to believe that, ceteris paribus, a depreciation of the dollar against the euro is likely in the medium term.

1.Germany is taken as an example representing the entire Eurozone. As they belong to a single monetary union, the exchange rate risk calculated by ExportPlanning will in fact be identical for all Eurozone countries.